How Stablecoins Captured 33% of Crypto Payments in 2024

15.01.2025 12:00 1 min. read Alexander Zdravkov

While Bitcoin (BTC) and Ethereum (ETH) ETFs fueled mainstream adoption in 2024 and a late-year bull run, crypto payments quietly evolved, with stablecoins emerging as a dominant force.

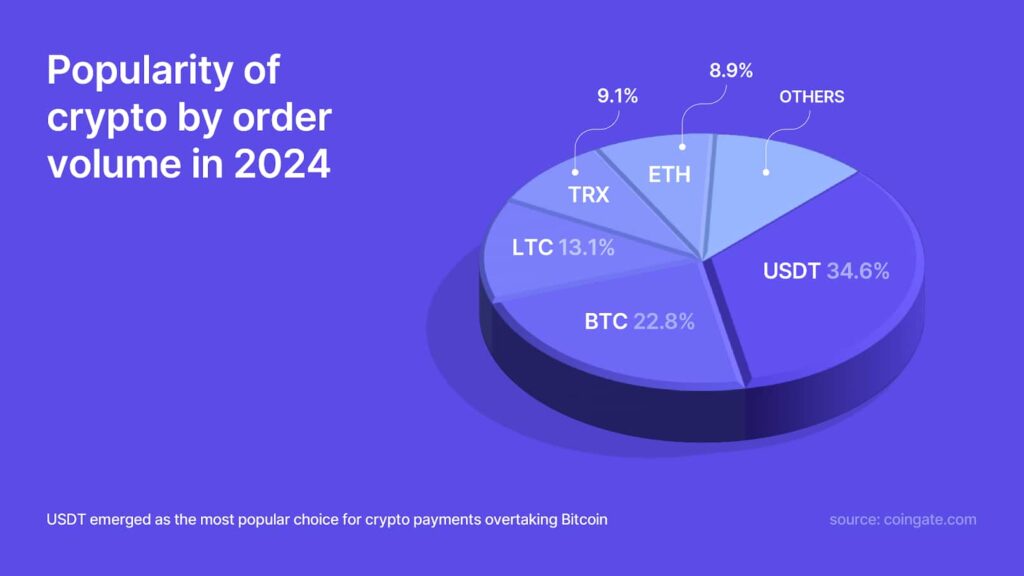

According to a recent CoinGate report, stablecoins surpassed Bitcoin as the preferred method of payment, with Tether (USDT) leading at 34.6% of transactions. Including other stablecoins like USD Coin (USDC), the share of stablecoin payments rose to 35.5%. USDT dominated the category, but USDC posted remarkable growth, increasing usage by 86.9%, largely due to its integration into the Solana network.

Blockchain preferences shifted as well, with the Tron network outpacing Bitcoin to account for 31.5% of transactions. Solana rose in popularity, boosted by a 56.4% spike in late 2024, while Ethereum’s payment share declined slightly. Litecoin also gained ground, climbing from 9.5% to 13.1% of total transactions.

Layer-2 solutions played a key role in improving transaction efficiency. The Lightning Network saw a 39.1% increase in Bitcoin payments, and Arbitrum experienced a staggering 565% surge in adoption, driven by Ethereum and USDT use cases. Polygon also recorded notable growth with a 135% rise in transactions.

Stablecoins solidified their place as a vital component of the crypto ecosystem, while the shifting blockchain dynamics underscored the industry’s focus on scalability, speed, and cost-effectiveness. These trends reflect a maturing market that continues to innovate and adapt to user demands.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

Ethereum ETF Inflows Hit Record High as Price Jumps Past $3,400

Ethereum saw an explosive surge in institutional demand this week, with spot exchange-traded funds (ETFs) posting their highest single-day inflow on record. O

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

Fartcoin (FARTCOIN) is once again leaving a trail of strong gains as the crypto market rallies. In the past 24 hours alone, the token has produced an 18.2% return as trading volumes have exploded. Data from CoinMarketCap shows that Fartcoin’s volumes have more than doubled during this period. More than $500 million worth of this […]

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

The cryptocurrency market is experiencing a notable shift in capital flows as Bitcoin’s market dominance has dropped to 61.6%, marking a 2.36% decrease.

-

1

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

2

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read