Here’s How Much Bitcoin (BTC) Was Mined in Russia in 2023

07.09.2024 8:30 1 min. read Alexander Stefanov

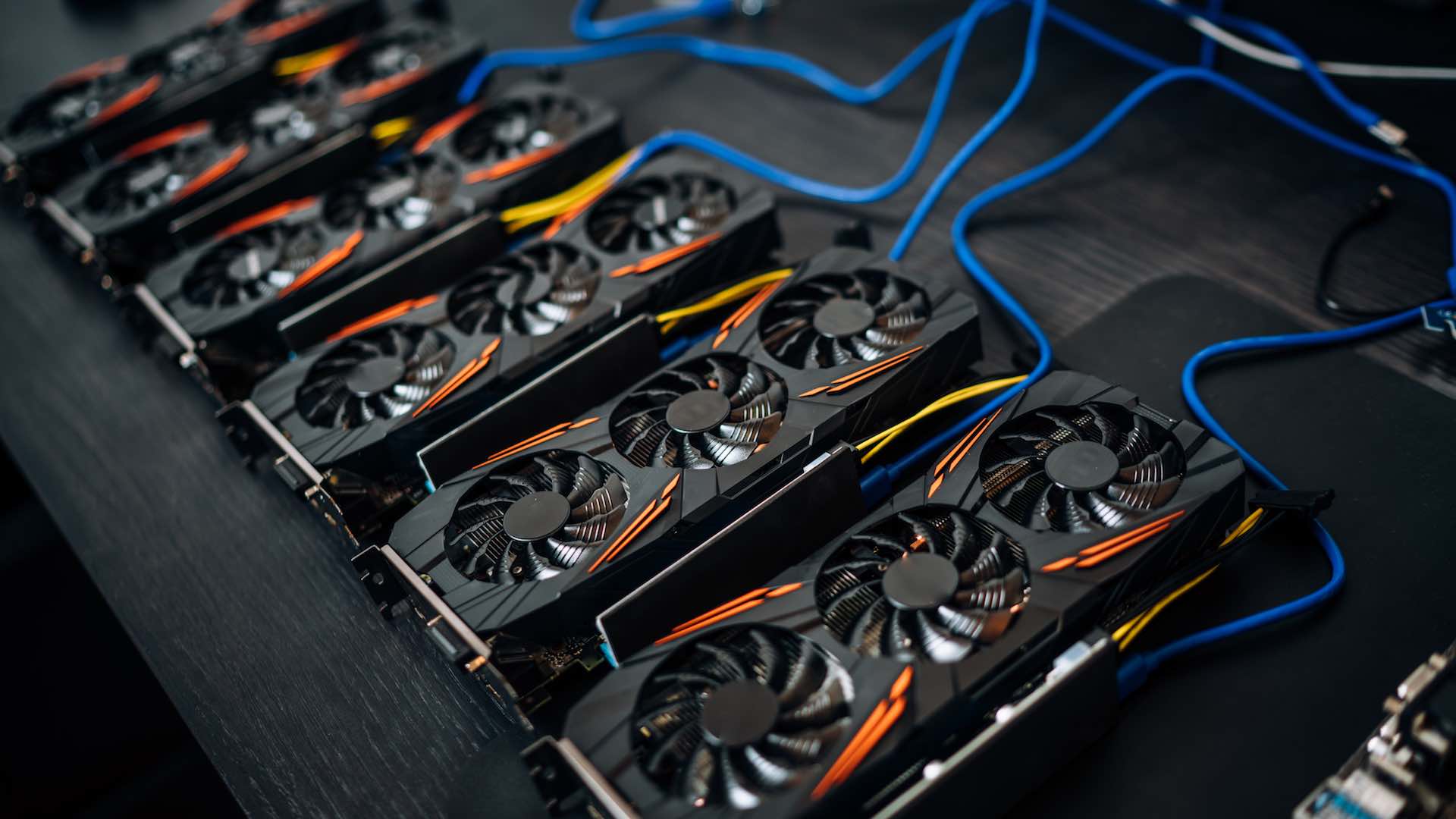

According to Sergey Bezdelov, director of the Industrial Mining Association, approximately 54,000 Bitcoin (BTC) tokens worth about $3 billion were mined in Russia in 2023.

Speaking at the Eastern Economic Forum 2024, Bezdelov estimated that this mining activity could generate around 50 billion rubles in tax revenue for the Russian government.

He expects the recent legalization of cryptocurrency mining in the country to attract more investors and further increase tax revenue.

On August 8, Russian President Vladimir Putin signed a law officially legalizing crypto mining. This means that this operation is now recognised as a legitimate economic activity, allowing legal entities to engage in it provided they register or comply with certain restrictions on energy consumption.

The new law is also expected to encourage infrastructure investment and contribute to Russia’s broader economic growth.

In addition, local reports indicate plans to establish at least two crypto exchanges in Moscow and St. Petersburg. These exchanges would facilitate international trade and align with Russia’s broader strategy to strengthen economic ties with the BRICS countries.

-

1

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

2

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

3

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

4

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read -

5

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

-

1

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

2

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

3

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

4

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read -

5

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read