Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Next 1000x Crypto: Solaxy Presale Hits $47 Million With Just 5 Days Until Launch

11.06.2025 13:51 6 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Solaxy (SOLX) just blasted through the $47 million mark during its final presale phase, locking in one of the fastest-growing raises of 2025. This powerful demand underlines a simple truth: investors believe Solaxy, the first Layer 2 rollup on Solana (SOL), could be the scaling catalyst that turns today’s growing Layer 1 into tomorrow’s dominant smart-contract chain.

Meanwhile, Nasdaq added SOL to its flagship Crypto US Index (NCI) on June 9, expanding a lineup that now also features Stellar (XLM), Cardano (ADA), and XRP – a move aimed at making the NCI less Bitcoin- and Ethereum-centric. On the regulatory side, institutions planning to launch Solana spot ETFs have seen promising responses from the SEC, which requested that the companies submit updated S-1 filings within the next several days (to be followed by a 30-day review process). This move continues the SEC’s now-well-established pattern of active engagement with crypto-related developments.

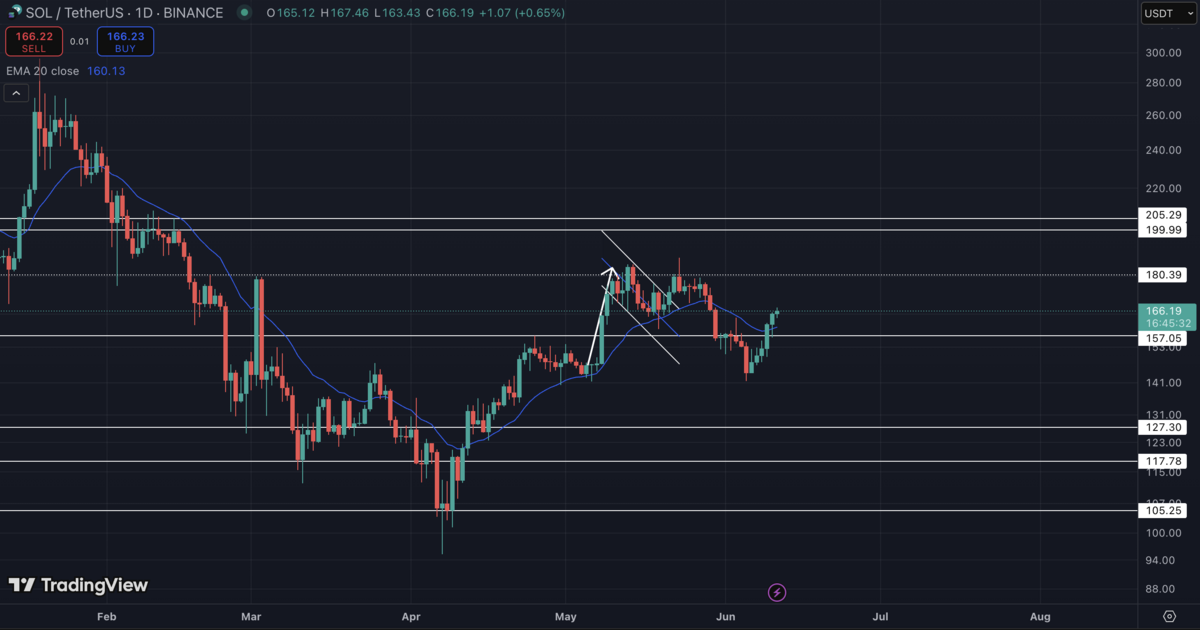

The tradfi expert and commentator James Seyffart has noted that investors waiting for Solana ETF approvals could set optimistic targets during July – which would be fast by the SEC’s standards. SOL gained roughly 4% and broke above $162 after the latest news updates began spreading across social media.

For Solaxy, the timing could not be better, as institutions are mapping routes into the Solana ecosystem just as the chain’s first Layer 2 (L2) prepares for liftoff. Only five days remain for early backers to pick up SOLX tokens at the final presale price of $0.001752. After that, SOLX will list on public markets, and price discovery will take over.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

With Macro Winds Turning Favorable, Solaxy’s Launch Could Reignite Solana’s Run

SOL saw a slight pullback last week, retracing to the mid-$140s in the wake of news that Pump.fun, a popular Solana-based meme coin launchpad, is getting ready to launch its own $1 billion token sale – and targeting a total valuation of $4 billion in the process.

However, the improving likelihood of Solana ETF approvals (supported by strong institutional backing and the SEC’s pro-crypto stance) has helped Solana regain momentum above the psychological $160 mark, registering a nearly 17% jump from its June 5 lows.

The broader macroeconomic backdrop has been equally supportive. On June 5, the European Central Bank cut its deposit rate to 2% (its eighth reduction in a year), citing tamed inflation. The Bank of Korea also agreed on a 25-basis-point cut to 2.50% in late May, and the Bank of England is signaling an incremental path after making its own cut to 4.25% last month. Easier monetary policy, historically, primes risk assets for new bull runs and major upside.

Meanwhile, Bitcoin is gliding above $109,000, within striking distance of its all-time high. Consistent stability at that altitude will give altcoin traders the confidence to rotate down the risk curve – and the success of the Solaxy presale shows that this is already happening.

Solaxy will help to address Solana’s occasional performance hiccups, potentially attracting users and liquidity back to Solana’s DeFi and meme coin arenas – and the Solana community is now hoping that Solaxy’s L2 rollup might re-energize Solana’s network activity.

Lost in the meme void? 🤔

Let $SOLX guide your way. 🛸 🔥https://t.co/mdaTX9aVVx pic.twitter.com/pfLVVi07YS

— SOLAXY (@SOLAXYTOKEN) June 3, 2025

After the Pump.fun potential token sale news, Solana enthusiasts are now looking to Solaxy’s launch as a way to inject even more positive momentum into the Solana ecosystem.

Solaxy Brings the Full Layer 2 Stack to Solana

Solana already clocks thousands of transactions per second, but traffic spikes (like high-profile meme coin launches and NFT mints) can still throttle its throughput.

Solaxy will fix that problem by moving the bulk of overwhelming network activity onto its high-speed Layer 2 rollup, then batching proofs back onto Solana’s Layer 1 for finality. This is more or less the same model that turned Arbitrum and Optimism into powerhouses on Ethereum, but adapted to Solana’s one-of-a-kind architecture.

Approaching Lightspeed! 🚀

47M Raised! 🔥 pic.twitter.com/Iw3eKAhbN3

— SOLAXY (@SOLAXYTOKEN) June 11, 2025

Because Solaxy inherits Solana’s security while adding elbow room, it can lower fees, decrease confirmation times, and keep the mainnet decongested, which is precisely what heavy-volume dApps and institutions need.

The project’s tech is now far beyond the whitepaper phase. Solaxy’s public testnet went live on June 2, letting anyone bridge devnet SOL via the Backpack Wallet, deploy programs, and watch the action on a dedicated block explorer.

On June 10, the team unveiled the latest phase of its partnership with Hyperlane – a permissionless interoperability layer that connects multiple blockchains. The collaboration promises friction-free bridges across Solana, Solaxy, and Ethereum. Through Hyperlane’s modular technology, Solaxy plans to deliver lightning-fast, user-friendly transfers and significantly reduced wait times.

🚨 Hey Solaxy Community, we’re thrilled to announce our collaboration with @hyperlane to deliver one of Web3’s most seamless bridging experiences.

Solana ↔️ Solaxy ↔️ Ethereum. Fast, modular, permissionless.

Together, we’re building the first true Layer 2 bridge for Solana… pic.twitter.com/Jfk2GJUUD3

— SOLAXY (@SOLAXYTOKEN) June 10, 2025

Beyond raw transaction capacity, Solaxy is rolling out a suite of infrastructure tools to jump-start its ecosystem. As noted above, the team has already launched a bridge and block explorer as part of its testnet – and it also recently teased the Igniter Protocol, Solaxy’s native token launchpad.

Igniter will allow SOLX holders to easily mint and deploy new tokens on Solaxy and, critically, have them automatically listed on an integrated decentralized exchange (DEX). This combo of launchpad and DEX systems will significantly lower the barrier to entry for new projects on Solana’s Layer 2, simply requiring users to hold SOLX tokens.

Thus, Solaxy is positioning itself as a full-service Layer 2 ecosystem. It’s not just a throughput booster, but a platform for new dApps, tokens, and DeFi activity. Every network transaction will involve SOLX as Solaxy’s internal payment method, and future project decisions will also run through a governance process using SOLX to determine a given holder’s voting power.

Final 5 Days to Join the Solaxy Presale

As no mainstream Layer 2 exists on Solana today, Solaxy has a clean runway. If the SOL crypto’s market cap (currently north of $85 billion) and the L1’s total locked DeFi value ($9.09 billion) rise ahead of Solana ETF approvals and perhaps another market-wide bull run, even a modest slice of activity migrating to Solaxy could translate into oversized demand (and 1000x price gains) for SOLX tokens.

Interested buyers can visit the official Solaxy presale site, then connect a compatible wallet and swap SOL, USDT, ETH, or BNB for SOLX (or make a bank card purchase at SOLX’s final fiat currency value of $0.001752). You can also stake SOLX tokens instantly within the sale dashboard to generate up to 86% APY while you wait for the coin’s exchange debut.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now As $1B Sell-Off Crashes the Market – Buy The Dip Coins

24.06.2025 12:21 8 min. read -

2

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read -

3

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

24.06.2025 17:55 5 min. read -

4

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

27.06.2025 17:05 6 min. read -

5

BTC Bull Token Presale Nears $8 Million with Just 24 Hours to Go: Next 100x Crypto?

29.06.2025 12:34 5 min. read

Best Crypto Presales to Invest in this Month: 4 Projects with Huge Potential

The overall crypto market cap is now valued at $3.47 trillion, marking a 2.36% jump over the past week and a near 50% increase year-on-year. This wave of bullish sentiment is partly driven by fresh macro developments, including the U.S. government’s pro-crypto stance and new housing policies that could soon allow crypto assets to count […]

BTC Bull Token Presale Enters Final 24 Hours Ahead of Exchange Listing Tomorrow: Next Crypto to Explode?

BTC Bull Token has reached a critical moment. With less than 24 hours left in its presale, the project has already raised $8 million, signalling huge investor confidence. Buyers now have one last chance to secure tokens at a lower price before claiming goes live and the token becomes tradable on exchanges. Many crypto traders […]

Best Crypto to Buy Now as $8.6B Bitcoin Whale Awakens After 14 Years

When a Bitcoin whale that had lain dormant since 2011 sprang to life this week, it unleashed a colossal 80,000 BTC, worth about $8.6 billion, onto the blockchain. Such a historic stir not only shattered records for daily movements of decade‑old coins but also underscored how long‑term holders can reshape market dynamics in a heartbeat. THE FINAL […]

Best Crypto Presales: BTC Bull Token Raises $8 Million, Just 48 Hours to Go Until Exchange Launch

One of the most talked-about new meme coin launches of 2025, BTC Bull Token (BTCBULL) has already raised over $8 million through its presale, signalling huge investor confidence. BTC Bull Token stands out by tracking Bitcoin’s performance and rewarding BTCBULL holders whenever BTC hits specific milestones for the first time. The concept blends meme coin culture […]

-

1

Best Crypto to Buy Now As $1B Sell-Off Crashes the Market – Buy The Dip Coins

24.06.2025 12:21 8 min. read -

2

Best Altcoins to Buy Now: 5 Low-Cap Cryptos That Could Explode in Q3

25.06.2025 23:39 5 min. read -

3

Best Crypto Presales to Buy for Q3: 4 Promising ICOs

24.06.2025 17:55 5 min. read -

4

Best Crypto Presales That Whales Are Adding to Their Portfolios for July

27.06.2025 17:05 6 min. read -

5

BTC Bull Token Presale Nears $8 Million with Just 24 Hours to Go: Next 100x Crypto?

29.06.2025 12:34 5 min. read