Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

If You Missed Huge Gains With Shiba Inu and Dogecoin, Don’t Miss The New Crypto Set To Rival XRP

25.02.2025 8:40 5 min. read Alexander ZdravkovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

The meme coin trend has taken a big hit as 2025 kicks off and once legendary players Dogecoin and Shiba Inu have had their foundations shaken.

Both assets have posted major losses on the monthly, weekly and daily timeframes, leaving holders in disarray.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Many investors have decided that enough is enough and are strategically diverting their funds to invest in more promising projects.

Among the frontrunners is Remittix (RTX) an advanced PayFi protocol gathering steam in its presale. Having stormed past $12.7 million raised in just two months on the market, Remittix is stealing the show.

So what’s so special about this up and comer and will Dogecoin and Shiba Inu recover their losses?

Shiba Inu Drops Below $9 Billion Market Cap

Shiba Inu has sunk below the $9 million market cap mark as it continues to see harsh losses. Things were looking ok between the 1st and 20th January but after that, Shiba Inu plummeted.

On the whole, Shiba Inu has seen a 28.8% loss in the last 30 days, with a steep 7.1% dip in the last 24 hours alone. Interestingly, the asset’s trading volume has seen a 63.8% uptick in the last week, suggesting some investors may be trying to buy the dip.

So why is Shiba Inu struggling? Well, the project has long been under criticism for its lack of utility, though the developers have made concerted efforts in recent quarters to add some, such as with the introduction of Shibarium and staking mechanisms in 2024.

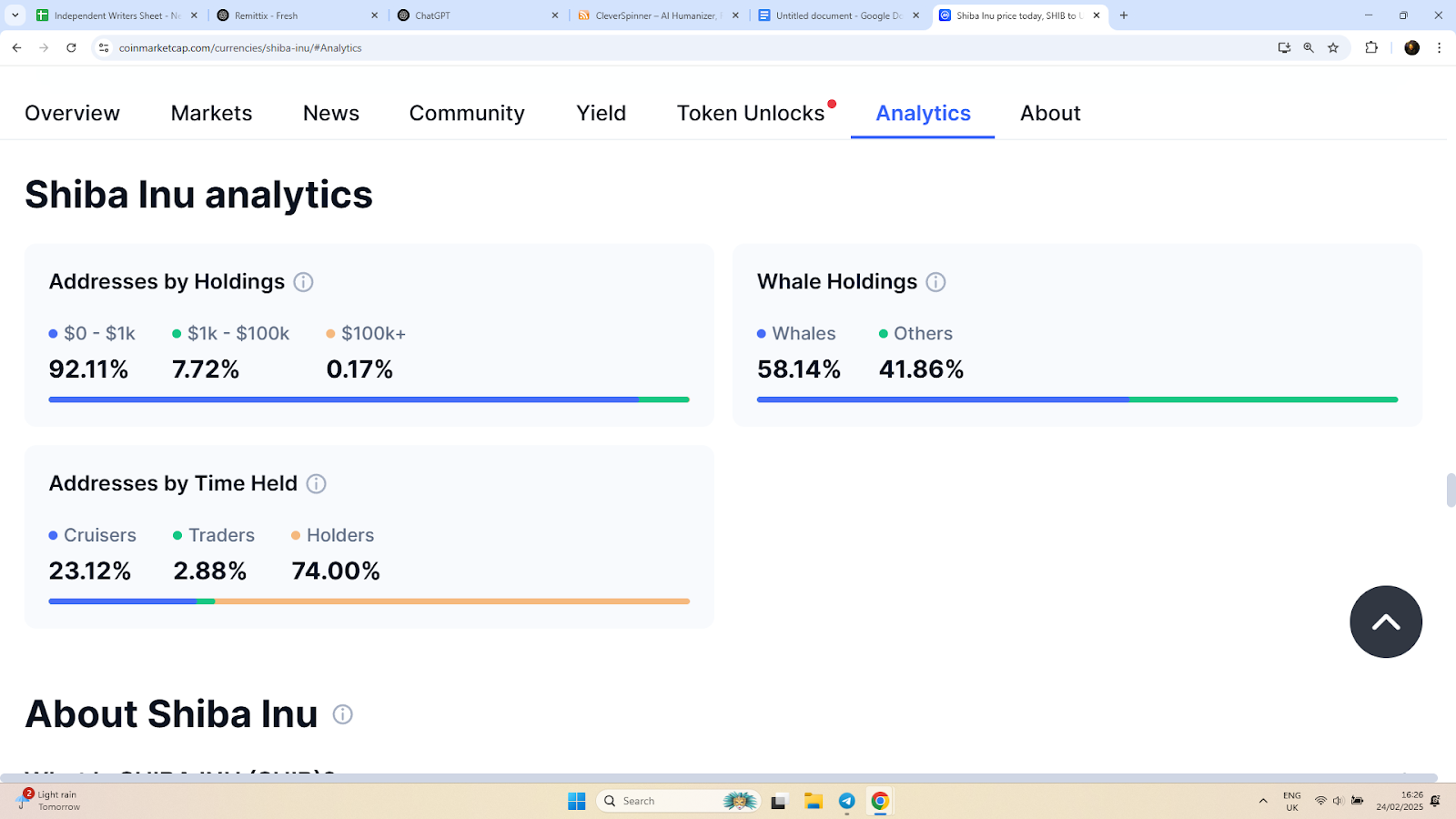

Shiba Inu holders are now holding onto hope that plans for the Shiba Hub and Shibarium 2.0 in 2025 could be a catalyst for more widespread adoption. However, cynics argue that Shiba Inu will likely remain highly volatile due to the large proportion of whale holders that make up its active addresses.

Currently, a staggering 58% of holders are classed as whales, meaning that large sell offs could trigger major price losses at any moment.

Shiba Inu Analytics (CoinMarketCap)

Shiba Inu Analytics (CoinMarketCap)

Could Dogecoin Drop Below $0.20?

Dogecoin (DOGE) just isn’t holding up like it used to. Right now, it’s trading at $0.226621, down 6.3$ in the last 24 hours, which comes off the back of a 36% drop in the last month.

Even with Grayscale launching a Dogecoin Trust to offer institutional exposure, the impact on DOGE’s price has been minimal. This suggests that even big players aren’t swaying the market in DOGE’s favor.

The technicals aren’t looking great either. Dogecoin just broke below key support at $0.2418, signaling more potential downside toward $0.20.

Dogecoin cynics continue to criticize the project’s unlimited issuance, which means that 5 billion Dogecoin are added into circulation every year, diluting value and making long-term price growth harder.

Between this inflationary mechanism, the project’s lack of clear utility and its harrowing price losses in the last month, things are not looking good for Dogecoin’s future.

Why Remittix Is Blowing Up

Remittix (RTX) is quickly gaining traction due to the solutions it offers in the global payments space. This industry is riddled by inefficiencies, such as lengthy delays, extortionate costs and hidden fees.

Remittix (RTX) removes these barriers entirely. With the ability to instantly convert over 40 cryptocurrencies into FIAT and send funds directly to bank accounts worldwide, Remittix is turning crypto into a truly usable form of money. No intermediaries slowing things down, no hidden conversion charges and no waiting days for funds to clear just a seamless way to access and spend crypto whenever needed.

Consider Daniel, a remote worker in Thailand who earns in Ethereum. Instead of dealing with long exchange delays and high withdrawal fees, he uses Remittix to convert ETH into Thai Baht and receive the funds in his bank account in minutes.

Financial Privacy Is Becoming a Priority And Remittix Delivers

As governments and financial institutions tighten restrictions on transactions, more people are looking for a way to move their money securely and privately.

Traditional banks track every transfer, impose limits and can even freeze accounts without warning, leaving users with little control over their own funds.

Remittix offers a practical alternative by ensuring that when funds are sent through the platform, the recipient receives a standard bank transfer with no indication that the payment originated from crypto.

This allows users to transfer money freely without unnecessary oversight or restrictions.

For people in countries where financial access is limited or heavily regulated, this level of autonomy is invaluable.

Remittix Presale Closes In On $13 Million Mark

The Remittix presale continues to boom, having raised more than $12.7 million in just two months on the market. Tokens are priced at a competitive $0.0671 a piece in the current stage, creating an accessible entry point for all types of investor. =

Remittix’s prime position within a high-value sector and its advanced technical design have led analysts to anticipate a steep 800% price rise before the presale’s end with further growth expected post-launch.

For any savvy investor looking to get in on a market disruptor in its early stages, this project is not one to sleep on in 2025.

Discover the future of PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as Iran-Israel Conflict Worsens – Will The Market Crash?

19.06.2025 18:22 9 min. read -

2

Best Crypto to Buy Now as Odds of U.S. Strike on Iran Surge to 71%

21.06.2025 9:39 7 min. read -

3

Best Crypto to Buy Now as Bitcoin Price Rises Back To $107,000 – 3 New Token ICOs

16.06.2025 17:56 8 min. read -

4

Best Crypto to Buy Now as XRP vs SEC Case Approaches Final Verdict

21.06.2025 18:05 8 min. read -

5

BTC Bull Token Price Prediction: The Next Crypto with 1000% Potential?

25.06.2025 18:55 4 min. read

Best Crypto to Buy Now as Regulators Green Light Cryptocurrency for Mortgages

A pivotal shift has landed: the Federal Housing Finance Agency now mandates Fannie Mae and Freddie Mac to draft plans for accepting cryptocurrency as collateral. This sea change bridges the gap between decentralized wealth and traditional home financing, while unlocking mortgages for those whose net worth lives on the blockchain. This publication is sponsored. CryptoDnes does not […]

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

BTC Bull Token (BTCBULL), a meme coin built around Bitcoin-themed rewards, managed to raise over $7.7 million in its ongoing presale. The rise in interest in the project has coincided with growing excitement around Bitcoin, which is currently trading at just above $107K. Many analysts believe BTC could be on the verge of new all-time […]

4 Meme Coins Under $1 That Could Explode in Q3

The overall meme coin sector has experienced a steep correction in the past month, with its market cap standing at $54.8 billion, down over 10% from its valuation at the start of June. Despite the correction, the broader crypto space remains resilient, with Bitcoin holding steady above $106K. Recent developments, such as the U.S. Federal […]

BTC Bull Token Presale Nears $8 Million with Just 24 Hours to Go: Next 100x Crypto?

The timing couldn’t be better for BTC Bull Token (BTCBULL), a Bitcoin-themed meme coin entering the final day of its presale with over $7.6 million already secured. Bitcoin (BTC) has been testing resistance levels at $108,000 after a strong rebound from its dip below the six-figure mark. Web3 commentators cite growing institutional inflows and improving […]

-

1

Best Crypto to Buy Now as Iran-Israel Conflict Worsens – Will The Market Crash?

19.06.2025 18:22 9 min. read -

2

Best Crypto to Buy Now as Odds of U.S. Strike on Iran Surge to 71%

21.06.2025 9:39 7 min. read -

3

Best Crypto to Buy Now as Bitcoin Price Rises Back To $107,000 – 3 New Token ICOs

16.06.2025 17:56 8 min. read -

4

Best Crypto to Buy Now as XRP vs SEC Case Approaches Final Verdict

21.06.2025 18:05 8 min. read -

5

BTC Bull Token Price Prediction: The Next Crypto with 1000% Potential?

25.06.2025 18:55 4 min. read