Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Next 1000x Crypto: How $100 in Bitcoin Hyper Could Generate $100,000 Returns

30.07.2025 12:36 5 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

While Bitcoin (BTC) has been consolidating above $116,000 for more than two weeks, underlying developments in the Web3 space have been progressing at a rapid pace. Institutional interest is showing no signs of cooling down, with Bitcoin and Ethereum ETFs seeing combined net inflows of more than $455 million so far this week.

Some of the biggest corporations are doubling down on Bitcoin, with Anchorage Digital quietly accumulating 10,141 BTC (worth over $1.1 billion). Strategy Inc. has also turbo-charged its treasury with an extra 21,021 BTC (for a grand total of 628,791 BTC) after raising $2.5 billion in the year’s biggest US IPO.

Looking ahead, investor anticipation is building as the White House prepares to unveil its first comprehensive digital asset policy framework later today. Amid these bullish developments, a new project called Bitcoin Hyper (HYPER) is rapidly garnering attention during its presale. It’s the first Layer 2 for Bitcoin that will leverage Solana’s high-speed technology.

As investors recognize the potential of this long-awaited solution, whales and retail buyers have poured more than $5.8 million into Bitcoin Hyper’s token sale so far. Based on the early investor response, many respected crypto analysts have also highlighted the HYPER token’s potential to yield 1000x gains during the next altseason and meme coin bull run.

You can still buy HYPER for just $0.01245, before the price increases in a matter of hours.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Why Bitcoin Is Outperforming Stocks and Gold

Multiple market indicators suggest the backdrop for crypto has rarely been stronger. Financial conditions in the US are looser than they have been in years, providing a tailwind for risk assets like Bitcoin.

According to the analysis portal Ecoinometrics, the National Financial Conditions Index (NFCI) has been trending deeper into negative territory for three straight years. A lower NFCI reading means money is relatively cheaper and easier to access in the market.

Looser financial conditions continue to drive Bitcoin higher.

This trend has been in place for the past three years.

Looser conditions mean more liquidity, greater risk appetite, and ultimately more capital flowing into assets like Bitcoin.

Today, financial conditions are the… pic.twitter.com/o7Vq5ONgGg

— ecoinometrics (@ecoinometrics) July 29, 2025

This reading also explains why Bitcoin experienced significant growth in Q2 2025. Per Bitwise Investments’ review on the crypto market’s second-quarter performance, BTC was the world’s best-performing major financial asset. The report also mentions that BTC gained more than 30% in Q2, which is almost triple the return of US stocks and over five times that of gold.

A key driver behind Bitcoin’s surge has been rising institutional and corporate adoption. New data from the Bitwise report shows public companies are adding Bitcoin to their balance sheets at a record pace. In Q2 alone, 46 new companies stockpiled BTC, helping to boost the total number of Bitcoin-holding public companies to 125, a 58% quarterly jump.

Heading into Q3, many Web3 experts continue to highlight how the market’s focus is now shifting to altcoins. This is why investors are now accumulating early-stage tokens like Bitcoin Hyper (HYPER) before they even get listed on major crypto exchanges.

Analyst Thinks Bitcoin Hyper Is the Next 1000x Altcoin

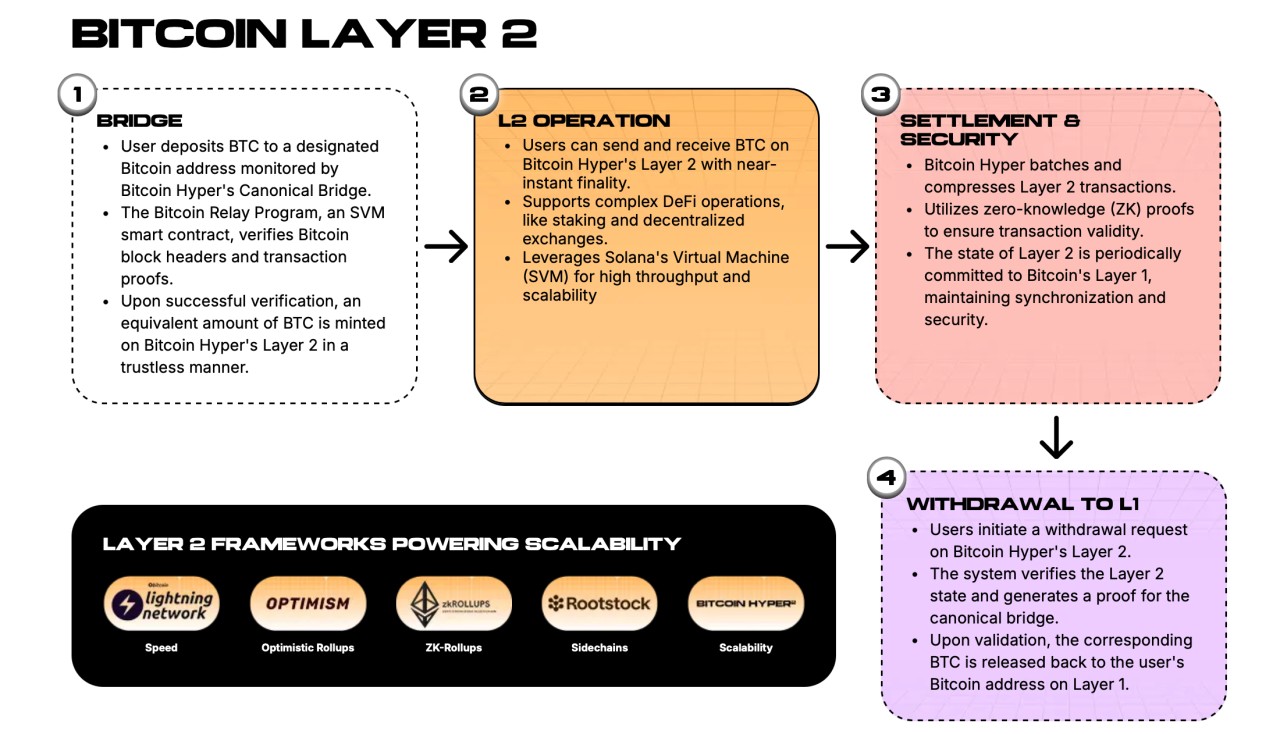

Bitcoin Hyper is a Layer 2 (L2) scaling project for Bitcoin that will leverage Solana’s technology to significantly improve transaction speed, cost, and functionality on the Bitcoin network.

Bitcoin’s base layer only processes one block every 10 minutes on average – and during peak usage, users face high fees and slow confirmations. To fix this, Bitcoin Hyper’s L2 solution will allow you to lock your BTC through a non-custodial canonical bridge, and receive a wrapped version of that BTC on Bitcoin Hyper’s second layer.

This mechanism unlocks new use cases for BTC holders, bringing smart contracts and decentralized apps (dApps) to the Bitcoin ecosystem for the first time.

Bitcoin Hyper’s native HYPER token is used to pay transaction fees on the project’s L2 network, and secure it through staking and governance.

In a recent YouTube video, the 99Bitcoins analyst Mark Khan explains that whales have begun stockpiling HYPER tokens. Khan also mentions that some price forecasts stretch to a potential 1,000x upside – which would turn $100 into $100,000, and could be achievable if Bitcoin pushes to new all-time highs again.

As Bitcoin Hyper now has more than 14,000 followers on X, while presale funds rush in by the hour, Khan sees the project as a timely proxy for investors who want Bitcoin exposure with the growth potential of a fast‑moving altcoin.

Buyers can visit Bitcoin Hyper’s official page to purchase HYPER at the earliest possible stage. You can also stake your HYPER immediately to generate passive annual yields of up to 176% – even before the presale ends.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

2

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

12.07.2025 11:10 6 min. read -

3

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

16.07.2025 18:38 8 min. read -

4

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

12.07.2025 13:47 4 min. read -

5

Bitcoin vs Ethereum: ChatGPT Reveals the Best Crypto to Buy in the Bull Run

20.07.2025 2:00 5 min. read

Best Crypto to Buy Now As UAE Bank Opens Crypto Trading to Retail Customers

For years, the Middle East has been steadily warming to digital assets, with retail interest already strong and active. But what was once seen as a parallel economy is now entering the very core of institutional banking. The change is no longer about passive support or distant partnerships. It is about integration. Institutions are not […]

Best Crypto Presale to Buy: $BEST ICO Nears $15 Million as Traders Bet Big

Bitcoin’s (BTC) resilience has been on full display this week, as the top cryptocurrency continues to trade less than 4% below its all-time high. Over the weekend, a Satoshi-era Bitcoin whale sold roughly 80,000 BTC (worth about $9.6 billion), yet the price of Bitcoin has remained within its broader uptrend. This stability under heavy selling […]

ETH Whale Wallets Hint at Altcoin Season – What Are the Best Meme Coins to Buy Now?

When ETH starts to rally with conviction and wallets swell with fresh inflows, it often foreshadows an altcoin breakout. That pattern appears to be forming again. Ethereum’s buying volume is rising faster than any other large-cap asset, yet the wider altcoin space has yet to catch up. This publication is sponsored. CryptoDnes does not endorse […]

With Cardano (ADA) Slipping Out of Top 20, Investors Prefer Unilabs (UNIL) & SUI For Staking ROI

As the Cardano price risks dropping out of the top 20 rankings, a major shift is shaking up the crypto landscape. Investors are rotating their capital toward promising alternatives like the SUI Blockchain and Unilabs Finance, a newcomer powered by artificial intelligence. This publication is sponsored. CryptoDnes does not endorse and is not responsible for […]

-

1

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

11.07.2025 19:24 4 min. read -

2

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

12.07.2025 11:10 6 min. read -

3

Best Crypto to Buy Now as Peter Schiff Warns Of Corporate Bitcoin Hoarding

16.07.2025 18:38 8 min. read -

4

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

12.07.2025 13:47 4 min. read -

5

Bitcoin vs Ethereum: ChatGPT Reveals the Best Crypto to Buy in the Bull Run

20.07.2025 2:00 5 min. read