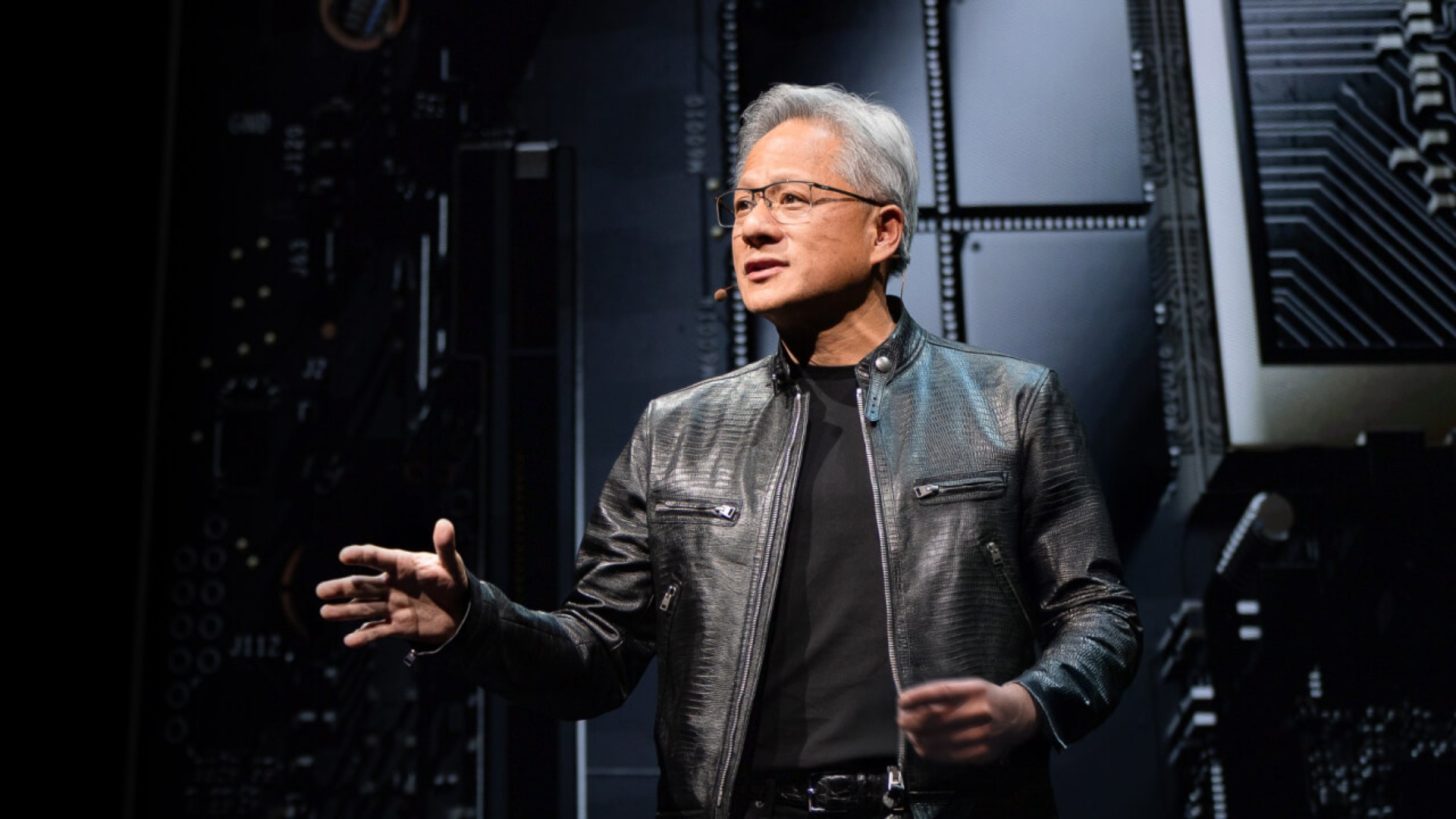

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read Alexander Stefanov

During London Tech Week, Nvidia CEO Jensen Huang highlighted a critical gap in the UK’s artificial intelligence ambitions: while the country is home to exceptional talent, it lacks the computing backbone necessary to lead globally.

Speaking alongside UK Prime Minister Keir Starmer, Huang described the moment as ideal for AI growth — but warned that without significant investment in infrastructure, the UK risks being left behind by the U.S. and China, both of which are rapidly scaling AI capacity through supercomputing and data centers.

In response, Starmer pledged £1 billion to boost the UK’s AI infrastructure twentyfold, a move aimed at closing the gap. Additional initiatives included a regulatory sandbox from the Financial Conduct Authority and a £1.5 billion investment pledge from fintech firm Liquidity.

While countries like the U.S. and China dominate the AI space through collaboration between industry and research or commercial applications, Europe has struggled to keep up. Huang, however, sees opportunity: AI, he says, will soon be as essential to industry as electricity — and Britain, with the right tools, could become a key player.

Huang’s European tour continues with stops in Paris, Berlin, and Brussels, as he promotes Nvidia’s vision of AI as critical infrastructure shaping the future of every major sector.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read