Is Dogecoin Gearing Up for a Major Breakout? On-Chain Signals Say Yes

17.05.2025 8:00 1 min. read Alexander Stefanov

Dogecoin could be approaching a powerful breakout phase, with on-chain data revealing a wave of heightened activity and renewed investor interest.

As the meme-inspired coin hovers near $0.225, analysts are increasingly bullish on its potential for a dramatic move.

One well-followed analyst, known as Trader Tardigrade, has pointed to historical price structures resembling the 2014–2018 cycle—an era that ultimately saw explosive growth. Based on similar chart patterns, he believes Dogecoin may be setting up for a multi-phase rally that could take it as high as $18 in the long term.

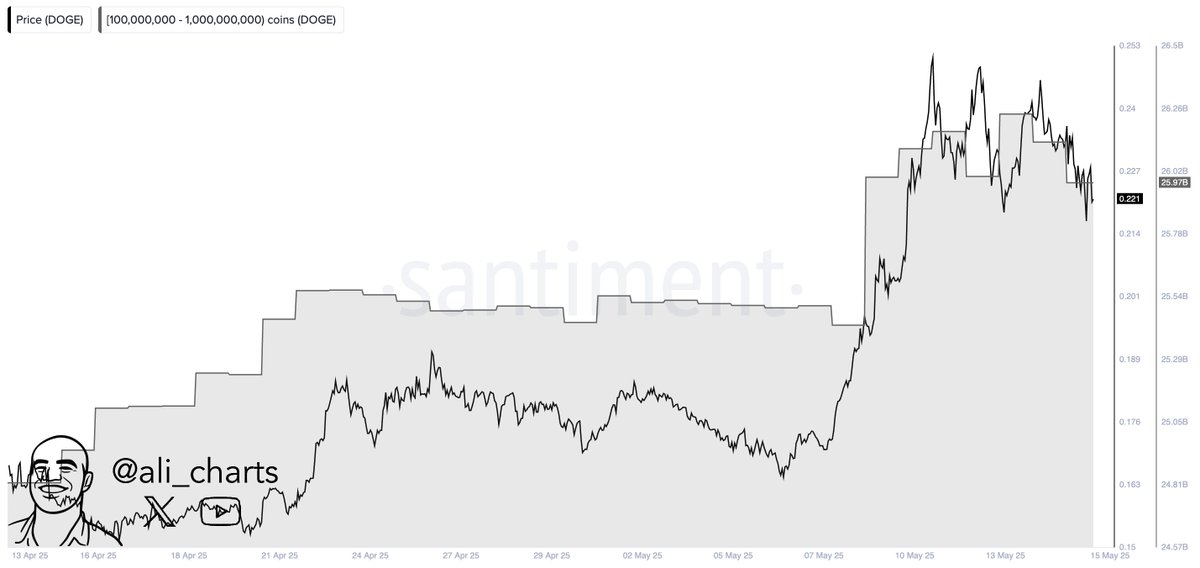

Supporting this optimistic outlook, on-chain analyst Ali Martínez has highlighted a surge across key metrics: daily active addresses, transaction volume, and, notably, large-scale wallet activity.

Over the past month alone, Dogecoin whales—large holders often seen as market movers—have accumulated more than 1 billion DOGE.

Such aggressive accumulation is often interpreted as a vote of confidence from sophisticated investors. When combined with rising usage and sustained transactional throughput, these indicators paint a bullish backdrop for the coin’s next move.

While Dogecoin remains known for its meme status, the current data suggests something more serious may be brewing beneath the surface.

-

1

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

2

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

Can Stellar bounce again? XLM returns to crucial retest zone

Stellar (XLM) is once again approaching a decisive technical moment after facing a familiar rejection at the $0.52 resistance zone.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

-

1

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

2

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read