Japan’s Stock Market Started to Recover After Yesterday’s Crash

06.08.2024 12:45 2 min. read Kosta Gushterov

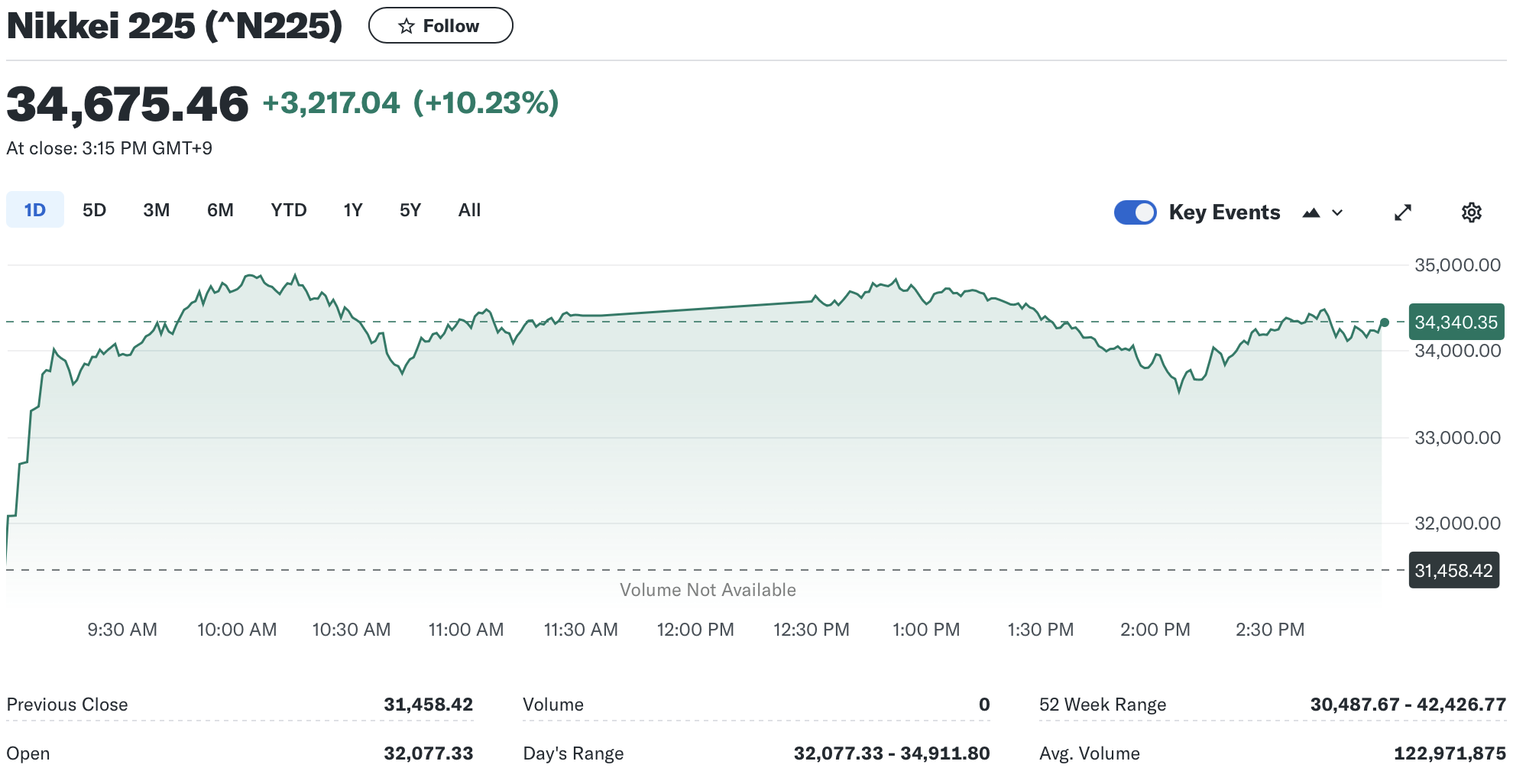

Japan's key Nikkei 225 index rallied more than 10 percent early Tuesday, after its biggest drop in 37 years the previous day.

Although the index fluctuated throughout the day, it eventually closed 10.23% higher at 34,675. Other Asian markets also posted gains after significant losses on Wall Street, though not as severe as Monday’s 12.4% drop in Tokyo.

Many stocks posted double-digit percentage increases, mirroring their declines of the previous day. For example, Toyota Motor Corp. rose 12.8 percent, and Tokyo Electron, a computer chipmaker, rose 16.6 percent. Honda Motor Co. advanced 14.7 percent, and Mitsubishi UFJ Financial Group rose 5.8%.

The latest losses followed last week’s decision by the Bank of Japan to raise its benchmark interest rate from near zero. The move boosted the value of the Japanese yen but also prompted traders to exit positions where they had borrowed money at low prices in Japan to invest globally.

Officials from Japan’s Ministry of Finance, the Financial Services Agency, and the Bank of Japan gathered Tuesday to discuss the recent market fluctuations.

Atsushi Mimura, a senior ministry official, refrained from commenting directly on the specifics of the market due to government policy. However, he acknowledged that experts attributed the recent volatility to various global events, noting similar trends in other markets.

He pointed to geopolitical tensions in the Middle East and recent economic data, as well as rising wages and investment in Japan, as contributing factors.

According to Mimura, deputy finance minister for international affairs, government and central bank officials reaffirmed their commitment to monitor both domestic and international fiscal conditions and work together.

Mimura declined to comment on whether the recent interest rate hike by the Bank of Japan (BOJ) was the cause of the market moves but stressed that the government is focused on maintaining exchange rate stability.

SPI Asset Management’s Stephen Ince likened Tuesday’s market rebound to a “lifeboat,” noting that market conditions can quickly change from bad to more favorable.

The Nikkei is currently 7.7 percent higher than its year-ago levels but more than 9 percent below its level of three months ago. Its biggest percentage rise to date was 14.2% in October 2008.

-

1

USA-China Trade Truce Sparks Crypto and Stock Market Optimism

13.05.2025 9:00 1 min. read -

2

China Dumps U.S. Treasuries as Global Holdings Hit Record High

19.05.2025 14:00 2 min. read -

3

Brazil Pours Cold Water on BRICS Currency Hopes, Citing Major Asset Gap

22.05.2025 10:00 1 min. read -

4

This Country Just Banned the U.S. Dollar in Domestic Transactions

19.05.2025 19:00 2 min. read -

5

Jamie Dimon Says U.S. Recession Still a Real Possibility Amid Global Instability

17.05.2025 19:00 1 min. read

Jamie Dimon Predicts Bond Market Shock, Urges U.S. to Fix Its Foundations

Jamie Dimon, CEO of JPMorgan Chase, has voiced fresh concerns about the state of the U.S. economy, warning that financial markets may be heading into troubled waters—particularly the bond market.

Ross Ulbricht’s Prison Relics Spark Bidding War on Bitcoin Marketplace

Ross Ulbricht, the man once behind the Silk Road dark web marketplace, has turned artifacts from his prison years into a multimillion-dollar Bitcoin windfall.

Nvidia’s Chart Hints at $200 Target Despite China Setback

Nvidia’s recent market retreat hasn’t shaken analysts’ confidence in the stock’s long-term potential. Despite a dip to $135.13 at the close of the last session, chart watchers say a powerful setup could send NVDA soaring toward the $200 mark in the coming months.

Pi Network Taps Into Gaming to Showcase Real Crypto Utility

The team behind Pi Network is diving into the gaming industry with the release of FruityPi, a new application designed to highlight the practical use of its ecosystem tools, including the Pi cryptocurrency, wallet, and ad services.

-

1

USA-China Trade Truce Sparks Crypto and Stock Market Optimism

13.05.2025 9:00 1 min. read -

2

China Dumps U.S. Treasuries as Global Holdings Hit Record High

19.05.2025 14:00 2 min. read -

3

Brazil Pours Cold Water on BRICS Currency Hopes, Citing Major Asset Gap

22.05.2025 10:00 1 min. read -

4

This Country Just Banned the U.S. Dollar in Domestic Transactions

19.05.2025 19:00 2 min. read -

5

Jamie Dimon Says U.S. Recession Still a Real Possibility Amid Global Instability

17.05.2025 19:00 1 min. read