Michael Saylor is Looking for a Government Bitcoin Bailout – Peter Schiff

26.07.2024 20:15 2 min. read Alexander Stefanov

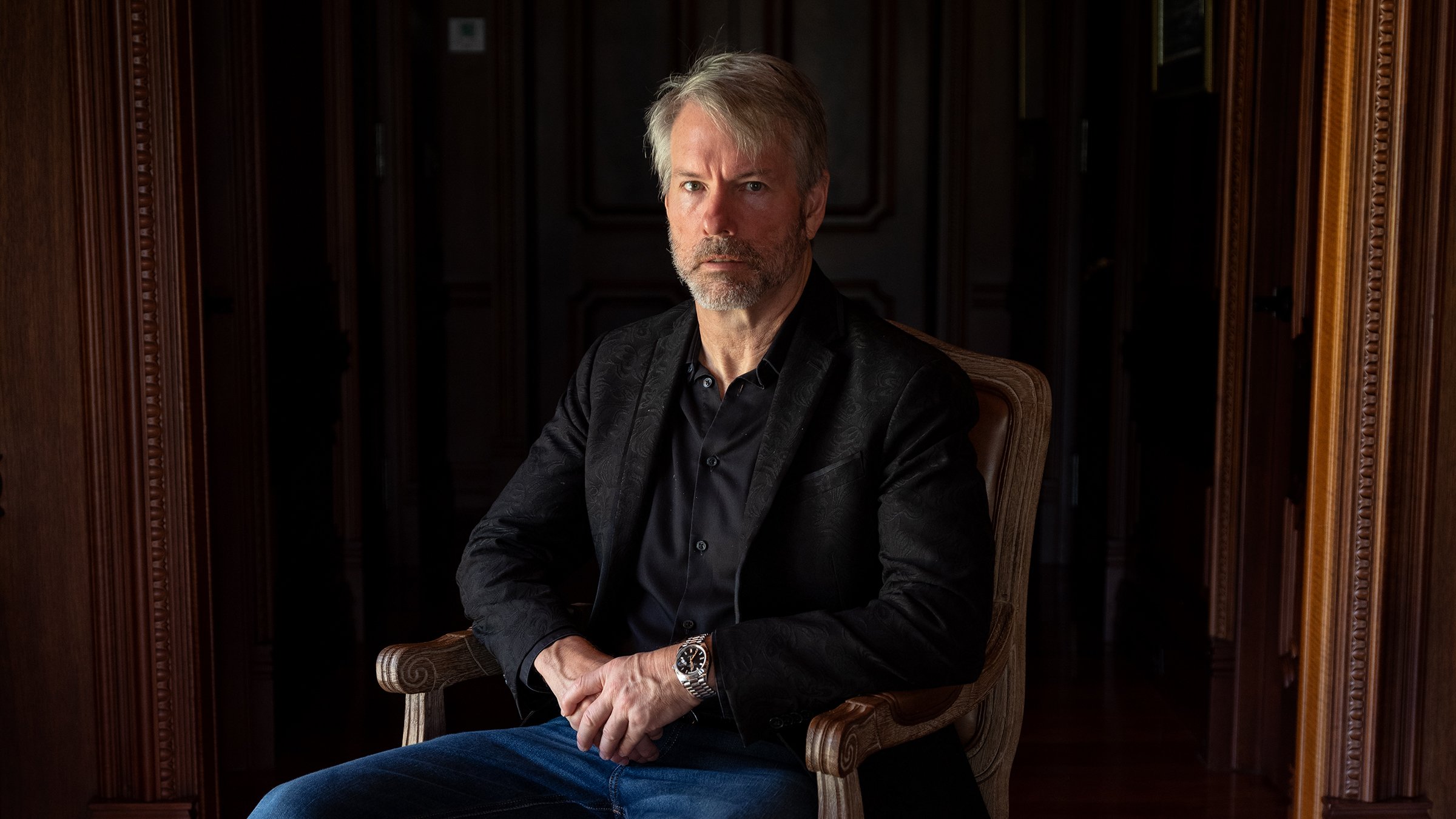

Economist Peter Schiff has harshly criticized Michael Saylor, the founder of MicroStrategy, for his recent Bitcoin advocacy.

Saylor’s proposal suggested that the U.S. should back its currency with Bitcoin, comparing it to “cyber Manhattan.”

Saylor argued that adopting Bitcoin could bolster the U.S. economy similarly to historic land acquisitions like the Louisiana Purchase.

He urged the government to acquire a significant Bitcoin reserve, drawing a parallel to its existing gold and land holdings.

[readmroe id=”134178″]Schiff rejected Saylor’s proposal, denouncing it as a form of a pyramid scheme. He warned that such a move could endanger taxpayers if the scheme fails.

Ironically, @saylor is looking for a government #Bitcoin bailout. He knows the Bitcoin blockchain letter is running out of chain and wants the U.S. government to become the buyer of last resort, leaving American taxpayers as the ultimate bag holders in the Bitcoin pyramid scheme.

— Peter Schiff (@PeterSchiff) July 26, 2024

Schiff criticized Bitcoin as lacking real value and yield compared to traditional investments and commodities.

The renowned economis also targeted the Bitcoin documentary “God Bless Bitcoin,” accusing it of falsely portraying Bitcoin as an equitable investment and efficient in energy use. He argued that Bitcoin is wasteful and that early investors have an unfair advantage over later entrants.

The exchange highlights the ongoing debate over Bitcoin’s role and value in the financial system, with Saylor envisioning a pivotal role for Bitcoin and Schiff remaining a vocal skeptic.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read