Here Are the Countries Most Interested in Real World Crypto Assets

20.09.2024 13:30 2 min. read Alexander Stefanov

Interest in Real World Assets (RWA) within the cryptocurrency sector is experiencing a notable upswing, reflecting broader trends in the digital economy.

Various countries are increasingly exploring how traditional assets can be integrated into the blockchain ecosystem, with differing levels of engagement and enthusiasm.

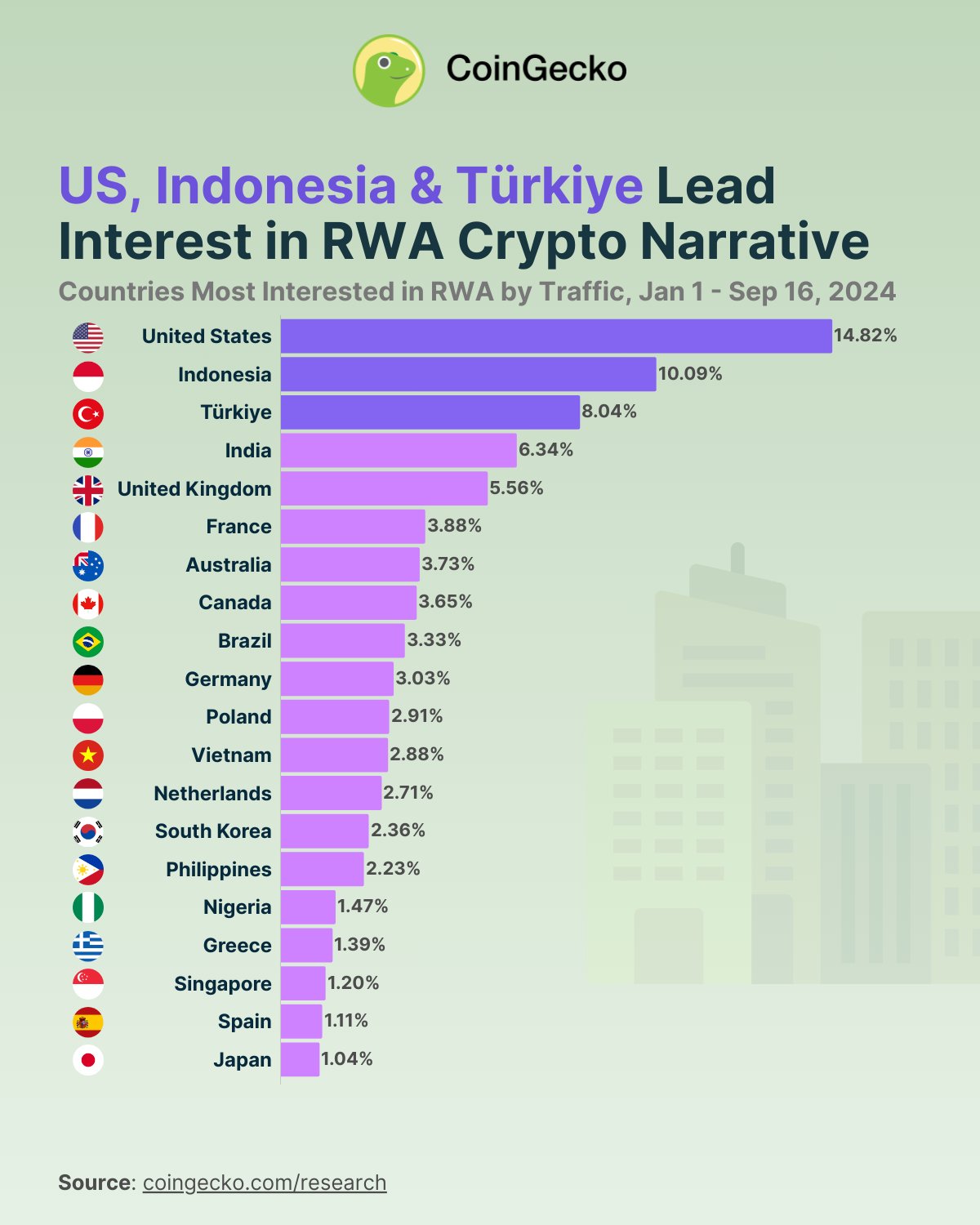

The concept of Real World Assets (RWA) is rapidly gaining traction in the cryptocurrency sector, with the United States leading the charge, accounting for 14.8% of global interest in 2024, according to a new CoinGecko report.

This aligns with its historical dominance in crypto trends, previously focusing on small-cap tokens and AI-related projects. Ondo Finance (ONDO) has emerged as a key player, capturing nearly half of U.S. interest in RWA, alongside significant attention for Goldfinch (GFI) and Maple (MPL).

Indonesia and Türkiye follow, representing 10.1% and 8.0% of global interest, respectively, with both nations showing a broader fascination with the RWA narrative rather than specific protocols. Southeast Asia is also notable, with Vietnam (2.9%), the Philippines (2.2%), and Singapore (1.2%) in the mix. India, at 6.3%, stands out as the only South Asian country in the top rankings.

In South America, Brazil holds a 3.3% share of RWA interest, ranking ninth globally, while Nigeria leads Africa with a 1.5% share, placing 16th overall. In Europe, the UK (5.6%) and France (3.9%) are at the forefront, with several EU countries appearing in the top 20.

Collectively, these top 20 nations account for 81.8% of global attention toward crypto Real World Assets, signaling a significant shift in how traditional assets are being integrated into the digital economy. The growing interest could reshape investment strategies and regulatory landscapes in the crypto market.

-

1

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

2

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

3

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

4

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

5

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

2

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

3

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

4

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

5

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read