Here is When Binance Ex-CEO Could Be Release From Prison

01.09.2024 9:00 1 min. read Alexander Stefanov

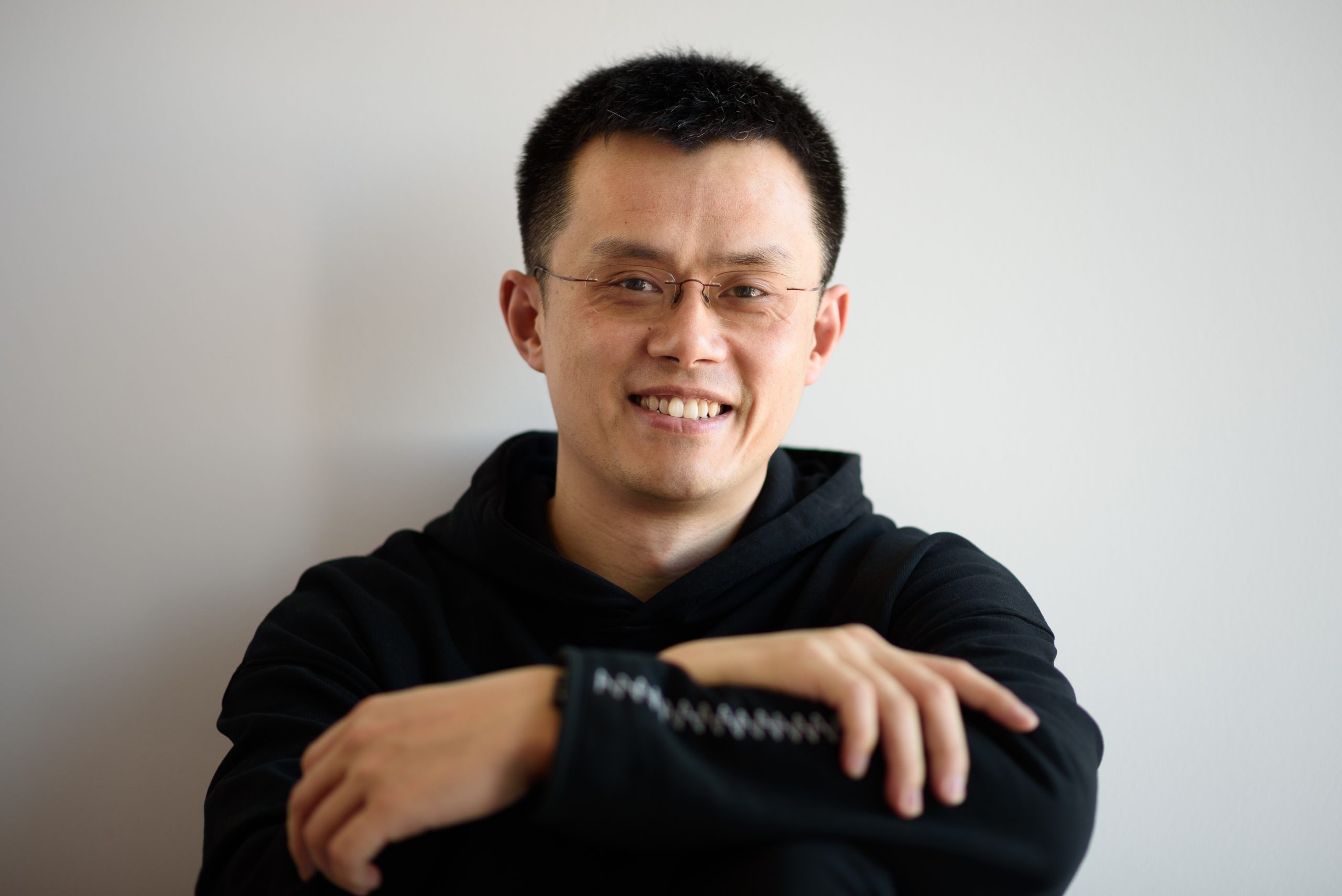

The ongoing legal case between Binance and the U.S. Securities and Exchange Commission (SEC) is seeing notable developments, particularly concerning Binance’s co-founder, Changpeng Zhao (CZ).

After being transferred from prison to a halfway house in California, CZ is anticipated to be released on September 29, following a four-month sentence for violating anti-money laundering laws. As part of his plea deal, Zhao agreed to step down as CEO of Binance.

Recent legal filings related to the case have raised speculation that they may be linked to his impending release. These include the court’s approval of attorney Emily Casey Warren Kapur to represent Zhao, as well as the withdrawal of several other attorneys from his legal team, signaling shifts in the defense strategy.

Meanwhile, the crypto community remains hopeful that ongoing political changes in the U.S. could lead to a more favorable regulatory environment and possibly result in the dismissal of charges against Zhao, similar to what occurred with Ripple’s leadership.

However, the court has decided to proceed with allegations against Zhao for his role in overseeing Binance and Binance.US’s alleged violations of the Exchange Act.

Post-release, Zhao is expected to focus on a new educational venture, Giggle Academy.

-

1

U.S. Court Cracks Down on Early Crypto Fraud With Massive Fine

14.06.2025 10:00 1 min. read -

2

Shaquille O’Neal Agrees to $1.8M Settlement Over FTX Endorsement Lawsuit

15.06.2025 21:00 1 min. read -

3

Whale Accumulates Curve Tokens Amid Market Lull

16.06.2025 11:00 1 min. read -

4

Crypto Investigator Links New Altcoin Project to $30M Scam

17.06.2025 18:00 1 min. read -

5

Iran Limits Crypto Trading Hours After Politically Charged Hack on Nobitex

20.06.2025 11:00 1 min. read

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

Coinbase CEO Brian Armstrong has spotlighted a significant acceleration in institutional crypto adoption, driven largely by the surging popularity of exchange-traded funds and increased use of Coinbase Prime among major corporations.

Whales Buy the Dip as Retail Panics: This Week in Crypto

The latest market turbulence, fueled by geopolitical tensions and investor fear, offered a textbook case of how sentiment swings and whale behavior shape crypto price action.

What Will Happen With the Stock Market if Trump Reshapes the Fed?

Jefferies chief market strategist David Zervos believes an upcoming power shift at the Federal Reserve could benefit U.S. equity markets.

-

1

U.S. Court Cracks Down on Early Crypto Fraud With Massive Fine

14.06.2025 10:00 1 min. read -

2

Shaquille O’Neal Agrees to $1.8M Settlement Over FTX Endorsement Lawsuit

15.06.2025 21:00 1 min. read -

3

Whale Accumulates Curve Tokens Amid Market Lull

16.06.2025 11:00 1 min. read -

4

Crypto Investigator Links New Altcoin Project to $30M Scam

17.06.2025 18:00 1 min. read -

5

Iran Limits Crypto Trading Hours After Politically Charged Hack on Nobitex

20.06.2025 11:00 1 min. read