MicroStrategy Stock Hits 25-Year High as Bitcoin Nears $70,000

26.10.2024 8:00 1 min. read Alexander Stefanov

MicroStrategy’s stock has soared to its highest level in 25 years, spurred by Bitcoin’s potential push toward $70,000.

Throughout this year, MSTR’s stock price has steadily climbed, significantly boosted by the company’s substantial Bitcoin holdings.

According to Google Finance, the stock has surged 244% year-to-date and recently reached $235.89 as of October 24, marking a 55% rise over the past month.

This strong performance coincides with Bitcoin’s recent growth, as the digital asset has gained 6% over the month, driven by rising institutional interest.

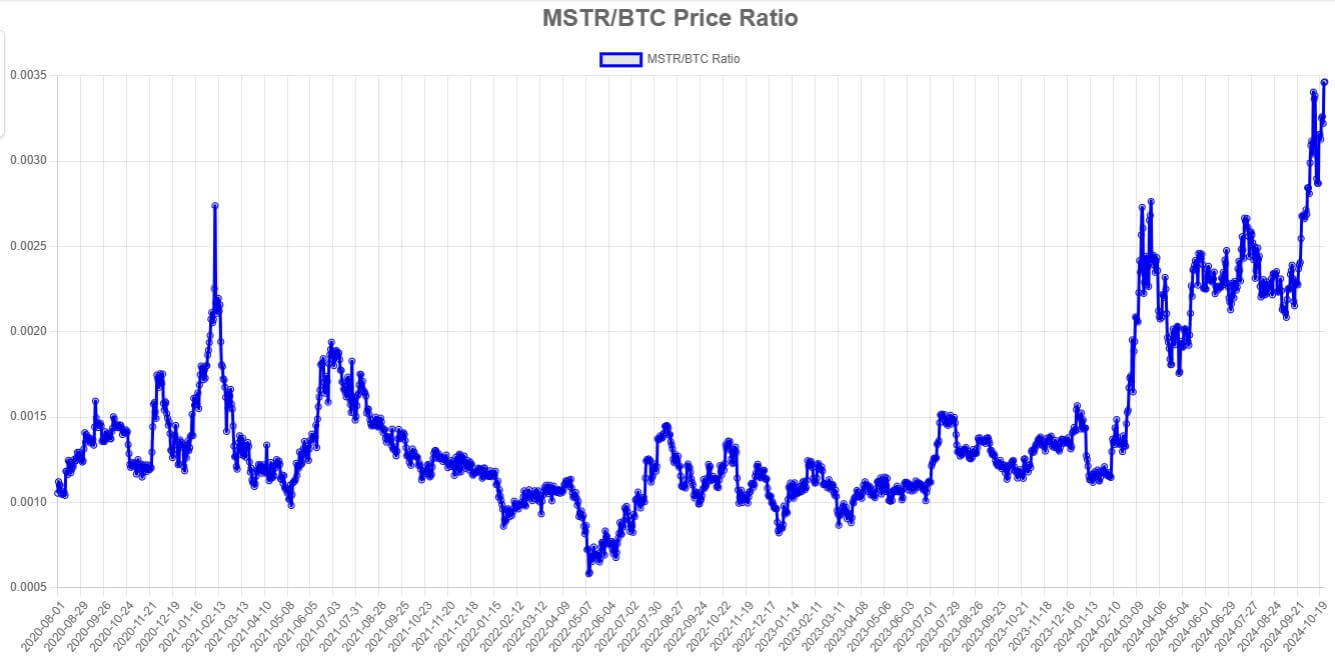

Recent data on the MSTR tracker highlights two core metrics tied to these market rallies: the “MSTR/BTC Ratio,” which measures MicroStrategy’s stock in comparison to Bitcoin’s price, reached an all-time high of 0.00346, surpassing levels seen during Bitcoin’s 2021 peak.

Additionally, the “NAV Premium” chart reveals that MicroStrategy’s stock is trading at its highest premium over its Bitcoin holdings in three years, with the market currently valuing the stock at 2.783 times its Bitcoin-equivalent net asset value.

-

1

At Least Five Law Firms Target Former Strategy Over Misleading BTC Risk Disclosures

28.06.2025 10:30 2 min. read -

2

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

3

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

4

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

5

U.S. Dollar Comes Onchain as GENIUS Act Ushers in Digital Era

20.07.2025 17:56 1 min. read

FTX Sets Next Data for Creditor Distribution

FTX Trading Ltd. and the FTX Recovery Trust have announced August 15, 2025 as the official record date for their next round of distributions.

Tesla Q2 Earnings Surge on Bitcoin Rally and AI Growth

Tesla stunned investors in Q2 2025 with a $1.2 billion profit, nearly tripling its previous quarter’s net income.

Jack Dorsey’s Block Joins S&P 500, Surges 10%

Block Inc. (NYSE: SQ) officially joined the S&P 500 on July 23, replacing Hess following its $54 billion acquisition by Chevron.

CoinShares Becomes First MiCA-Authorized Crypto Asset Manager in Europe

CoinShares, Europe’s top digital asset investment firm with over $9 billion in AUM, has secured full authorisation under the EU’s new Markets in Crypto-Assets (MiCA) regulation.

-

1

At Least Five Law Firms Target Former Strategy Over Misleading BTC Risk Disclosures

28.06.2025 10:30 2 min. read -

2

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

3

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

4

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

5

U.S. Dollar Comes Onchain as GENIUS Act Ushers in Digital Era

20.07.2025 17:56 1 min. read