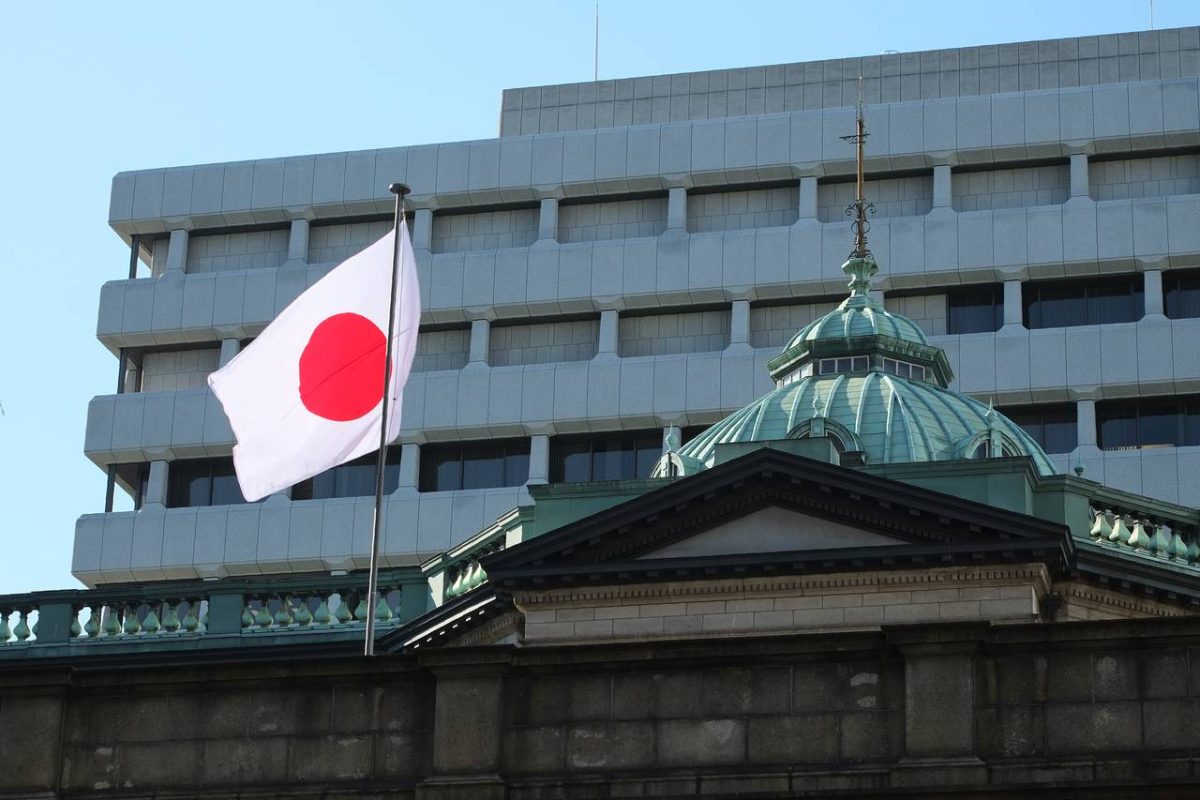

Japan Proposes Two-Tier Crypto Framework in Push for Smarter Regulation

12.04.2025 17:00 1 min. read Alexander Stefanov

Japan is preparing to reshape its crypto regulations with a fresh proposal that would divide digital assets into two distinct categories—one for business-backed tokens and another for decentralized cryptocurrencies like Bitcoin.

The country’s Financial Services Agency (FSA) released the draft framework this week, opening the door to public feedback until May 10, 2025.

The new approach aims to bring clarity to a fragmented regulatory environment. Under the plan, tokens used for fundraising or issued by businesses—often lesser-known altcoins—would face stricter rules around transparency, investor protection, and disclosure. Projects would need to outline how funds are used and disclose potential risks. If they reach a significant investor base, they may fall under security token laws.

In contrast, widely held decentralized tokens such as Bitcoin and Ethereum would not be regulated at the asset level. Instead, crypto exchanges would bear responsibility for market monitoring, including reporting sharp price movements.

While the paper avoids the thorny issue of taxation, it lays the groundwork for more formal recognition of crypto within Japan’s financial system. Regulators are also considering broader changes to financial laws by 2026 that could redefine digital assets as investment products rather than just payment tools.

The proposal reflects a shift in tone from Japan’s traditionally cautious stance. A possible lifting of the crypto ETF ban is also in discussion, signaling that Tokyo is increasingly open to embracing digital assets under tighter safeguards.

-

1

FCA Considers Opening Crypto ETNs to UK Retail Investors

07.06.2025 9:00 2 min. read -

2

Russia Hits Pause on Expanding Crypto Mining Restrictions

07.06.2025 11:00 1 min. read -

3

U.S. State of Connecticut Blocks Crypto from Public Sector Operations

12.06.2025 16:00 1 min. read -

4

Vietnam Charts a Clear Course for Digital Assets With New 2026 Law

16.06.2025 18:00 1 min. read -

5

Federal Reserve Clears Path for Banks to Enter Crypto Market

24.06.2025 8:00 2 min. read

Turkey Targets Crypto Crime With New Withdrawal Delays and Transfer Limits

Turkey is preparing to roll out a series of strict crypto regulations aimed at curbing financial crimes tied to illegal gambling and online fraud, according to new comments from Finance Minister Mehmet Simsek.

Japan Plans Major Crypto Reform with New Tax Rules and ETF Access

Japan is preparing to dramatically reshape its cryptocurrency regulations, with officials drafting a proposal that would reclassify digital assets and streamline their tax treatment.

Federal Reserve Clears Path for Banks to Enter Crypto Market

In a significant policy shift, the U.S. Federal Reserve has quietly removed reputational risk as a factor in evaluating banks, a move that could make it easier for financial institutions to offer cryptocurrency services without fear of regulatory backlash.

Europe Takes the Lead in Crypto as U.S. Stalls on Regulation

Europe is emerging as the new global crypto hub, propelled by its MiCA regulatory framework, which is attracting investors and platforms alike.

-

1

FCA Considers Opening Crypto ETNs to UK Retail Investors

07.06.2025 9:00 2 min. read -

2

Russia Hits Pause on Expanding Crypto Mining Restrictions

07.06.2025 11:00 1 min. read -

3

U.S. State of Connecticut Blocks Crypto from Public Sector Operations

12.06.2025 16:00 1 min. read -

4

Vietnam Charts a Clear Course for Digital Assets With New 2026 Law

16.06.2025 18:00 1 min. read -

5

Federal Reserve Clears Path for Banks to Enter Crypto Market

24.06.2025 8:00 2 min. read