Here’s Where Bitcoin Could Face Significant Resistance

21.01.2025 11:00 1 min. read Kosta Gushterov

Cryptocurrency research firm Alphractal has issued a warning, suggesting that Bitcoin may be nearing a local peak.

Based on their analysis, the firm predicts that Bitcoin’s price could reach a local top around the $111,000 mark.

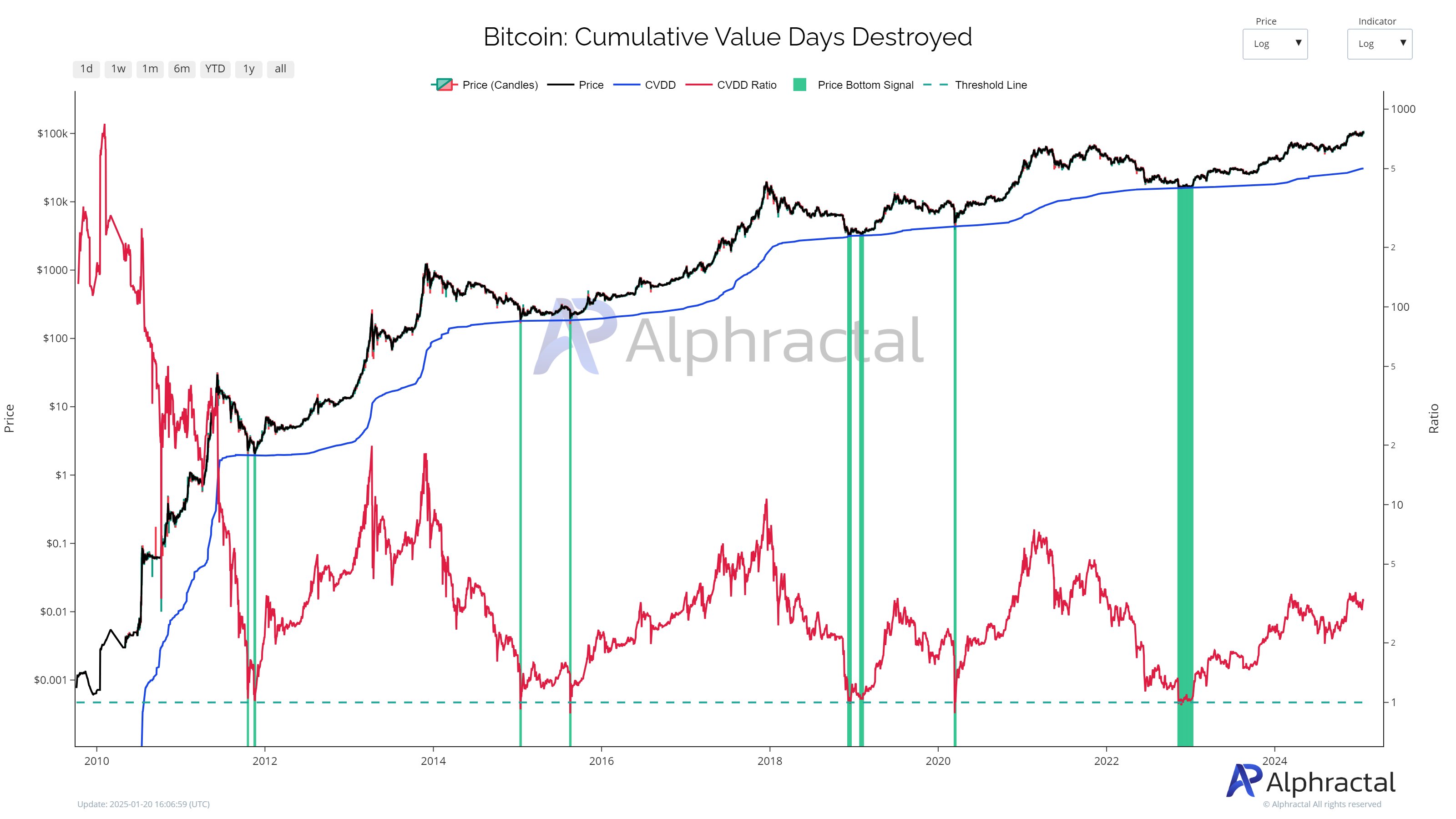

This forecast is grounded in the Cumulative Value Days Destroyed (CVDD) metric, which Alphractal describes as one of the most effective tools for identifying price bottoms in Bitcoin’s market.

The firm highlights the $111,000 price point as a significant resistance level.

The analysts explained that the CVDD Channel, which is composed of several lines derived from the CVDD metric, provides a reliable means of pinpointing support and resistance zones.

They estimate that the $111,110 level represents a key resistance point. While breaking this barrier could signal bullish momentum, Alphractal cautioned that this level might continue to act as a ceiling for Bitcoin’s price in the short term.

-

1

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read -

4

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

11.07.2025 21:00 1 min. read -

5

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

-

1

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read -

2

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

3

Corporate Bitcoin Adoption Soars: 125 Public Companies Now Hold BTC

16.07.2025 20:00 2 min. read -

4

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

11.07.2025 21:00 1 min. read -

5

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

13.07.2025 17:45 2 min. read