JPMorgan CEO Warns Market Is Overlooking Risks from Tariff Tensions

22.05.2025 8:00 1 min. read Alexander Stefanov

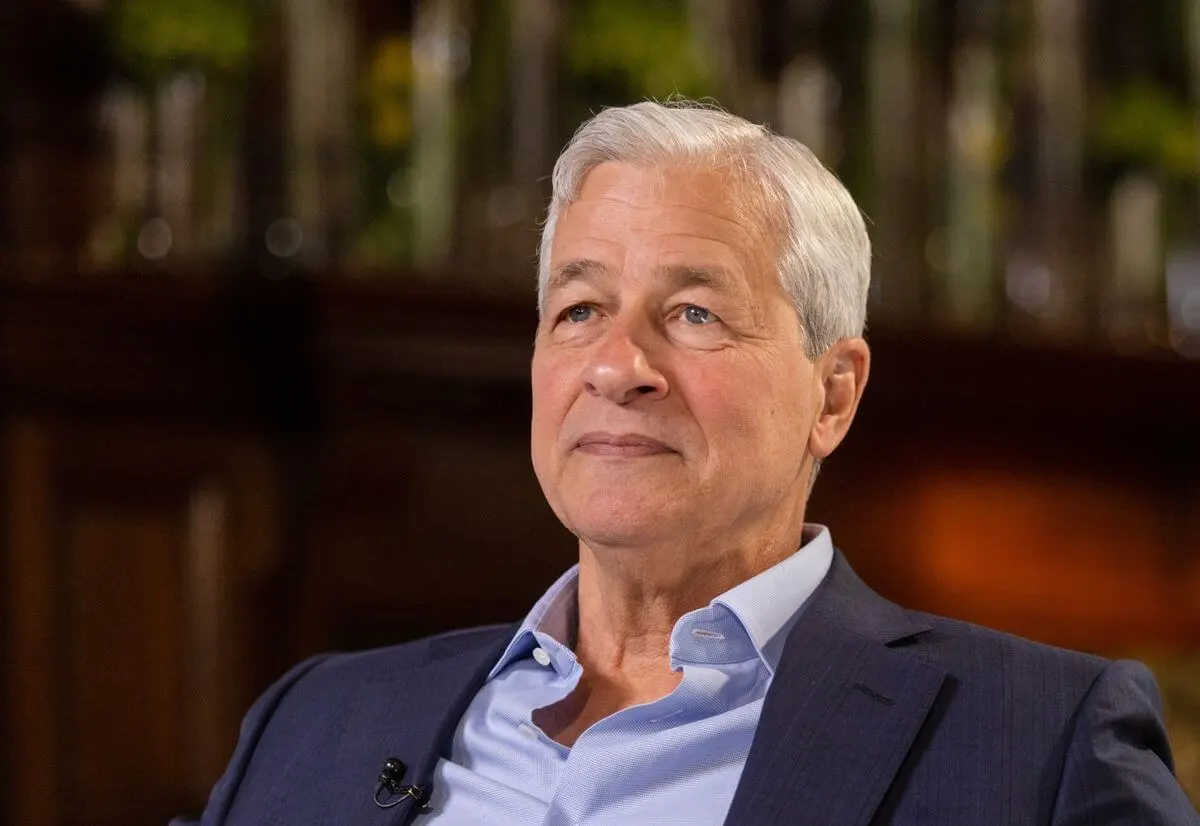

Despite the S&P 500’s strong rebound, JPMorgan CEO Jamie Dimon believes investors may be ignoring warning signs that could spell trouble for the economy.

In a recent webcast, Dimon cautioned that enthusiasm in the markets might be masking deeper issues—particularly the long-term fallout of trade tariffs.

The market has rallied sharply, recovering 23% in just a few weeks, but Dimon sees this as a sign of complacency rather than resilience. According to him, the real economic consequences of renewed tariffs—like inflation and stagnation—have yet to be priced in.

“Markets are behaving as if tariffs don’t matter,” he said, suggesting that the threat of stagflation is greater than most assume. Tariffs, even at current levels, are already significant, and the full effect may still lie ahead.

Beyond inflation risks, Dimon pointed to growing geopolitical shifts. Countries affected by U.S. tariffs are increasingly forging new trade alliances, which could erode America’s influence in global markets. He also stressed that reshoring manufacturing won’t be a quick fix, noting that building new production capacity typically takes years.

As of the latest close, the S&P 500 sits at 5,940—well into recovery territory—but Dimon’s tone suggests the optimism might be premature.

-

1

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

2

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read -

3

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

4

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

06.07.2025 13:00 2 min. read -

5

Crypto Sector H1 2025 Roundup: Binance Report Shows Institutional Surge and Tech Growth

19.07.2025 11:00 2 min. read

JPMorgan: Coinbase Could Gain $60B From USDC-Circle Ecosystem

A new report from JPMorgan is shedding light on the staggering upside potential of Coinbase’s partnership with Circle and its deep exposure to the USDC stablecoin.

5 Major US Events and How They Can Shape Crypto Market in The Next Days

The week ahead is shaping up to be one of the most pivotal for global markets in months. With five major U.S. economic events scheduled between July 30 and August 1, volatility is almost guaranteed—and the crypto market is bracing for impact.

eToro Launches 24/5 Stock Trading, Unlocking Round-the-clock Access to Top US Shares

Global fintech platform eToro has officially rolled out 24/5 trading on its 100 most popular U.S. stocks, giving users the ability to buy and sell equities at any time from Monday to Friday.

Stablecoins are Overtaking Visa: Here is The Latest Data

A new chart from Bitwise Asset Management has sent shockwaves through the financial world, showing that stablecoin transaction volumes are now rivaling—and in some cases surpassing—Visa’s global payments.

-

1

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

2

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read -

3

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

4

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

06.07.2025 13:00 2 min. read -

5

Crypto Sector H1 2025 Roundup: Binance Report Shows Institutional Surge and Tech Growth

19.07.2025 11:00 2 min. read