Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Hedera (HBAR) Price Today – $HBAR Loses 10% Over the Weekend While PlutoChain Attracts Whale Attention – HBAR News Today

19.02.2025 15:19 3 min. read Alexander StefanovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Hedera (HBAR) has faced a tough week, dropping 10% over the weekend and struggling to regain momentum.

While the price has slightly recovered, technical indicators suggest uncertainty, with HBAR needing a breakout above $0.248 to turn bullish.

At the same time, PlutoChain ($PLUTO) is attracting attention as a potential Layer-2 solution for Bitcoin’s speed and high gas-fee issues. By processing block times in two seconds and supporting Ethereum-based applications, it could improve Bitcoin’s efficiency.

Here’s all you need to know.

Could HBAR Recover From a Recent Drop in Price?

HBAR is currently trading at around $0.2217 and has had a minor drop of 0.5% in the last 24 hours while its 7-day overview shows a 6.1% drop according to CoinGecko.

Hedera has seen a small rebound, but its technical indicators still show weakness. The Average Directional Index (ADX), which tracks trend strength, has dropped from 28.9 to 23 in the past three days.

With the ADX and RSI now both on 35, Hedera’s downtrend has lost stream. This could mean the selling pressure is easing, and that a clear reversal of trends has come.

For HBAR to turn bullish, it needs to break above $0.248. If it does, the next target would be $0.32, a 46% jump.

Crypto analyst and content creator, ALLINCRYPTO, posted on X that he believes Hedera is going to go to $0.50 before possibly reaching $2.

Could PlutoChain ($PLUTO) Help Bitcoin Overcome Its Biggest Challenges?

Bitcoin has long struggled with slow transactions, high fees, and network congestion. While blockchains like Ethereum and Solana have adopted solutions to improve scalability, Bitcoin’s infrastructure has remained largely unchanged.

Some believe PlutoChain ($PLUTO), a Layer-2 network, could offer a way to enhance Bitcoin’s efficiency without modifying its core design.

One possible advantage of PlutoChain is speed. Bitcoin takes around 10 minutes to confirm a block, but PlutoChain finalizes blocks in just two seconds by processing them off-chain before finalizing them on Bitcoin’s network.

If successful, this might make Bitcoin more practical for everyday use, international payments, and smaller transactions. Lower fees are another potential benefit—by handling transactions more efficiently, PlutoChain could make Bitcoin more accessible to users who want to avoid high costs.

PlutoChain also claims full Ethereum Virtual Machine (EVM) compatibility, which could allow Ethereum-based applications—like DeFi protocols, NFT marketplaces, and AI-driven platforms—to integrate with Bitcoin. If widely adopted, this could expand Bitcoin’s role beyond just a store of value.

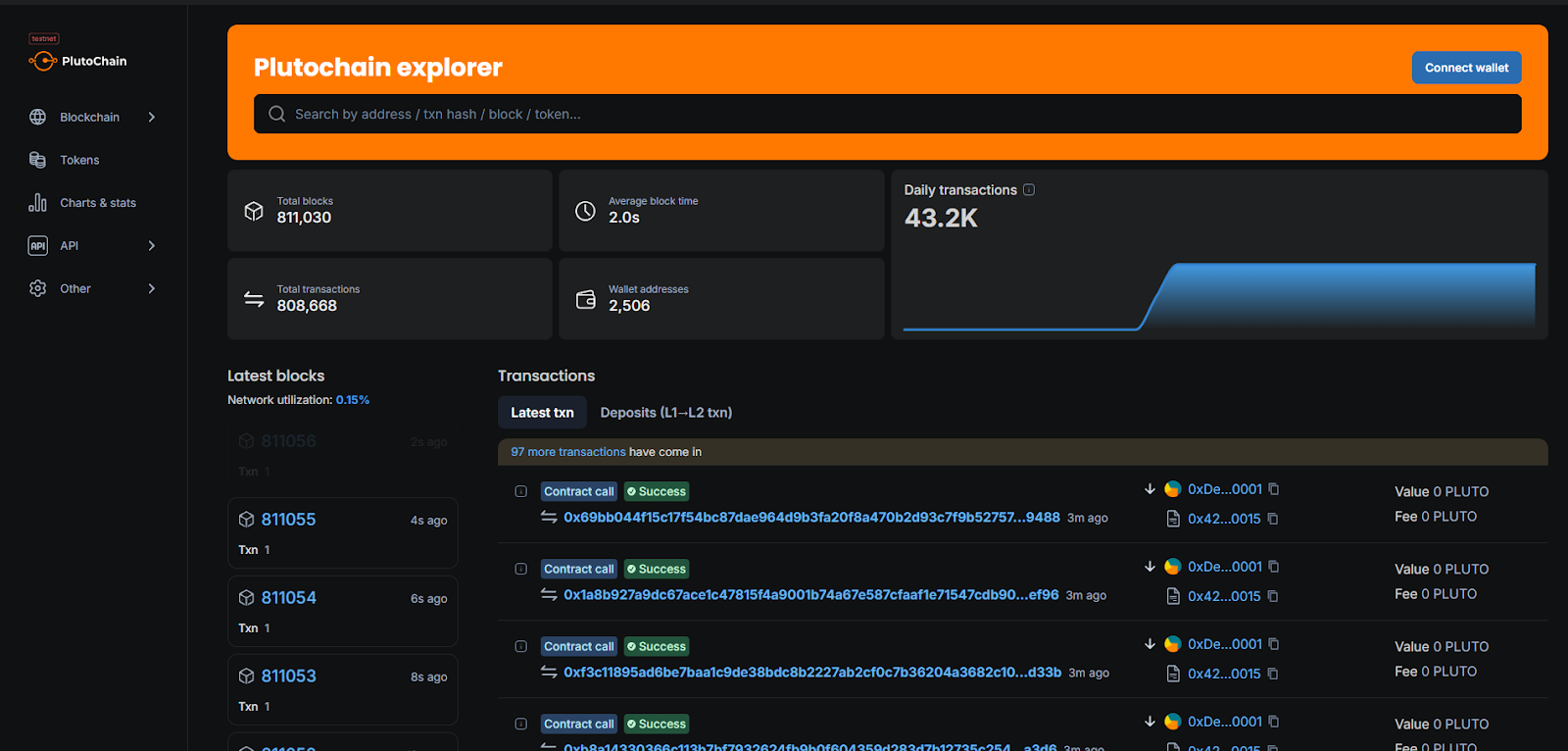

Early tests suggest PlutoChain can handle high transaction volumes, reportedly processing over 43,000 transactions in a single day without issues. Security rema=

The platform also promotes decentralized governance, letting the community influence key decisions. While it’s still early, PlutoChain could be a step toward making Bitcoin more scalable and efficient in the future.

The Bottom Line

HBAR faces a tough path ahead, with technical indicators suggesting a lack of clear direction. For a bullish shift, it needs to break through resistance at $0.248, but if the downtrend continues, it may drop further.

PlutoChain, on the other hand, may have the potential to solve Bitcoin’s scalability issues. With faster transactions and lower fees, it could improve Bitcoin’s practicality, though its future impact is still uncertain.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

3

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read

Best Crypto to Buy Now as Bitcoin Market Cap Rises Higher Than Google and Amazon

Bitcoin’s latest milestone saw it vault past tech giants Google and Amazon to rank as the fifth most valuable asset on earth. Clocking in at roughly $2.4 trillion in market capitalization, just above Amazon and comfortably ahead of Alphabet, this achievement underscores a turning point for cryptocurrencies. This publication is sponsored. CryptoDnes does not endorse […]

Pump.fun Token Price Prediction: PUMP Tanks After Launch, Traders Rotate Into Snorter Token Presale

The Solana-based crypto launchpad Pump.fun recently made headlines by raising roughly $500 million in just 12 minutes during its PUMP token sale, achieving a fully diluted valuation of $4 billion. But the hype quickly fizzled away after PUMP became available for trading, as its price dropped almost 55% from its peak and fell to around […]

Bitcoin Price Prediction: Here’s When BTC Could Hit $150,000 as Bitcoin Hyper Presale Goes Viral

After Bitcoin (BTC) hit a new all-time high just above $123,000 yesterday, investor attention is now turning to the $150,000 milestone. Polymarket’s prediction markets show a roughly 46% chance of BTC hitting $150,000 this year, and a 74% probability for the $130,000 level. A few market commentators are even more bullish. For instance, the analyst […]

Ethereum Price Prediction: ETH to Could Soar to $3.5K as Trading Volumes Hit $33.7B

Ethereum (ETH) just broke $3,000 for the first time since February, with volume and open interest jumping in tandem. But can ETH continue rising to $3,500 or will this rally fizzle out? Meanwhile, the rest of the Ethereum ecosystem is benefiting from ETH’s latest surge. Best Wallet Token (BEST) is one project that is taking […]

-

1

Best Crypto to Buy Now as XRP’s Legal Saga With Ripple Ends

28.06.2025 22:31 7 min. read -

2

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read -

3

3 Crypto Presales That Could Generate 100x Returns in Q3

29.06.2025 12:27 4 min. read -

4

Best Crypto to Buy Now After Trump’s $220 Million Bitcoin Power Play

02.07.2025 19:23 7 min. read -

5

5 Best Crypto to Buy for Q3 Altcoin Season as Bitcoin Dominance Dips

29.06.2025 12:31 5 min. read