How Did Bitcoin ETFs Perform During Yesterday’s “Carnage”?

06.08.2024 12:14 1 min. read Kosta Gushterov

After August 5, one of the worst days for both crypto and stock markets, many investors chose to move away from risky assets, which affected Bitcoin ETFs in the US.

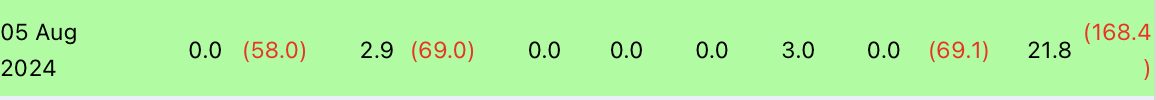

Bitcoin spot ETFs saw a collective outflow of $168.4 million on August 5 amid ongoing market volatility.

The Grayscale Bitcoin Trust, a prominent crypto investment vehicle, saw outflows totaling $69.1 million.

However, Grayscale’s smaller ETF, often referred to as a mini ETF, saw inflows of $21.8 million. Fidelity’s FBTC, one of the most well-known in the market, saw the largest outflow – $58 million.

Similarly, ARKB of ARK 21Shares saw a significant outflow of $69 million. Although Cathie Wood’s ARK Investment Management is a strong proponent of cryptocurrencies, the outflows show that even the most bullish investors are reevaluating their positions in response to market dynamics.

BlackRock’s iShares Bitcoin Trust (IBIT) recorded no inflows or outflows, along with BTCO, EZBC, BRRR, and BTCW.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

2

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

3

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

4

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

5

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read