Is PayPal’s PYUSD Stablecoin in Trouble? Market Cap Drops 30%

26.09.2024 21:00 1 min. read Alexander Stefanov

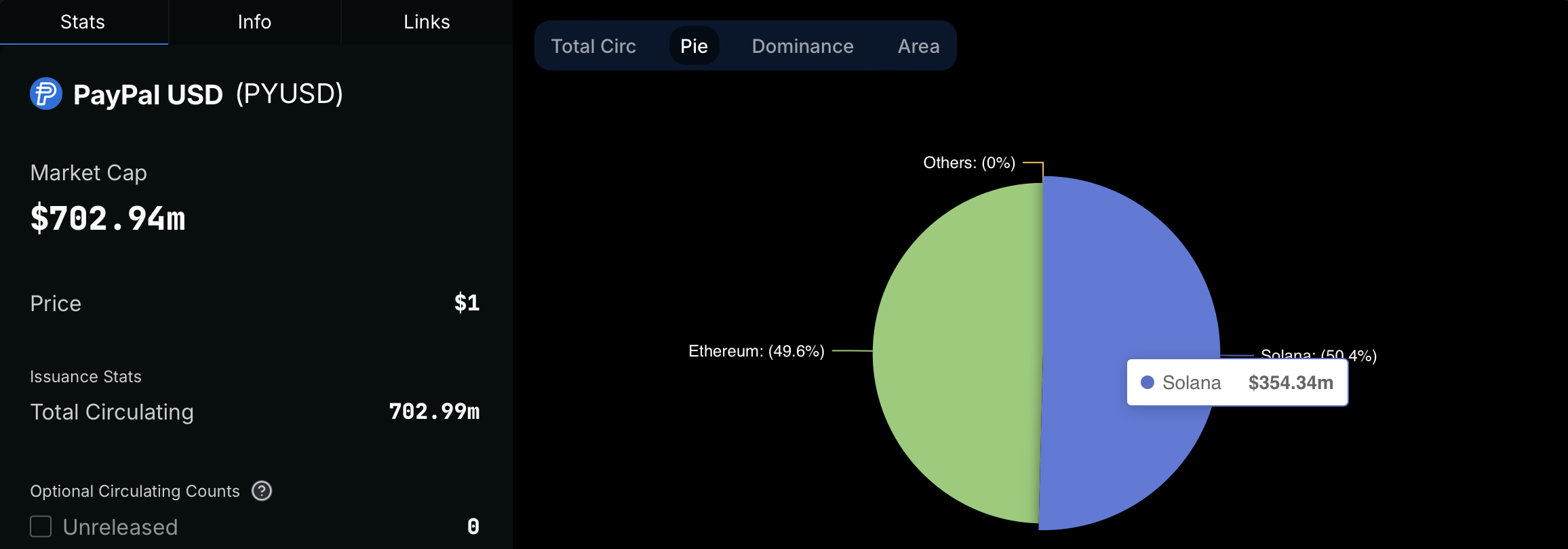

PayPal's stablecoin PYUSD has lost nearly 30% of its market capitalization in the past 30 days, falling from over $1 billion to $709 million as of September 26.

The decline is due to Solana’s significant reduction in its market capitalization, which on August 26 represented about 65% of the total.

PYUSD, circulating or locked within the Solana ecosystem, dropped from $662 million to $354 million, while its market capitalization on Ethereum held steady at $348 million.

However, average daily PYUSD remittance volume held steady at $242.2 million, only slightly below the previous month’s average.

While fluctuations in stablecoin market caps are common, the PYUSD drop coincided with a 1.6% rise in the overall stablecoin market, which added $3 billion.

The decrease is likely related to the decline in DeFi yields, which dropped nearly 50% on platforms like Kamino. PYUSD’s collateral yield fell from 14% in August to 7.6% as of September 24, resulting in a 30% decrease in stablecoins locked in the minutes.

Despite the decline, PYUSD remains the third largest stablecoin in Solana’s network.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read