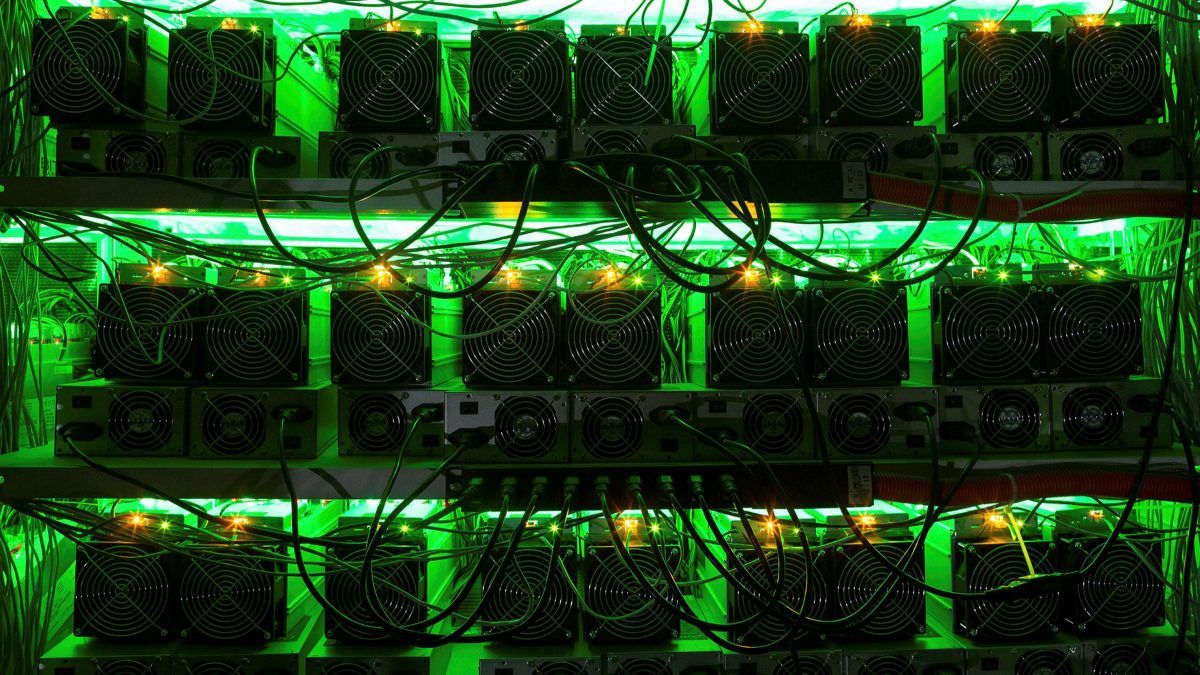

How AI and New Targets are Transforming Bitcoin Mining in 2024

02.08.2024 14:00 1 min. read Alexander Stefanov

Mike Novogratz, a prominent figure in the cryptocurrency world, recently highlighted that 2024 is a critical year for Bitcoin mining.

He praised the industry’s “remarkable resilience” amidst economic challenges and shared insights from a Galaxy Digital report on the latest trends in mining.

One of the standout developments this year is the integration of cryptocurrency mining with artificial intelligence (AI) and high-performance computing (HPC). According to Novogratz, this convergence is transforming the mining landscape, opening up new opportunities and increasing the demand for power.

Galaxy Digital has updated its forecast, now predicting a year-end hashrate target of 775 EH. The firm anticipates that public miners could manage up to 30% of the network’s hashrate and expects a significant improvement in mining efficiency. However, the rollout of new mining equipment still faces uncertainties.

For Bitcoin mining to sustain healthy growth, Bitcoin prices need to stay between $65,000 and $70,000. If prices fall below this range, mining could become economically unfeasible. Additionally, Bitcoin mining difficulty saw a notable decrease, dropping below 80 T in July for the first time since the last halving.

In the first quarter of the year, Bitcoin mining firms attracted a record amount of equity capital to enhance cash reserves and boost equipment efficiency. Galaxy Digital predicts that this trend of capital raising will continue in the latter half of 2024.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read