New Data Shows Shiba Inu is at Risk Due to Centralization

04.07.2025 10:30 2 min. read Kosta Gushterov

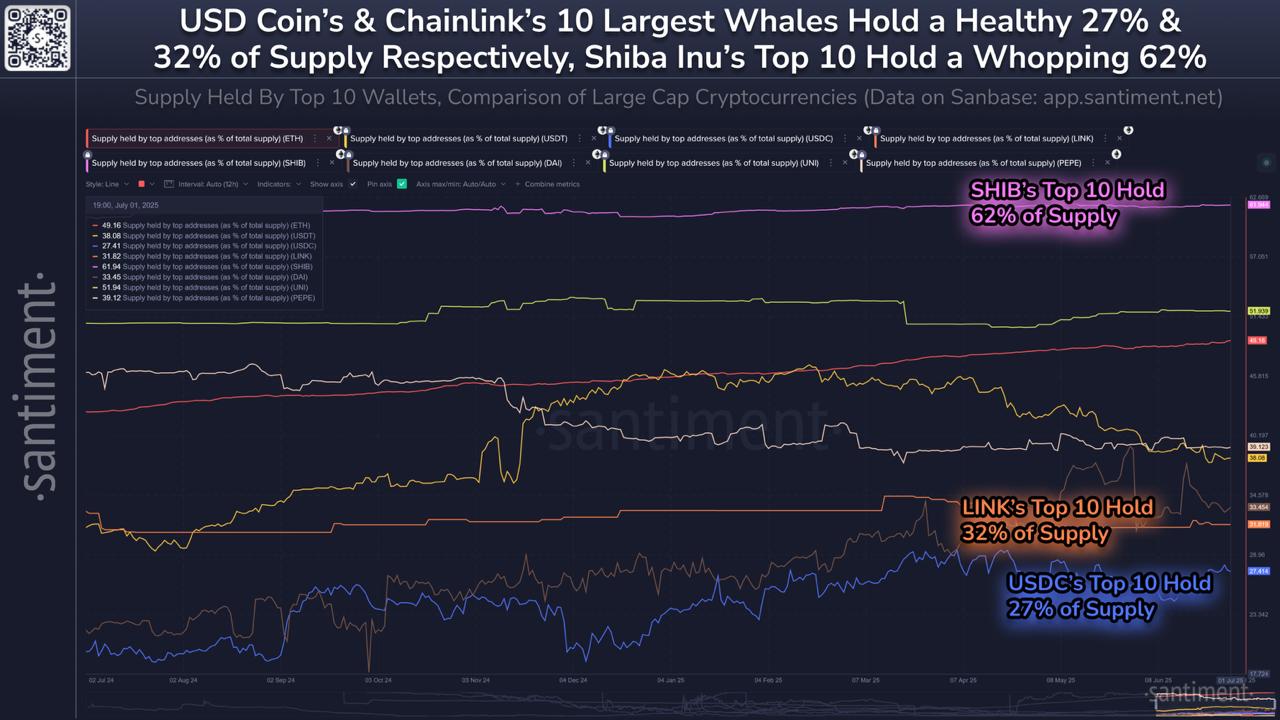

New data from Santiment highlights major differences in token distribution among top cryptocurrencies, revealing critical insights for traders monitoring whale influence.

The platform compared the supply held by the top 10 largest wallets for various large-cap assets, uncovering stark contrasts in decentralization levels.

Shiba Inu (SHIB) stands out as the most centralized among the analyzed assets. A massive 62% of SHIB’s total supply is held by just 10 wallets, raising concerns about potential price manipulation or sudden market shocks if one or more whales decide to sell. Such a high level of concentration makes SHIB vulnerable to volatility driven by a handful of holders.

In contrast, USD Coin (USDC) and Chainlink (LINK) demonstrate more balanced supply distributions. USDC, a leading stablecoin, has only 27% of its supply in the hands of its top 10 wallets, reflecting a higher level of decentralization and reduced risk of abrupt price movements. Chainlink’s top 10 wallets hold 32% of its total supply, also indicating relatively healthy distribution for a large-cap token.

For retail investors and smaller traders, lower whale concentration generally signals a safer trading environment. Assets with decentralized ownership structures are less likely to experience dramatic swings caused by coordinated whale actions. This is especially critical during times of heightened market volatility, when large movements by top holders can amplify price instability.

Santiment’s analysis underscores the importance of tracking whale wallet activity, not just price trends. As on-chain transparency increases, such data becomes an essential component of due diligence for crypto investors seeking to minimize exposure to centralized supply risks.

Ultimately, while meme coins like SHIB may offer rapid gains, their whale dynamics demand caution. Meanwhile, assets like USDC and LINK appear more stable due to broader supply distribution across holders.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

3

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

Ethereum: What The Last Move Tells us About the Next One

Ethereum is showing strength in the face of broader market weakness, holding firm even as Bitcoin and other major assets trend downward.

PENGU Price Eyes Bounce From Key Support Level – What’s Next?

Pudgy Penguins’ native token $PENGU is attracting renewed attention from traders after showing consistent support at a key technical level.

Sui Price Prediction: As DeFi TVL Jumps by 42% – Will SUI Hit $5 Soon?

Sui (SUI) has gone up by 34% in the past 30 days as the project’s DeFi ecosystem has been growing rapidly this year. This favors a bullish SUI price prediction as it indicates increased adoption by developers. Data from DeFi Llama shows that the total value locked (TVL) within the Sui blockchain has expanded by […]

Eric Trump Says Ethereum is Undervalued, Backs Analyst’s $8,000 Target

U.S. President Donald Trump continues to draw attention for his pro-cryptocurrency stance—and now his son, Eric Trump, is turning the spotlight to Ethereum.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

3

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read