Here’s How Ethereum ETFs Performed in Their First Week

30.07.2024 11:22 1 min. read Kosta Gushterov

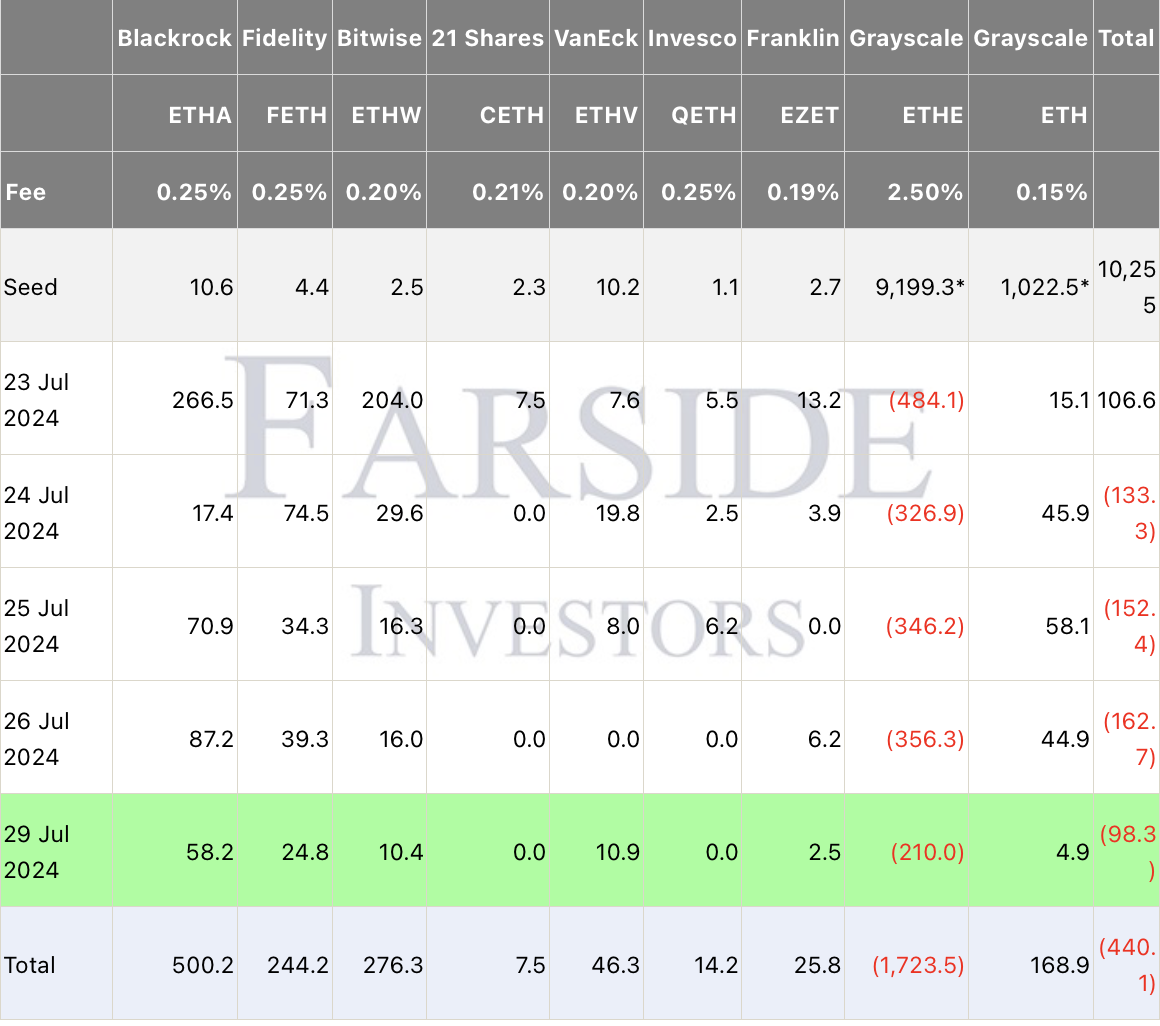

On July 29, U.S. ethereum ETFs saw net outflows of $983 million, the fourth consecutive day of negative results.

According to data from Farside, the Grayscale Ethereum Trust (ETHE) saw a significant one-day outflow of $210 million. In contrast, the Grayscale Ethereum Mini Trust (ETH) attracted inflows of $4.9 million.

On the other hand, BlackRock’s iShares Ethereum Trust (ETHA) saw inflows of $58.2 million, while Fidelity’s FETH garnered $24.8 million.

Overall, Ethereum ETFs saw outflows of $340 million in the first week of trading ending July 26. Adding in Monday’s outflows brings the total to $440.1 million.

This period was characterized by investor withdrawals from legacy high-fee products converted to exchange-traded funds.

The most significant inflows were into the BlackRock, Bitwise and Fidelity funds, which attracted $500.2 million, $276 million and $244 million, respectively, from launch through July 30.

In contrast, the Grayscale-created Ethereum Trust suffered outflows of $1.723 billion over the same time period.

-

1

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

2

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

3

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

2

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

3

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

4

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

5

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read