Hedera (HBAR) Faces Sharp Pullback After 49% Monthly Rally

16.07.2025 7:00 2 min. read Kosta Gushterov

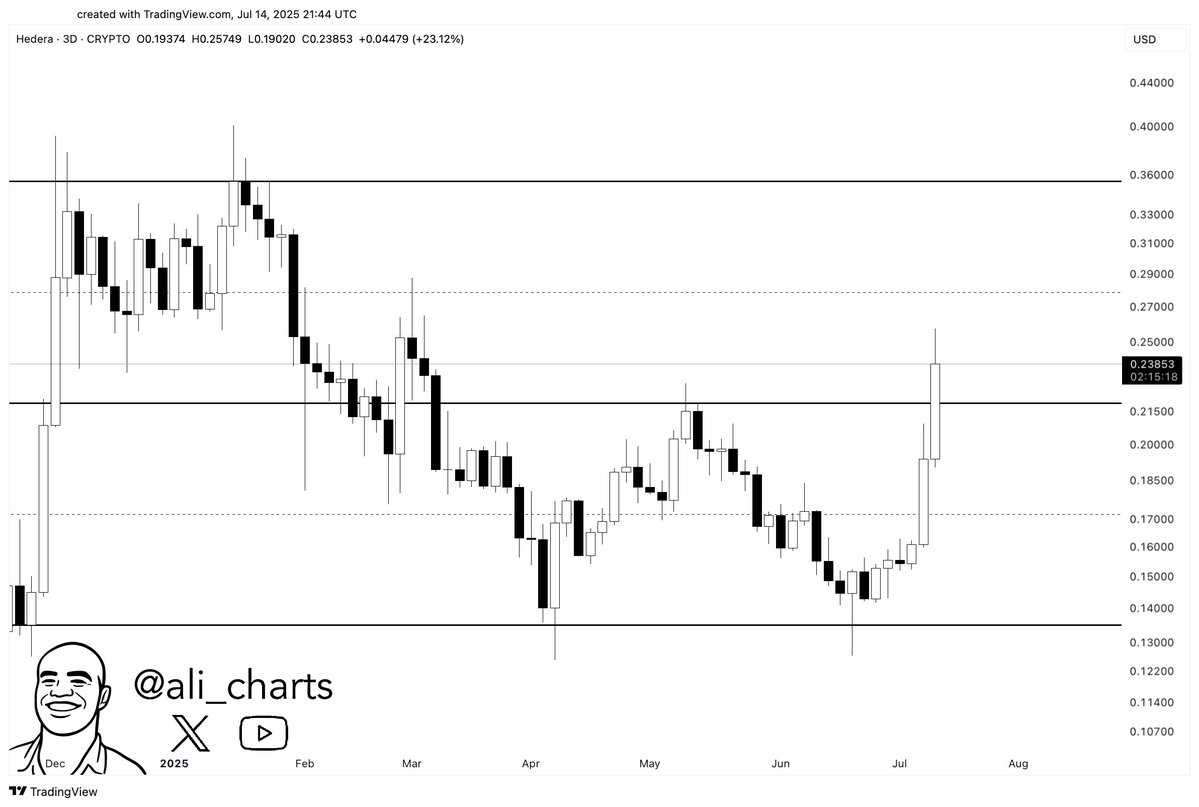

Hedera’s native token HBAR is facing selling pressure after an explosive 49% monthly surge, dropping over 5% in the past 24 hours at time of writing.

Despite holding above $0.22, technical signals and derivatives market dynamics suggest the altcoin could face more volatility in the short term.

Overbought signals trigger sharp correction

HBAR’s Relative Strength Index (RSI) hit extreme levels—87.9 on the 7-day and 79.8 on the 14-day—indicating overbought conditions. Historically, such levels have often preceded price corrections. The token was also trading 30% above its 50-day moving average, making it vulnerable to mean reversion.

Support near $0.225, based on Fibonacci retracement (23.6% level), failed to hold during Tuesday’s pullback. The next key support is around $0.206, corresponding to the 38.2% Fibonacci level.

Market-wide headwinds add pressure

HBAR’s underperformance came amid a 1.8% drop in the overall crypto market cap and a rise in Bitcoin dominance to 63.12%. This signals capital rotation toward BTC and away from riskier altcoins. Meanwhile, the Crypto Fear & Greed Index remains at 70, a traditionally contrarian signal warning of potential downside.

Still, prominent analyst Ali Martinez sees bullish potential if HBAR breaks above the $0.36 resistance. For now, traders are watching whether institutional adoption narratives can offset technical headwinds—especially if Bitcoin stabilizes above $117,000.

Key levels to watch: $0.206 support, $0.265 resistance, and Bitcoin’s $117.4K macro pivot.

READ MORE:

How Can You Tell When it’s Altcoin Season?

Futures market shows signs of overheating

Open interest in HBAR futures climbed to a record $450 million, according to Coingape, intensifying volatility. Within 24 hours, long positions worth $7.1 million were liquidated as the token failed to break resistance in the $0.233–$0.263 zone.

Trading volume also dropped 43% to $834 million, indicating fading momentum. The spot-to-perpetual ratio sits at 0.46, implying price movements are being driven largely by speculative derivatives rather than organic demand.

-

1

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

2

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read -

3

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

30.06.2025 19:00 1 min. read -

4

Top Trending Cryptocurrencies Today

01.07.2025 15:17 3 min. read -

5

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

30.06.2025 22:06 3 min. read

Ondo Price Breakout Confirms Bullish Trend: What’s the Target in Sight

Ondo (ONDO) has captured trader attention with a confirmed breakout above $0.87, signaling a possible shift in trend after months of consolidation.

Solana Price Prediction: SOL Could Jump to $200 After This ‘Buy’ Signal

Solana (SOL) has gone up by 7% in the past 7 days after the approval of the first exchange-traded fund (ETF) linked to this token in the United States. The REX-Osprey SOL + Staking ETF (SSK) is already nearing the $100 million mark in assets under management (AUM), which favors a bullish Solana price prediction. […]

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

A major development in the world of crypto ETFs has just been confirmed, as NYSE Arca has officially certified the approval for listing the ProShares Ultra XRP ETF (UXRP).

Top Crypto Trends Dominating Discussions This Week

As Bitcoin smashes through all-time highs, crypto-related conversation is surging across social media.

-

1

What Are the Most Talked-About Words in Crypto Today?

28.06.2025 7:30 2 min. read -

2

Ethereum Accumulation Surges While U.S. Politics Stir Market Uncertainty

30.06.2025 18:00 2 min. read -

3

Ethereum Launches Onchain Time Capsule to Mark 11th Anniversary in 2026

30.06.2025 19:00 1 min. read -

4

Top Trending Cryptocurrencies Today

01.07.2025 15:17 3 min. read -

5

XRP Price Prediction: Can XRP Hit $4 After XRPL EVM Sidechain Launch?

30.06.2025 22:06 3 min. read