Here’s What’s Holding XRP Back and What Could Trigger a Breakout

23.02.2025 9:00 1 min. read Alexander Zdravkov

XRP’s price remains stuck in a tight range as investors assess the fallout from the Bybit hack. Despite a broader selloff, the token has managed to hold above $2.5, though its recent price action suggests uncertainty.

Analysts at More Crypto Online describe XRP’s outlook as neutral, casting doubt on earlier expectations that the coin could reach $250 in the long term.

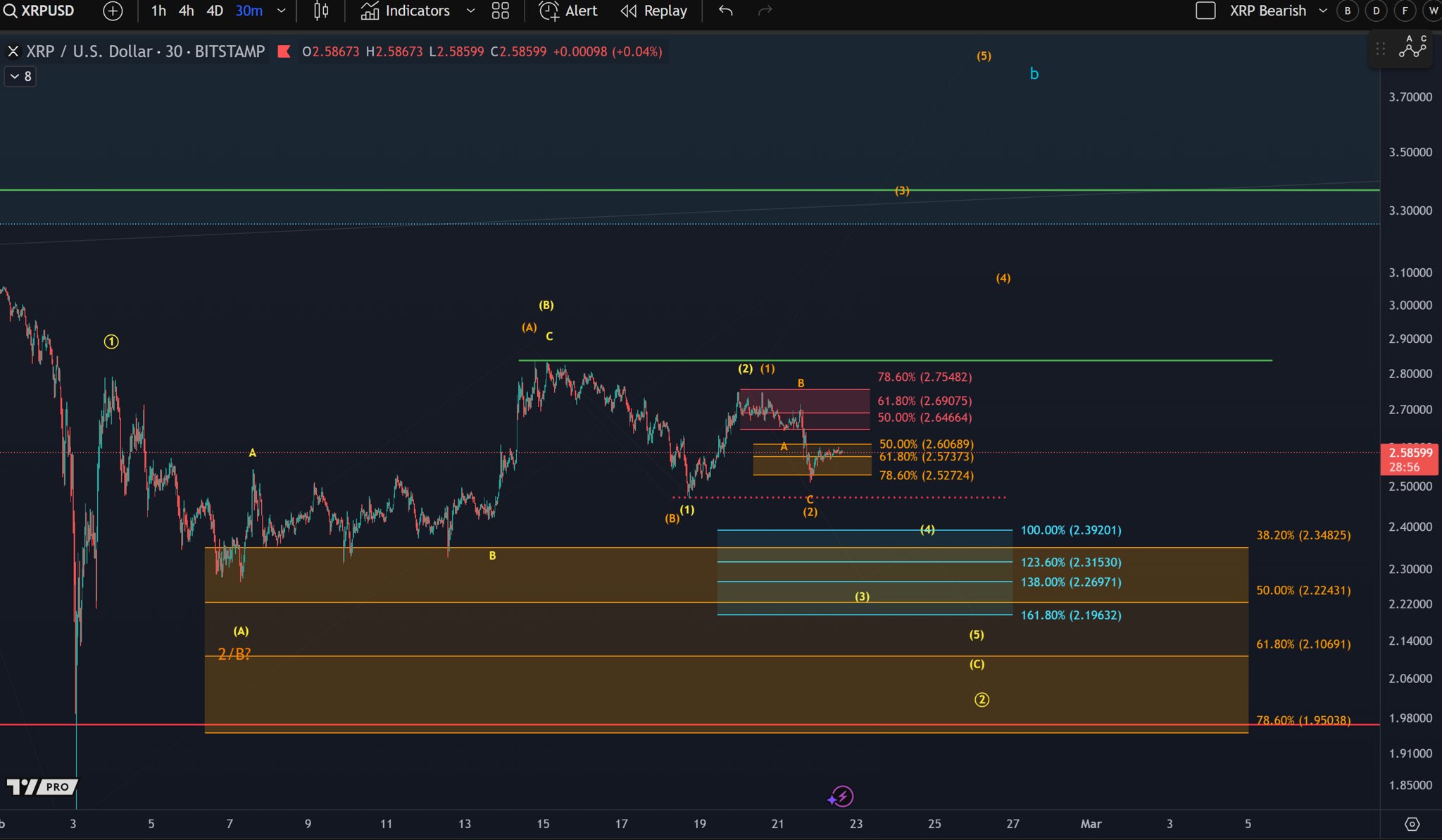

According to More Crypto Online, XRP has yet to break out of its current range, maintaining support above $2.47. At last check, the token was priced at $2.592, marking a 0.63% decline over the past day. During this period, it fluctuated between $2.512 and $2.597 before settling.

While XRP’s bullish structure remains technically intact, it has struggled to push past the $2.8 resistance level. If this trend continues, further downward movement could be likely in the short term. Analysts point to two critical levels: a drop below $2.47 could signal more losses, while a break above $2.75 may trigger a rally.

Earlier projections suggested XRP could surge to $250 by 2026, with market analyst XRP Captain attributing this potential rise to heavy accumulation by large investors. However, this remains one of the most optimistic predictions for the token.

While sentiment around Ripple remains positive, supply concerns have been highlighted as a major hurdle for significant price appreciation. Nevertheless, the broader regulatory environment in the U.S. appears favorable, keeping long-term prospects open-ended.

-

1

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

2

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

3

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

4

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read -

5

Peter Schiff Doubts Stablecoins Can Shield a Weakening Dollar

19.06.2025 13:00 1 min. read

Trump’s Truth Social Files For Spot Crypto ETF Holding 5 Cryptocurrencies

Truth Social, the media venture linked to U.S. President Donald Trump, has taken a bold step into the digital asset space with a fresh filing for a spot cryptocurrency exchange-traded fund (ETF).

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

Large-scale investors are steadily increasing long positions in several overlooked altcoins, signaling a potential early-stage accumulation phase.

Ethereum Price Prediction: ETH Ongoing Accumulation Favors Bullish Outlook – Can It Rise to $5,000?

Ethereum (ETH) has gone up by 1% in the past 24 hours and trading volumes have increased by 12% after news that Donald Trump’s media company has filed an application to list a crypto exchange-traded fund (ETF). The top altcoin is included in the prospectus with a target 15% weight on the ETF’s portfolio. This […]

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

As Bitcoin enters a new on-chain trend phase, two altcoins are standing out for their growing correlation with the leading cryptocurrency and their resilience amid market shakeouts, according to new analysis by Joao Wedson, CEO of analytics firm Alphractal.

-

1

SEC Seen as Nearly Certain to Approve Wave of Crypto ETFs, Say Bloomberg Analysts

21.06.2025 13:00 2 min. read -

2

Ethereum Price Prediction: This Trader Thinks ETH Could Soon Hit $12,000 – Here’s Why

25.06.2025 23:53 3 min. read -

3

Dogecoin’s Slump Could Be the Setup for a Massive Breakout

22.06.2025 14:00 2 min. read -

4

Solana Price Prediction: Trader Thinks SOL Could Rise to $200 in July – Here’s Why

26.06.2025 22:25 3 min. read -

5

Peter Schiff Doubts Stablecoins Can Shield a Weakening Dollar

19.06.2025 13:00 1 min. read