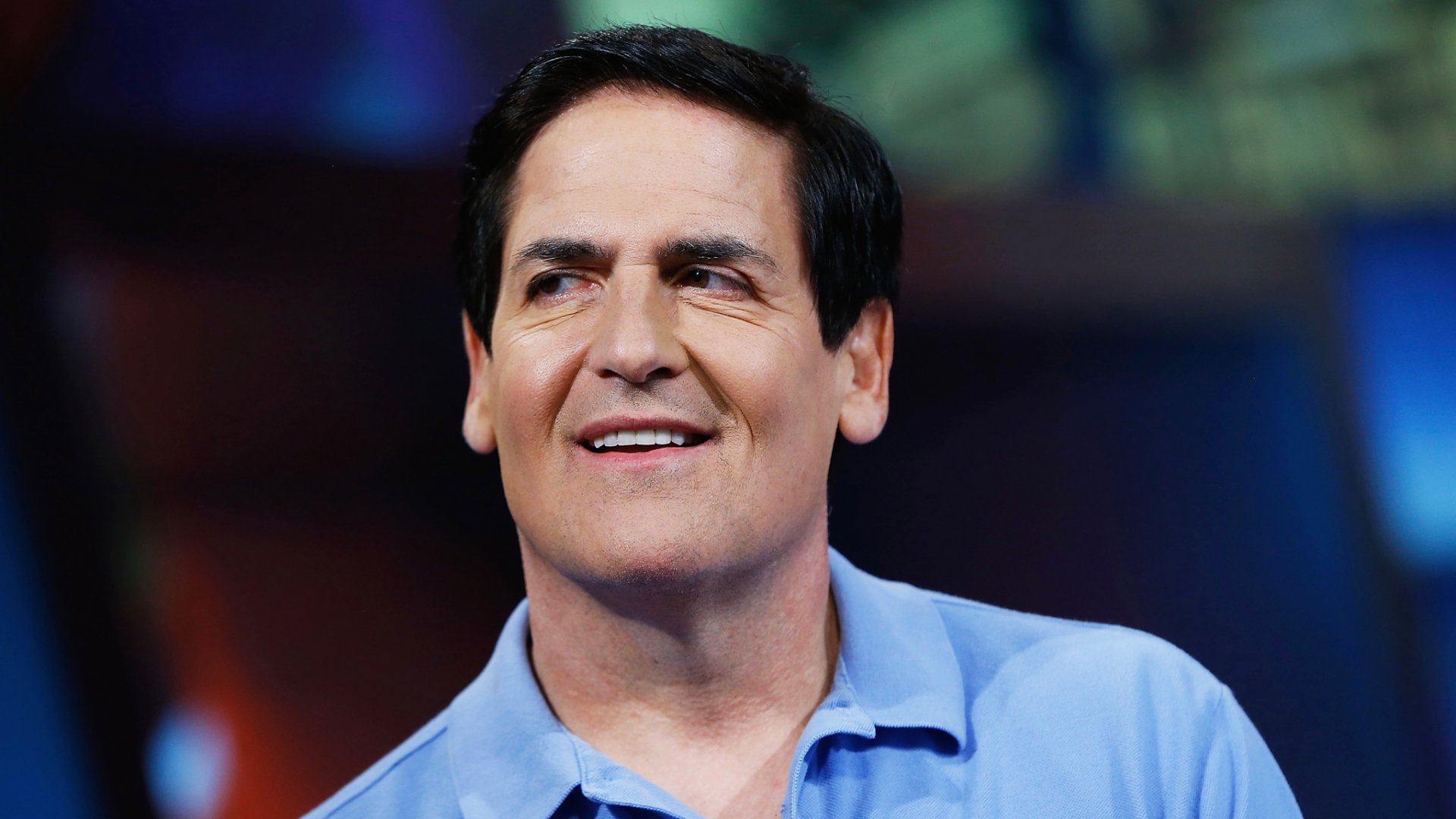

Mark Cuban Blasts SEC Chair Gensler, Hints His Exit Could Boost U.S. Economy

26.09.2024 9:00 1 min. read Alexander Zdravkov

After the recent hearing with Gary Gensler, tech billionaire Mark Cuban criticized the SEC Chair's regulation-by-enforcement strategy.

Cuban noted that even Kamala Harris’s team disapproves of this approach, which has characterized Gensler’s tenure.

He mentioned discussions with Harris’s team, who oppose “regulation through litigation,” and indicated that Gensler’s departure could benefit the economy, stating, “You leaving is worth a point in GDP growth.” Gensler acknowledged errors regarding the Debt Box case during the hearing.

The SEC’s strategy has faced backlash from the crypto industry for its lack of clear guidelines and reliance on legal actions. Congressman Tom Emmer condemned Gensler as one of the most damaging SEC chairs, accusing him of creating the term “crypto asset security” without legal backing.

Representative Ritchie Torres criticized Gensler for inventing the term “digital asset securities” and questioned whether it applies to in-game NFTs compared to sports tickets. Cuban supported Torres’s remarks with, “Gensler is gone.”

SEC Commissioner Hester Peirce admitted the agency should have recognized earlier that not all crypto assets are securities and criticized the preferential treatment given to large institutions like BNY Mellon in bypassing certain accounting standards.

-

1

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

2

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Key U.S. Events to Watch This Week That Could Impact Crypto

30.06.2025 11:00 2 min. read -

5

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

30.06.2025 10:00 2 min. read

Weekly Roundup: What Happened in Crypto Over the Past Week

From groundbreaking Ethereum developments to record-breaking DeFi activity and major protocol updates, the crypto industry saw a flurry of important announcements this past week.

Pump.fun Raises $600M in Record-Breaking PUMP Token Sale

Memecoin launchpad Pump.fun has stunned the crypto market by pulling off one of the fastest initial coin offerings (ICOs) in history.

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

Binance founder Changpeng Zhao has once again threatened legal action against Bloomberg.

Top 10 Biggest Crypto Developments This Week

The latest WuBlockchain Weekly report captures a high-volatility week in crypto. From Bitcoin’s new all-time high to controversy around Pump.fun’s presale and Elon Musk’s political Bitcoin endorsement, markets are witnessing sharp shifts in momentum and policy.

-

1

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

2

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Key U.S. Events to Watch This Week That Could Impact Crypto

30.06.2025 11:00 2 min. read -

5

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

30.06.2025 10:00 2 min. read