Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read Kosta Gushterov

According to data shared by Wu Blockchain, over $5.8 billion in crypto options expired today, with Ethereum leading the action.

A total of 41,000 BTC options and 240,000 ETH options reached expiry on July 18, marking one of the most significant delivery days this quarter.

Ethereum dominance emerges in options expiry

Ethereum clearly took the spotlight. It saw a total notional value of $880 million expiring today, with a Put/Call Ratio of 1.0 and a max pain point of $2,950. Notably, ETH has broken decisively above $3,650 in recent days, triggering renewed bullish sentiment. The uninterrupted rally—with no meaningful pullbacks—has invigorated traders, with ETH implied volatility (IV) for major terms now spiking to as high as 70%.

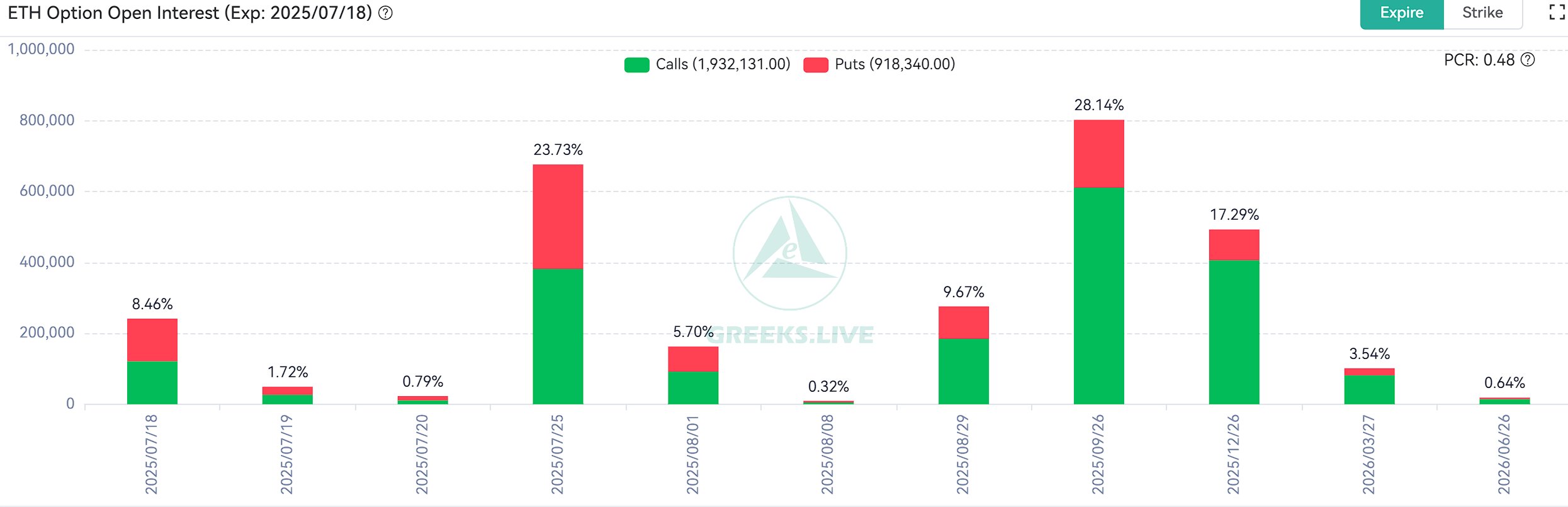

ETH option open interest data from Greeks.Live reveals a strong skew toward bullish bets beyond the July 18 expiry, especially for the July 25 and September 26 terms. Calls continue to dominate, with the overall ETH Put/Call Ratio sitting at just 0.48, signaling strong upside bias in future positioning.

Bitcoin stays strong but calm, max pain at $114K

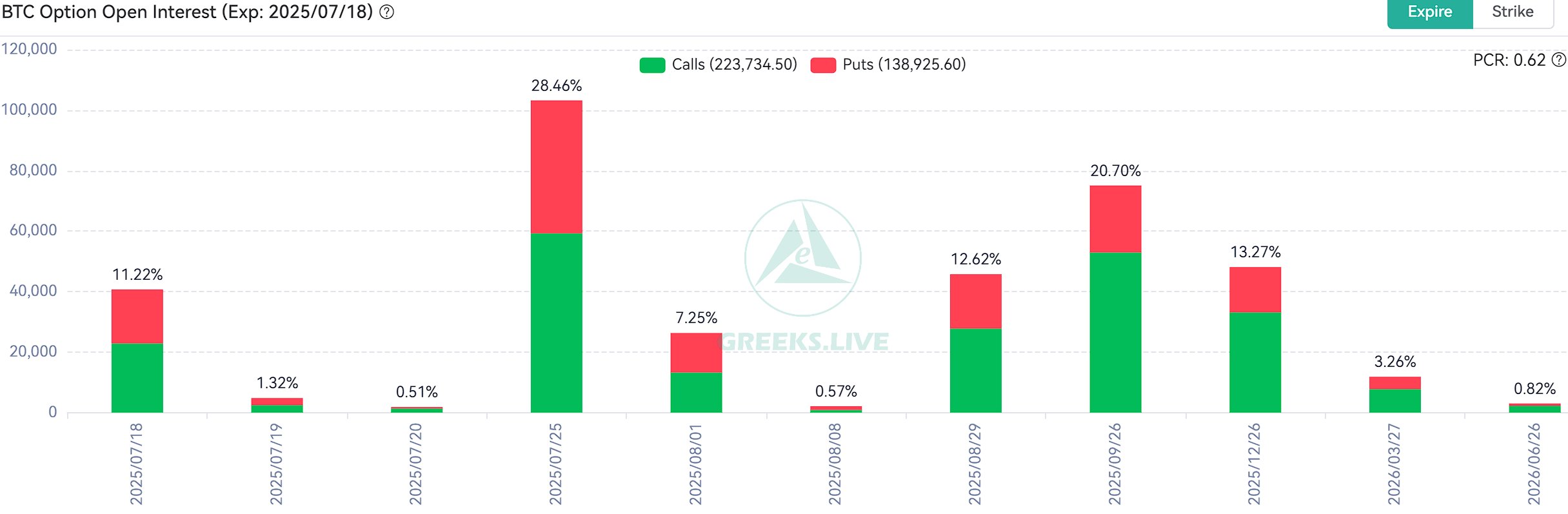

While Ethereum soared, Bitcoin remained more stable. The 41,000 BTC options that expired today had a combined notional value of $4.93 billion, with a Put/Call Ratio of 0.78 and a max pain point of $114,000. Despite briefly touching its all-time high around $120,000, BTC has mainly ranged tightly.

BTC implied volatility rebounded slightly, now steady around 40%. However, large block call buying in the past two weeks—comprising over 30% of trades—indicates institutional bets are still bullish. As ETH’s momentum picks up, BTC could follow if sentiment carries over.

BTC implied volatility rebounded slightly, now steady around 40%. However, large block call buying in the past two weeks—comprising over 30% of trades—indicates institutional bets are still bullish. As ETH’s momentum picks up, BTC could follow if sentiment carries over.

What’s next?

With July 18’s massive expiry behind us, traders will turn their focus to the July 25 and September 26 expiries. Ethereum’s sharp rise and option market dominance suggest bullish momentum may persist in the short term. However, with elevated IV and high call concentrations, volatility could surge if sentiment shifts. For now, the market is tilting optimistic—but caution may return quickly if ETH stumbles.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

Bit Digital Acquires Nearly 20,000 ETH, Expanding Treasury to Over 120,000 Coins

Bit Digital, Inc. has significantly expanded its Ethereum holdings, purchasing roughly 19,683 ETH with proceeds from a recent $67.3 million direct offering to institutional investors.

2 Main Reasons Behind Ethereum’s Surge to $3,600

Ethereum surged 5.18% in the past 24 hours, crossing the $3,600 level and reaching $3,670 before going back to $3,590 at the time of writing.

XRP Hits All-time High Amid Regulatory Breakthrough and Whale Surge

XRP officially entered uncharted price territory on July 18, surging past its previous record to hit a new all-time high of $3.64, fueled by a powerful combination of U.S. regulatory progress, technical breakouts, and heavy whale accumulation.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read