Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Hedera Price Prediction: Explosion to $10 Coming for HBAR? Prediction Surprises in Hedera News Today as PlutoChain Gets Whales

22.02.2025 17:34 3 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Even though Hedera (HBAR) has entered bearish waters after Trump’s recent tariffs plans, some investors are talking about its potential to skyrocket up to the $10 mark.

With its fast, cheap transactions and growing adoption, HBAR has massive potential – but can it reach double digits and how long would it take?

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

At the same time, new projects like PlutoChain ($PLUTO) could be shaking things up. PlutoChain is a Layer-2 solution that could improve Bitcoin’s scalability by potentially enabling instant transactions, lower fees, and Ethereum compatibility. It might solve one of Bitcoin’s biggest problems – speed.

Hedera (HBAR) Price Prediction – Can We See HBAR’s Price Explode to $10 Soon?

Hedera (HBAR) has been gaining attention, with some experts like UAE WHALES predicting it could hit the $10 mark. With fast, low-cost transactions and backing from leading companies like Google and IBM, it’s a strong player in the crypto sphere. But can it really reach double digits?

For HBAR to hit $10, it needs more real-world adoption and growing demand. Its technology is solid, but the price depends on how many businesses and developers actually use it. If Hedera expands into DeFi, NFTs, and tokenization, it could see more traction.

However, HBAR faces competition from blockchains like Solana and Avalanche, which also offer speed and low fees. While Hedera’s Hashgraph technology is unique, it must keep growing to stay relevant. Crypto market trends, regulations, and demand will also play a part in its price.

If another bull run happens and Hedera keeps landing big partnerships, a big price jump is possible. But hitting $10 would require a massive increase in market cap, so investors should stay realistic about how fast it could happen.

Could PlutoChain ($PLUTO) Be the Key to Unlocking Bitcoin’s Full DeFi Capabilities?

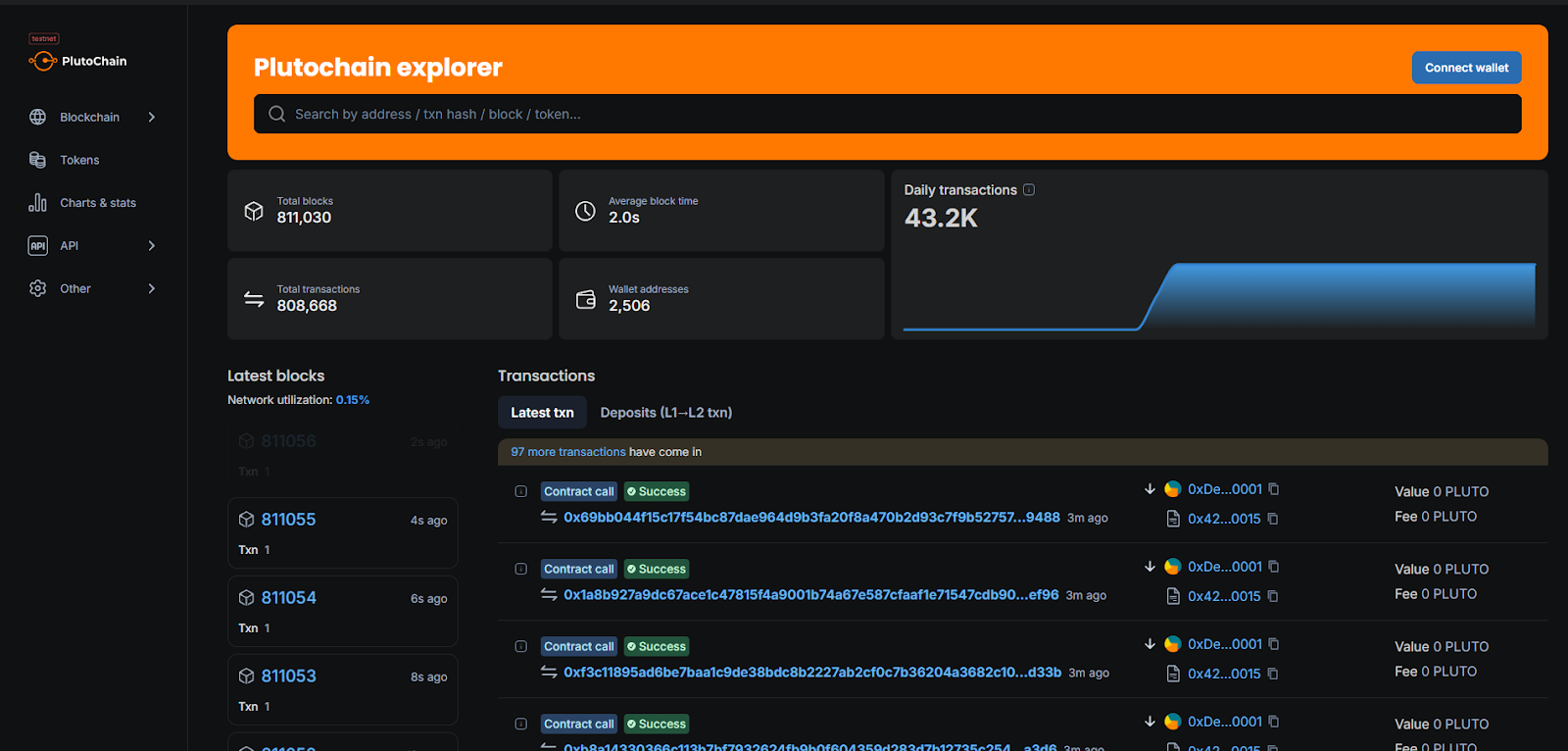

PlutoChain ($PLUTO) might help solve one of Bitcoin’s biggest issues – its slow transaction speed. While Bitcoin’s 10-minute block time makes it less practical for fast transactions and modern applications, PlutoChain could change that. With its Layer-2 solution, it offers 2-second block time, making transfers feel quick and easy.

Early testnet results suggest it might handle over 43,200 transactions a day. For comparison, PlutoChain could process hundreds of transactions in the time it takes Bitcoin to confirm just one block.

It could also connect different blockchain networks. By combining Bitcoin’s security with Ethereum’s EVM compatibility, PlutoChain may allow developers to build DeFi apps and NFT marketplaces on Bitcoin.

On top of that, it introduces a more community-driven governance system. Instead of relying on a small group for decisions, users could vote on key changes, making the platform more responsive to their needs. To ensure security and trust, PlutoChain has passed audits from firms like SolidProof, QuillAudits, and Assure DeFi.

The Bottom Line

HBAR has the technology and strong partnerships to grow, but reaching $10 will depend on adoption, market conditions, and ongoing development. While it has potential, competition and wider trends will play a big role in its future.

Meanwhile, new projects are trying to solve blockchain challenges. PlutoChain ($PLUTO) could help Bitcoin scale by potentially making transactions faster and adding Ethereum compatibility. This might allow developers to build DeFi and NFT projects on Bitcoin, which could make it a project to watch in the following weeks.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

3

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read

Best Crypto to Buy Now as Bitcoin Market Cap Rises Higher Than Google and Amazon

Bitcoin’s latest milestone saw it vault past tech giants Google and Amazon to rank as the fifth most valuable asset on earth. Clocking in at roughly $2.4 trillion in market capitalization, just above Amazon and comfortably ahead of Alphabet, this achievement underscores a turning point for cryptocurrencies. This publication is sponsored. CryptoDnes does not endorse […]

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

The Solana-based crypto launchpad Pump.fun recently made headlines by raising roughly $500 million in just 12 minutes during its PUMP token sale, achieving a fully diluted valuation of $4 billion. But the hype quickly fizzled away after PUMP became available for trading, as its price dropped almost 55% from its peak and fell to around […]

Bitcoin Price Prediction: Here’s When BTC Could Hit $150,000 as Bitcoin Hyper Presale Goes Viral

After Bitcoin (BTC) hit a new all-time high just above $123,000 yesterday, investor attention is now turning to the $150,000 milestone. Polymarket’s prediction markets show a roughly 46% chance of BTC hitting $150,000 this year, and a 74% probability for the $130,000 level. A few market commentators are even more bullish. For instance, the analyst […]

Ethereum Price Prediction: ETH to Could Soar to $3.5K as Trading Volumes Hit $33.7B

Ethereum (ETH) just broke $3,000 for the first time since February, with volume and open interest jumping in tandem. But can ETH continue rising to $3,500 or will this rally fizzle out? Meanwhile, the rest of the Ethereum ecosystem is benefiting from ETH’s latest surge. Best Wallet Token (BEST) is one project that is taking […]

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

3

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read