JUST IN: Movements Spotted From $2.2 Billion Mt. Gox Wallet

13.08.2024 16:14 1 min. read Alexander Stefanov

Failed cryptocurrency exchange Mt. Gox is on its last stage of reimbursing clients with Bitcoin (BTC).

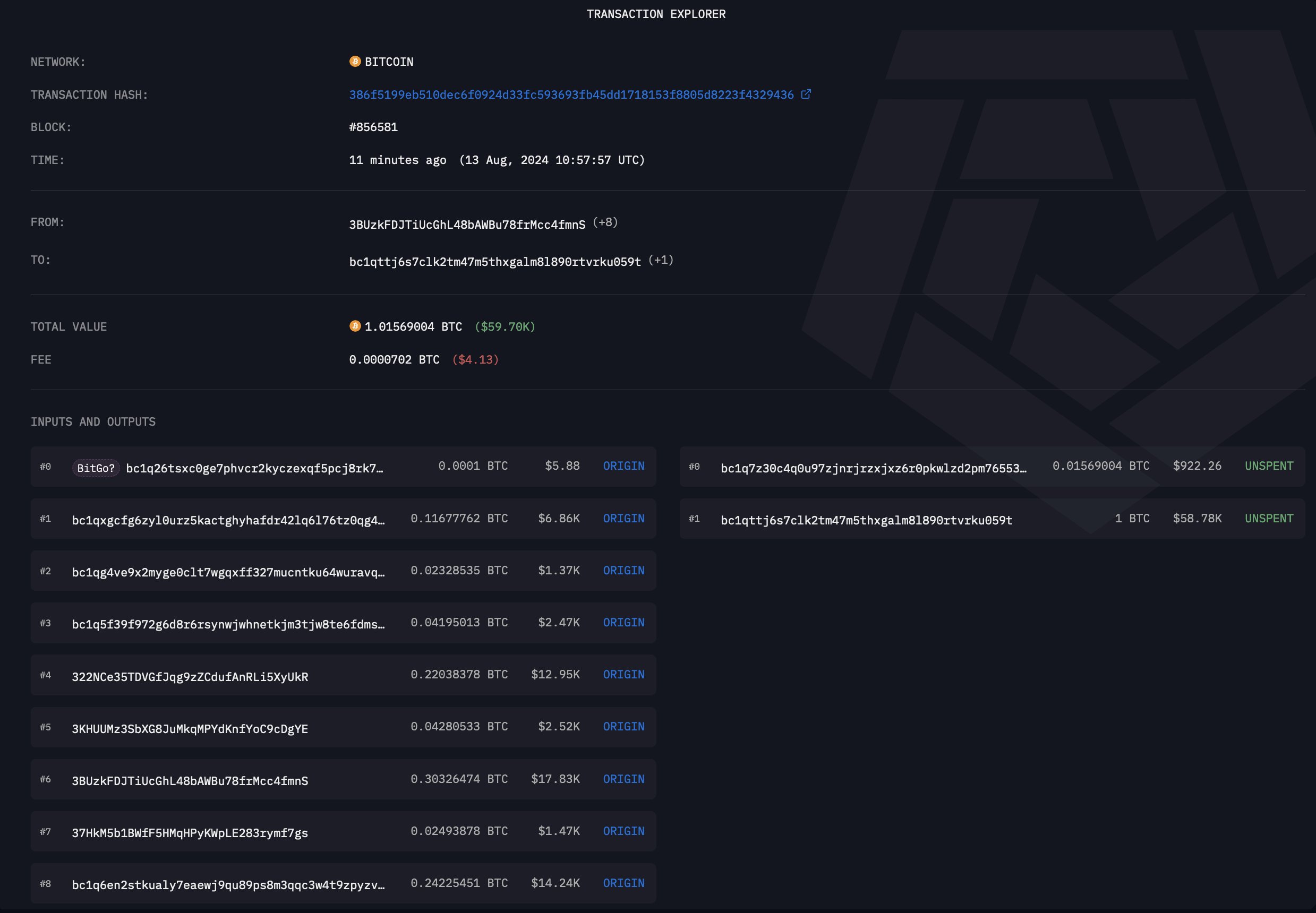

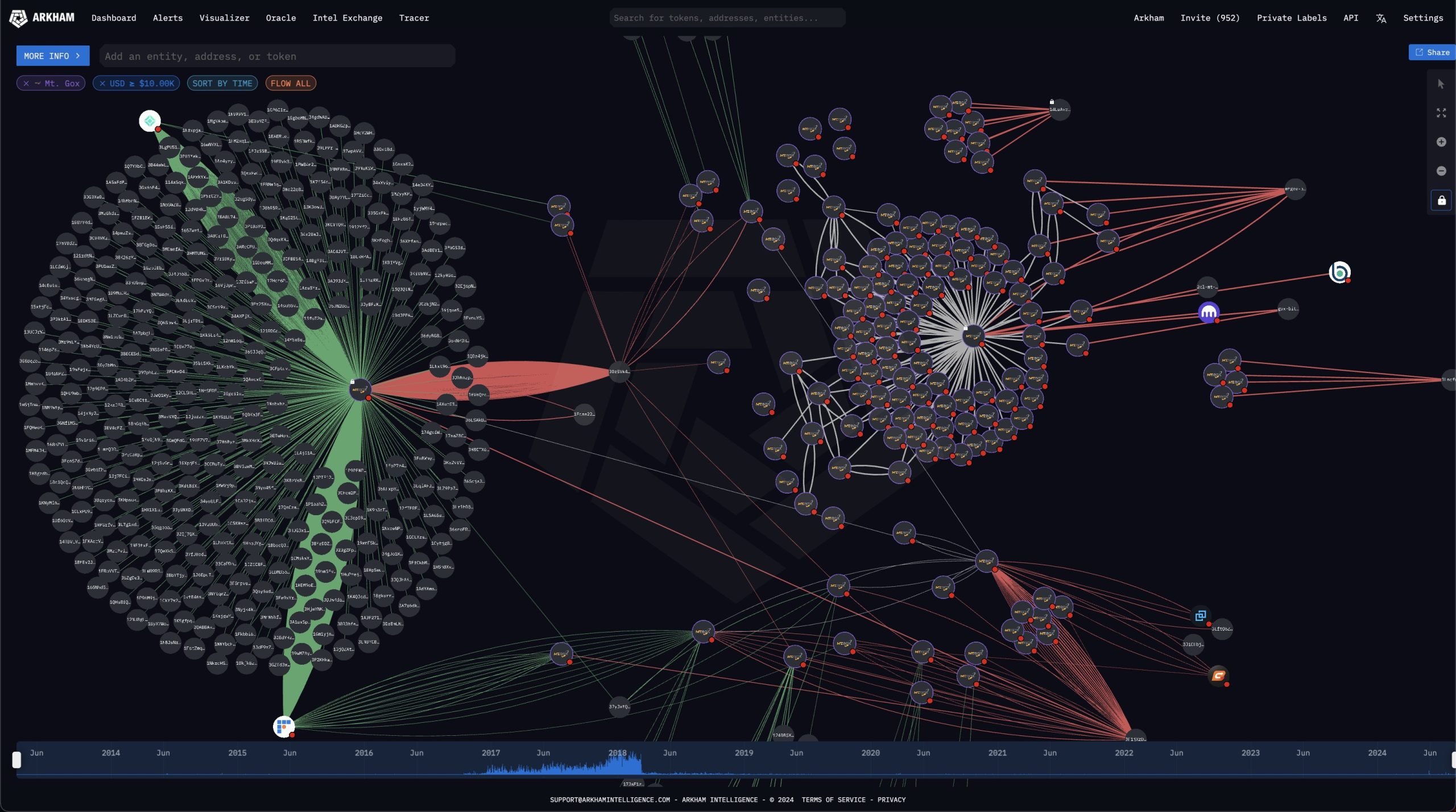

According to data from Arkham Intelligence, a wallet that received $2.19 billion in Bitcoin from Mt. Gox has just initiated test transactions.

This wallet “bc1q26” is likely Bitgo, the 5th and final exchange working with Mt. Gox Trustee to distribute funds to creditors.

So the main question now is when will they start distributing and could this have a negative impact on BTC’s price?

During the initial Bitcoin distribution through the top crypto exchange Kraken we witnessed a significant price drop that affected not only BTC, but the whole crypto market aswell.

At the time of writing, Bitcoin is trading at $59,180 after a 1% drop in the past 24 hours and has $33 billion in trading volume. Despite this slight drop, BTC is up almost 8% on the weekly chart.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read