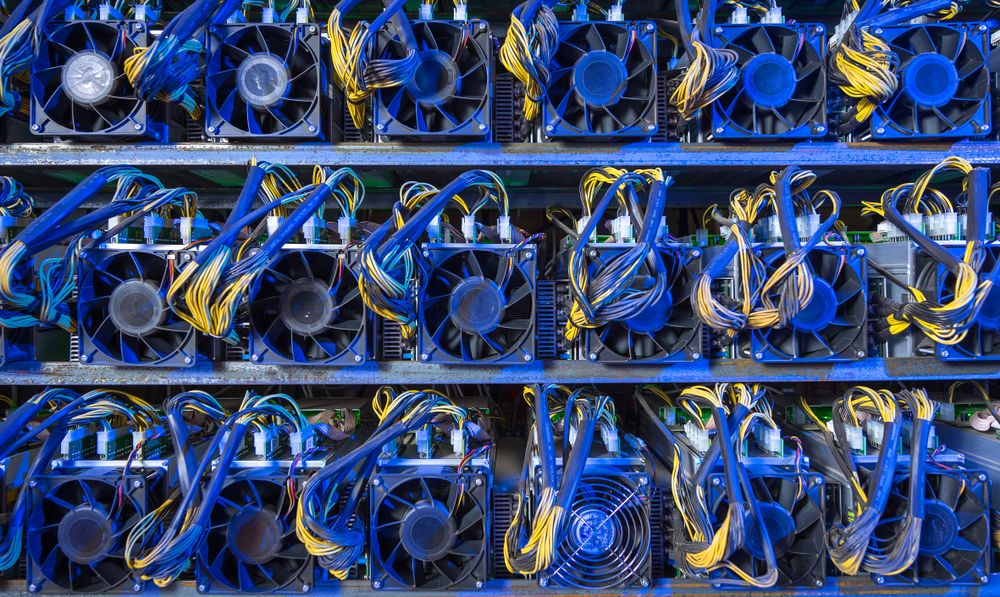

Malaysian Authorities Destroy $450K Worth of Bitcoin Mining Equipment

21.08.2024 18:00 1 min. read Alexander Stefanov

Malaysian officials have dismantled 985 bitcoin mining rigs valued at approximately 1.98 million Malaysian ringgits ($452,500), as part of an ongoing effort to combat electricity theft associated with cryptocurrency mining.

According to local reports, the Perak Tengah district police used a steamroller to crush the equipment on Monday, following a court order. These machines were confiscated during enforcement actions conducted from 2022 through April of this year.

Ibu Pejabat Polis Daerah (IPD) Perak tengah melupuskan 985 peralatan yang digunakan dalam kegiatan perlombongan Bitcoin dianggarkan bernilai RM1.98, pada Isnin.#IPDPerak #Lupus #bitcoin

Video: Amirrul Rabbani Rashid pic.twitter.com/kEgdqTopCH

— Malaysia Gazette (@MalaysiaGazette) August 19, 2024

This latest operation is part of a broader crackdown on illicit power use linked to Bitcoin mining. Just last week, Sepang district police apprehended seven individuals suspected of stealing electricity for cryptocurrency mining activities.

Akmal Nasrullah Mohd Nasir, the Deputy Minister for Energy Transition and Water Transformation, revealed last month that between 2018 and 2023, cryptocurrency miners in Malaysia were responsible for stealing at least RM3.4 billion ($777 million) worth of electricity.

As crypto mining operations shift away from China—where all mining activities were banned in 2021—countries such as the U.S., Malaysia, Indonesia, Laos, and Thailand have become new hubs for mining. These Southeast Asian nations offer attractive conditions for miners due to their lower electricity costs, skilled workforce, and developed infrastructure.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read