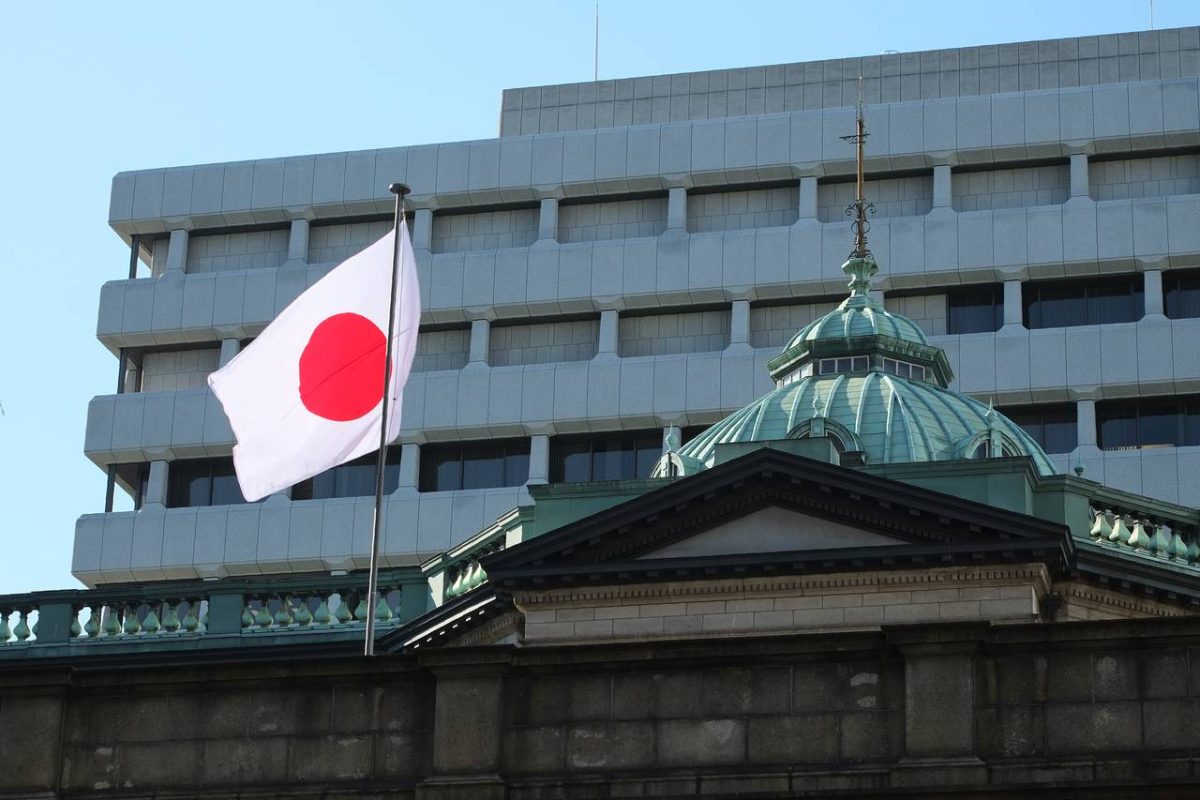

Japan Hikes Interest Rates for the Third Time – How Did Crypto React?

24.01.2025 11:41 2 min. read Alexander Stefanov

Japan's central bank has made a bold move, increasing its benchmark lending rate to 0.5% - a level not seen since 2008.

This long-anticipated hike is stirring unease among global markets, with ripple effects reaching the cryptocurrency sector.

The Bank of Japan’s third rate hike in under a year reflects its effort to address persistent inflation, expected to stay above 2.6% through 2025. However, this policy shift comes at a cost, as Japan’s growth outlook has been downgraded. A stronger yen could upend the carry trade, a strategy where investors borrow yen to invest in higher-yielding markets, potentially disrupting global liquidity.

Bitcoin and other cryptocurrencies like Ethereum and Solana quickly reacted to the news, with Bitcoin dropping 3% before rebounding.Now, BTC is up around 3.5% in the pasr 24 hours. Analysts suggest this volatility is tied not only to Japan’s rate hike but also to uncertainties stemming from U.S. policies on digital assets.

While some analysts warn that Bitcoin could face a steep decline, comparing current trends to historical market crashes, others see a chance for long-term gains. The potential for a significant sell-off has raised concerns, but a segment of the market remains optimistic, viewing the volatility as an opportunity to accumulate assets at lower prices.

The rate hike adds another layer of complexity to an already uncertain global environment. As Japan adjusts its monetary stance, geopolitical tensions and U.S. trade policies are further shaking investor confidence. Despite the turbulence, history suggests that market recoveries often follow these brief periods of sell-offs, offering strategic opportunities for the patient investor.

By adapting to these shifts, traders can position themselves to benefit from any eventual stabilization, provided they maintain a long-term perspective.

-

1

Tom Lee Warns Fed Could Trigger Market Turmoil With Delayed Pivot

22.06.2025 19:00 3 min. read -

2

Fed’s New Projections Hint at a Slower Easing Cycle Through 2026

19.06.2025 15:00 2 min. read -

3

Trump Targets Fed Over Missed Rate Cut Opportunity

20.06.2025 9:00 1 min. read -

4

UK Inflation Stalls at 3.4%, Spotlight Shifts to BoE’s August Meeting

19.06.2025 9:00 2 min. read -

5

Fed Holds Fire on Rates, Signals Cuts Could Arrive if Jobs Falter

18.06.2025 21:30 1 min. read

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

Robert Kiyosaki Predicts When The Price of Silver Will Explode

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

Fresh data on Personal Consumption Expenditures (PCE) — the Federal Reserve’s preferred inflation gauge — shows inflation ticked higher in May, potentially delaying the long-awaited Fed rate cut into September or later.

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

Federal Reserve Chair Jerome Powell is once again under fire, this time facing renewed criticism from Donald Trump over the Fed’s decision to hold interest rates steady in June.

-

1

Tom Lee Warns Fed Could Trigger Market Turmoil With Delayed Pivot

22.06.2025 19:00 3 min. read -

2

Fed’s New Projections Hint at a Slower Easing Cycle Through 2026

19.06.2025 15:00 2 min. read -

3

Trump Targets Fed Over Missed Rate Cut Opportunity

20.06.2025 9:00 1 min. read -

4

UK Inflation Stalls at 3.4%, Spotlight Shifts to BoE’s August Meeting

19.06.2025 9:00 2 min. read -

5

Fed Holds Fire on Rates, Signals Cuts Could Arrive if Jobs Falter

18.06.2025 21:30 1 min. read