Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read Kosta Gushterov

In the volatile world of cryptocurrency, investor psychology is one of the most powerful forces behind price movement.

To help traders and analysts gauge that emotional backdrop, CoinMarketCap developed the Crypto Fear and Greed Index—a straightforward, real-time indicator that measures the market’s mood and sentiment.

Understanding the Fear and Greed Index

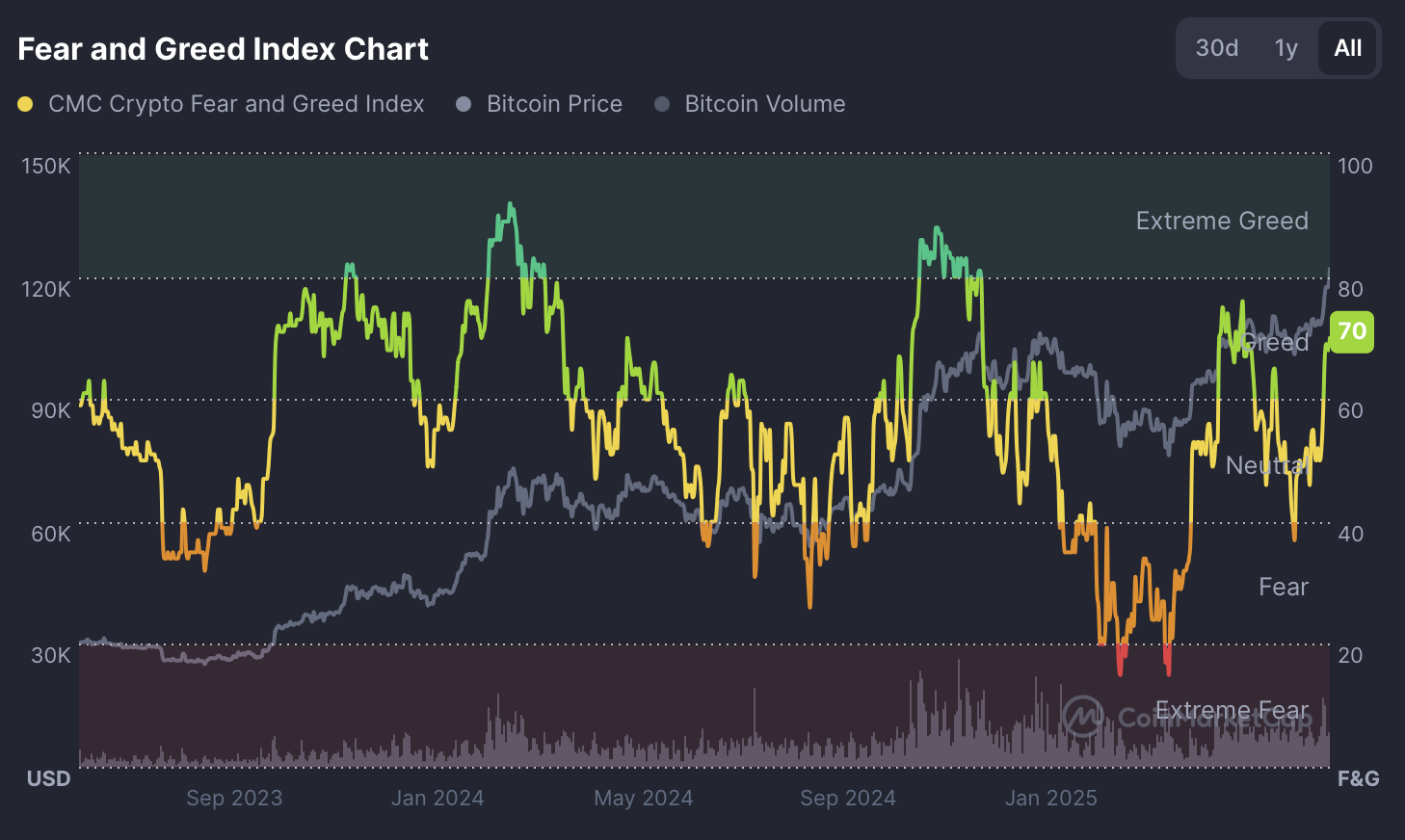

The index ranges from 0 to 100, where lower values represent extreme fear and higher values reflect extreme greed. A score of 0 indicates intense panic and uncertainty among investors, while a score near 100 signals overwhelming optimism and speculative fervor. By tracking this single metric, investors can quickly assess whether the market is likely undervalued or overheated—two states that often precede major market moves.

What does it mean when the index is below or above 50?

When the index dips below 50, it reflects growing fear in the crypto market. This typically means that traders are hesitant, capital is fleeing risky assets, and sentiment is bearish. Extremely low readings—especially below 25—can signal capitulation, where investors may be panic-selling. Ironically, these moments of widespread fear often present the best long-term buying opportunities for bold investors.

On the other hand, a score above 50 suggests that greed is entering the market. Traders are more confident, risk appetite rises, and bullish sentiment prevails. Once the index crosses 70, it enters what’s considered a “greed zone,” where market euphoria may push prices to unsustainable levels. If the reading moves beyond 80, the market could be nearing a local top, as excessive greed has historically preceded corrections.

Current sentiment and market context

At the time of writing, the CMC Fear and Greed Index sits at 70, placing it firmly in the “Greed” category. Just a week ago, the index read 52—classified as neutral. This sharp rise reflects the broader crypto rally, with Bitcoin recently surpassing $120,000. The last time sentiment reached such elevated levels was in November 2024, when the index hit a yearly high of 88, categorized as “Extreme Greed.”

How to use the index in your strategy

The index is widely used for market sentiment analysis, helping investors gauge the overall mood before making trades. Some adopt a contrarian strategy, choosing to “be fearful when others are greedy and greedy when others are fearful.” In this approach, extreme readings serve as counter-signals: high greed might suggest it’s time to take profit, while deep fear may present undervalued opportunities.

It’s also important to treat the index as a complementary tool, not a standalone signal. It works best when paired with technical analysis, on-chain data, and broader macro insights.

Conclusion

The CMC Crypto Fear and Greed Index offers a quick, emotional snapshot of the market. Values above 50 show confidence, while scores below that point indicate caution or panic. Understanding how to interpret these signals—and how to act on them—can give traders a psychological edge in navigating crypto’s unpredictable cycles.

-

1

Key U.S. Events to Watch This Week That Could Impact Crypto

30.06.2025 11:00 2 min. read -

2

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

30.06.2025 10:00 2 min. read -

3

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

4

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

5

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read

Bank of England Governor Warns Against Stablecoins, Backs Tokenized Deposits Instead

Bank of England Governor Andrew Bailey has voiced strong concerns about the rising push for stablecoin adoption, calling on banks to steer clear of issuing their own digital currencies.

Czech National Bank Enters Crypto Sector with $18M Coinbase Investment

The Czech National Bank (CNB) has entered the crypto sector with a $18 million investment in Coinbase, purchasing 51,732 shares in Q2 2025, according to a U.S. SEC filing.

Weekly Roundup: What Happened in Crypto Over the Past Week

From groundbreaking Ethereum developments to record-breaking DeFi activity and major protocol updates, the crypto industry saw a flurry of important announcements this past week.

Pump.fun Raises $600M in Record-Breaking PUMP Token Sale

Memecoin launchpad Pump.fun has stunned the crypto market by pulling off one of the fastest initial coin offerings (ICOs) in history.

-

1

Key U.S. Events to Watch This Week That Could Impact Crypto

30.06.2025 11:00 2 min. read -

2

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

30.06.2025 10:00 2 min. read -

3

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

4

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

5

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read