Is the Altcoin Season Approaching?

23.07.2024 20:20 2 min. read Kosta Gushterov

The likelihood of an altcoin season appears to be diminishing as the price of Bitcoin (BTC) has surged in recent weeks after falling to around $53,000.

Many crypto assets remain subdued due to low market liquidity, further delaying the onset of the so-called altcoin season.

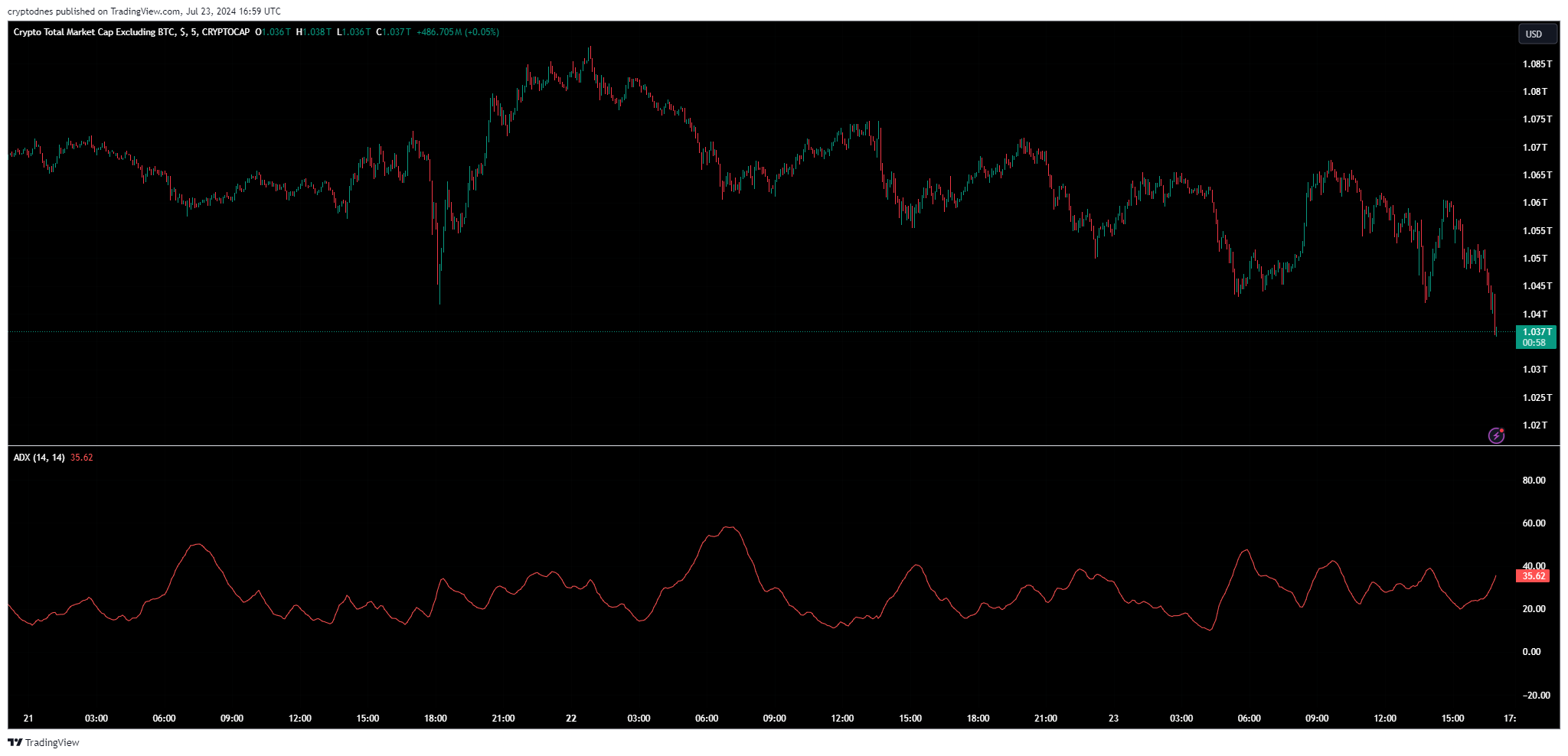

Currently, the altcoin season is facing delays as market conditions are not conducive to rising altcoin prices. The uptrend in the altcoin market is showing signs of weakening as reflected in the Average Directional Index (ADX).

The ADX is approaching the critical level of 25. A decline below this threshold may signal a loss of trend strength and a lack of momentum.

This weakening trend is a worrying sign. Declining trend strength could undermine investor confidence and reduce buying interest, exacerbating market difficulties.

This season, most altcoins have struggled to show significant growth. Interestingly, only Toncoin and PEPE have achieved gains exceeding 50%, indicating their strong performance in an otherwise stagnant market.

The limited growth among most altcoins points to ongoing issues within the crypto market. If this trend continues, it could lead to increased uncertainty and volatility, which will affect investor sentiment and market stability.

Furthermore, a further rise in the price of Bitcoin could further delay the start of a potential season for altcoins. However, if Bitcoin’s dominant position drops below 55.67%, this could provide alternative cryptocurrencies with some potential for recovery, potentially sparking the start of such a season.

-

1

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read -

2

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

3

XRP Price Prediction: XRP Soars Over 30%, Can it Hit $10 in this Bull Run?

15.07.2025 0:49 5 min. read -

4

Solana Price Prediction: SOL Could Jump to $200 After This ‘Buy’ Signal

15.07.2025 23:39 3 min. read -

5

How Can You Tell When it’s Altcoin Season?

14.07.2025 14:07 2 min. read

Solana Reclaims $200 as Short Squeeze, ETF hopes, and Institutional Flows Collide

Solana surged 5.6% to reclaim the $200 level for the first time since February, fueled by a confluence of bullish technical, fundamental, and institutional catalysts.

Top trending tokens today: WEMIX, Drift and TRUMP Coin

CoinMarketCap’s momentum algorithm is flashing strong upside signals for several fast-moving tokens. WEMIX, Drift, and OFFICIAL TRUMP Coin top today’s trending list, each driven by unique catalysts—from GameFi upgrades and DeFi volume surges to political tailwinds.

Altcoin Season Signals Strengthen as Institutional Flows Accelerate

According to QCP Capital’s latest report, altcoin season may have finally arrived.

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

Solana (SOL) has gone up by 35% in the past 30 days as multiple tailwinds have lifted the price of this top altcoin above the $190 level. A breakout above this level favors a bullish Solana price prediction as it could anticipate a big move ahead, especially at a point when market conditions are favorable. […]

-

1

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read -

2

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

3

XRP Price Prediction: XRP Soars Over 30%, Can it Hit $10 in this Bull Run?

15.07.2025 0:49 5 min. read -

4

Solana Price Prediction: SOL Could Jump to $200 After This ‘Buy’ Signal

15.07.2025 23:39 3 min. read -

5

How Can You Tell When it’s Altcoin Season?

14.07.2025 14:07 2 min. read