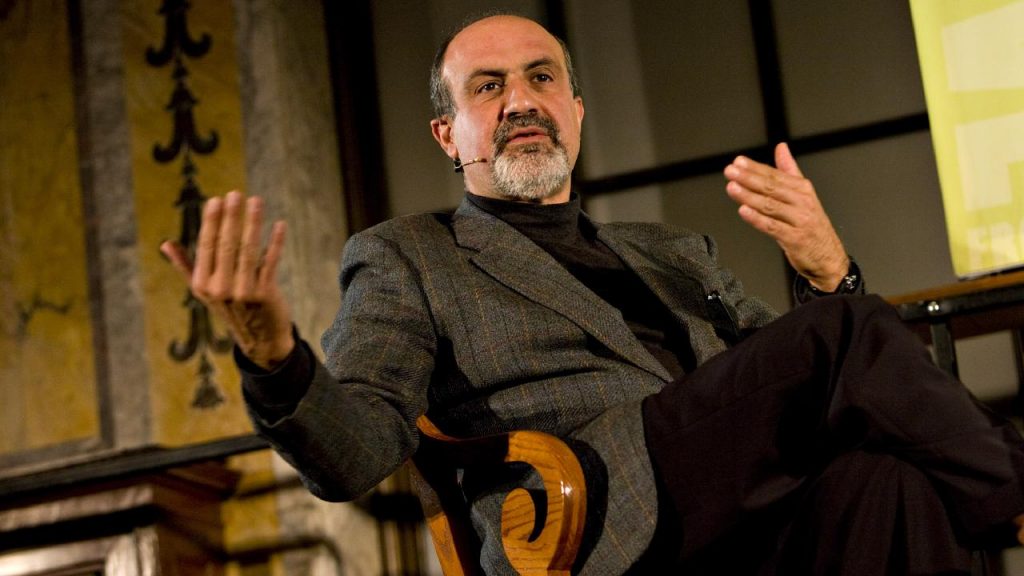

Nassim Taleb Warns of Fragile Markets and Cautions on AI Investment Hype

13.10.2024 10:00 1 min. read Kosta Gushterov

Nassim Nicolas Taleb, renowned for his influential books like The Black Swan, and Skin in the Game, recently shared his insights on financial markets and the future of AI companies from an investment perspective.

Speaking on Bloomberg TV, Taleb expressed concerns about the increasing fragility of the markets, noting that the current environment is more precarious than it has been in the past two to three decades.

While gold prices have been rising, Taleb emphasized that he isn’t relying on gold as a safeguard, preferring instead to hedge against a potential market downturn.

He pointed out that the recent rally in the S&P 500 is largely driven by a few firms involved in AI, but he cautioned that the best investment opportunities in AI may not lie with those companies.

Taleb compared the current hype around AI to the early days of the internet, when Alta Vista dominated search engines before being overtaken by Google.

Reflecting on the possibility of a market crash this year, he noted that such events tend to occur when investors are overconfident and heavily exposed, drawing parallels to previous economic collapses.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

3

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

4

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

5

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

AI Becomes Gen Z’s Secret Weapon for Crypto Trading

A new report from MEXC reveals a striking generational shift in crypto trading behavior: Gen Z traders are rapidly embracing AI tools as core components of their strategy.

3 key Reasons Behind Today’s Crypto Market Drop

The crypto market shed 1.02% in the past 24 hours, led by a sharp Bitcoin drop and fading altcoin interest.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

3

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

4

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

5

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read