Kamala Harris Hires Former Binance Advisor to Campaign Team

05.08.2024 9:30 2 min. read Alexander Stefanov

U.S. presidential candidate Kamala Harris is reportedly expanding her campaign team by adding a former Binance advisor.

Politico has revealed that David Plouffe, a former political adviser to President Barack Obama and a previous member of Binance’s Global Advisory Board, is joining Harris’s campaign. An insider told Politico that Plouffe’s role is significant, but he will not be overseeing the entire campaign.

A campaign representative clarified that Plouffe’s involvement is specific to a certain role and he is not a senior advisor for the entire campaign.

Harris, who became the Democratic nominee after President Joe Biden exited the race last month, has been reaching out to major crypto companies, such as Coinbase, Ripple, and Circle, to mend relations with the crypto sector. She reportedly conveyed that Democrats are now “pro-business, responsible business” in their approach to the industry.

The Winklevoss twins, co-founders of the Gemini crypto exchange, have been critical of Harris’s efforts to improve the party’s stance on cryptocurrency. Cameron Winklevoss dismissed Harris’s outreach as insincere, while Tyler Winklevoss accused Democrats of mistreating the crypto sector over the past four years.

Additionally, anti-crypto Senator Gary Peters from Michigan is rumored to be a potential vice presidential pick for Harris. Peters, known for co-sponsoring legislation to impose strict money laundering regulations on the crypto industry, holds an “F” rating from the digital asset advocacy group Stand With Crypto.

-

1

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

2

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

3

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

4

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

5

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

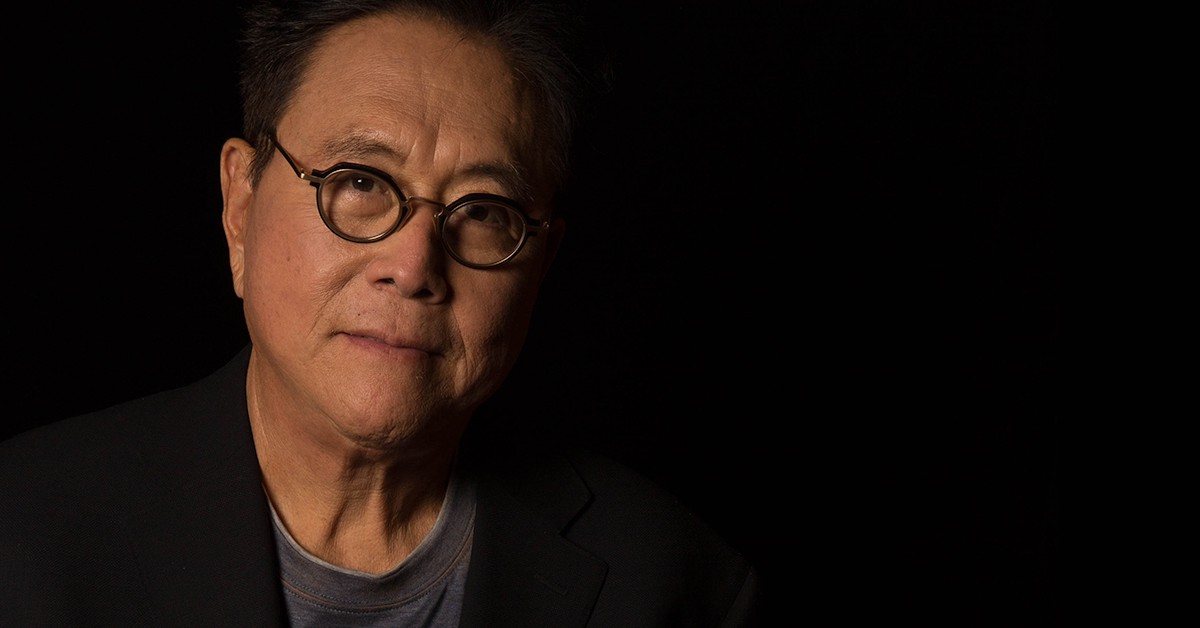

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

2

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

3

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

4

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

5

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read