Is Shiba Inu (SHIB) a Good Buy Right Now?

10.08.2024 19:00 1 min. read Alexander Stefanov

Shiba Inu (SHIB), the second largest meme coin, experienced a significant dip on August 5, hitting a five-month low before rebounding a few days later.

This bounce raised hopes of a price surge, but SHIB has not yet met these expectations, though its current price might be an attractive buy.

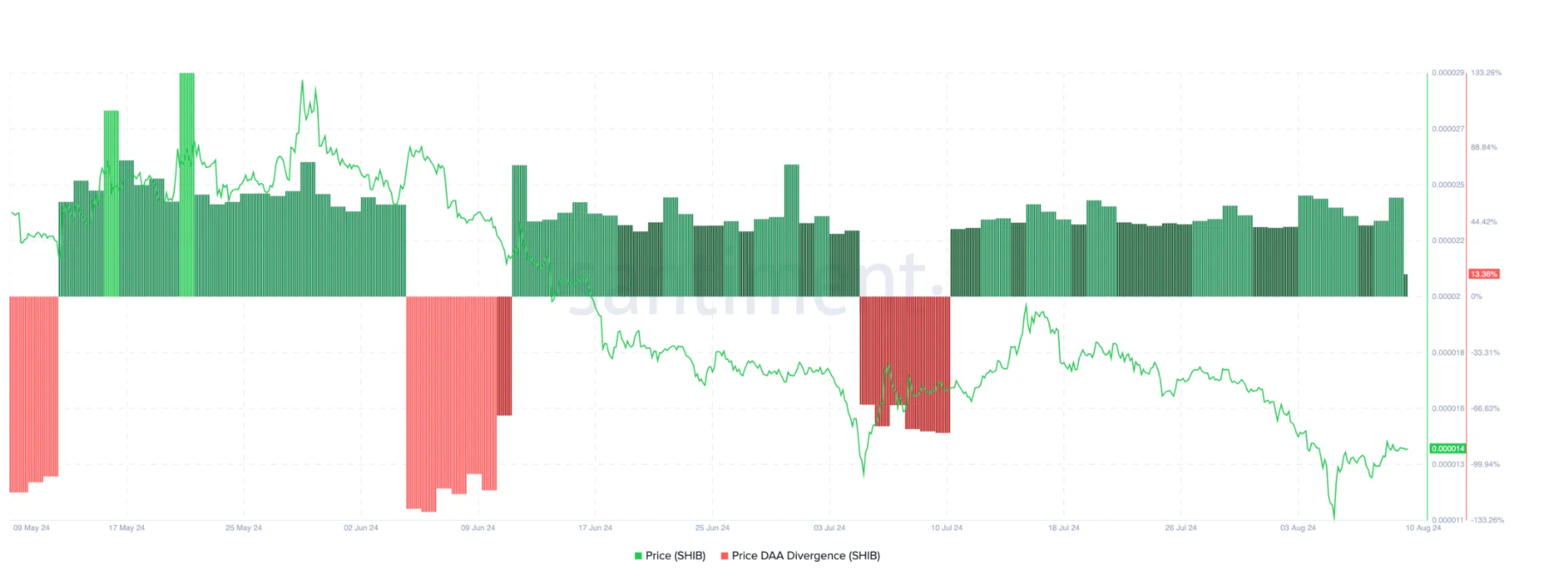

Santiment’s analysis reveals insights through SHIB’s price and Daily Active Addresses (DAA). A rise in DAA typically hints at price growth, while a drop suggests the opposite. Currently, SHIB’s DAA indicates a buying opportunity with a 12.17% positive divergence.

Supporting this, the Market Value to Realized Value (MVRV) ratio, which assesses market profitability, shows SHIB is undervalued with a ratio of 0.69. This implies more unrealized losses than gains, suggesting potential for accumulation before a price increase.

Despite positive on-chain signals, technical analysis shows SHIB in a bearish descending channel since mid-July. At $0.000014, it hasn’t broken out of this pattern, indicating limited near-term upside. The Bull-Bear Power (BBP) indicator also favors bears, pointing to potential price consolidation between $0.000012 and $0.000014, or a possible drop to $0.000010. However, increased buying pressure could push the price up to $0.000017.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read

Ethereum’s On-chain Volume Surges 288% — Is a Breakout Next?

Ethereum’s network just witnessed a seismic shift in activity.

Binance Launches New Airdrop and Trading Competition

Binance has officially launched a new airdrop event for Verasity (VRA) through its Binance Alpha platform, giving eligible users the chance to claim free tokens and compete for a massive prize pool.

XRP: What’s the Next Target After Bullish Breakout?

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

Bitcoin Dominance Holds Firm as Altcoins Show Early Signs of Rotation

Despite recent gains across select DeFi and RWA tokens, Bitcoin continues to dominate the crypto landscape, with the Altcoin Season Index sitting at 43/100, according to today’s CoinMarketCap data.

-

1

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

2

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read