NFT Sales Crash to New 2024 Low in August

03.09.2024 9:30 1 min. read Alexander Stefanov

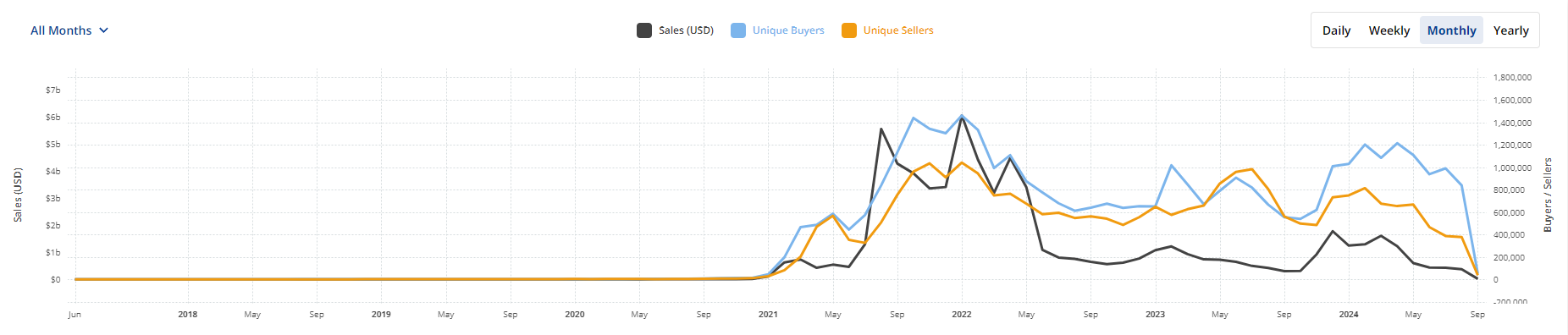

In August 2024, sales of non-fungible tokens (NFTs) fell to $374 million, marking the lowest monthly total of the year and the first time sales have dipped below $400 million in 2024.

According to NFT tracker CryptoSlam, this figure represents a sharp 76% decrease from the peak of $1.6 billion in March.

NFTs saw a robust start to the year with $4.1 billion in sales during the first quarter. However, momentum waned significantly, with second-quarter sales falling to $2.24 billion—a 45% decline from the previous quarter.

Despite a brief uptick in the final week of August, NFT sales have been on a steady decline since April, when sales first dropped to $1.2 billion.

The decline deepened with May’s $598 million and continued through July, which saw sales of $427 million but an 87% increase in transaction volume. NFT transactions surged from 5.7 million in June to 10.7 million in July.

In August, transactions decreased to 7.3 million, a 31% drop from July. On a positive note, the average value of each NFT sale rose by 27%, from $39.93 to $50.74. By early September, this average value had further increased to $86.04 per transaction.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

2

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

3

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

4

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read -

5

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

09.07.2025 15:28 2 min. read