Has BTC Topped? Key Signals Suggest The Rally isn’t Over

15.07.2025 21:00 2 min. read Kosta Gushterov

Despite Bitcoin soaring past $120,000 and testing new all-time highs, several high-frequency market indicators suggest that the current bull run may still be gathering momentum.

According to Swissblock’s latest multi-chart analysis, the market structure remains healthy, with no signs of overheating behavior typically seen at major cycle tops.

Profit-taking behavior stays in check

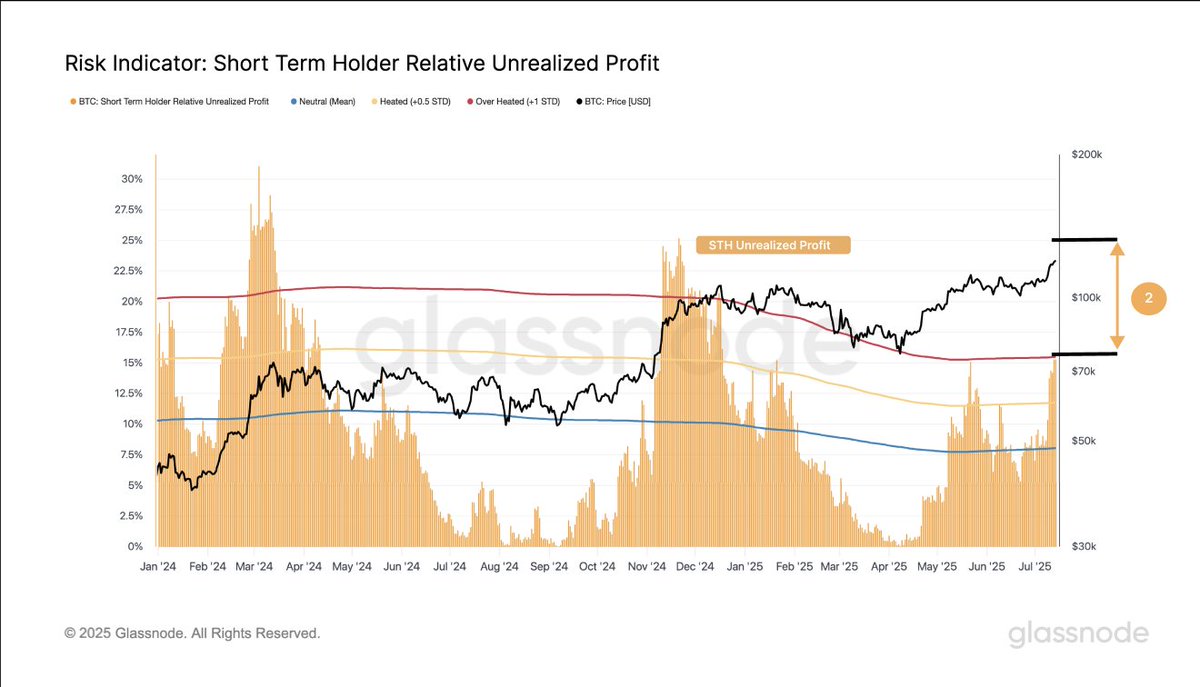

Glassnode’s Short-Term Holder Relative Unrealized Profit metric—used to assess the profitability of recent buyers—remains far below prior cycle peak thresholds from January and April 2024. Historically, this metric spikes when markets become euphoric, as investors rush to lock in gains. The current subdued reading indicates that traders are not yet in a frenzy of profit-taking, which often precedes a top.

Swissblock interprets this as a sign of ongoing market discipline, implying there’s still room for BTC to climb without triggering mass exits.

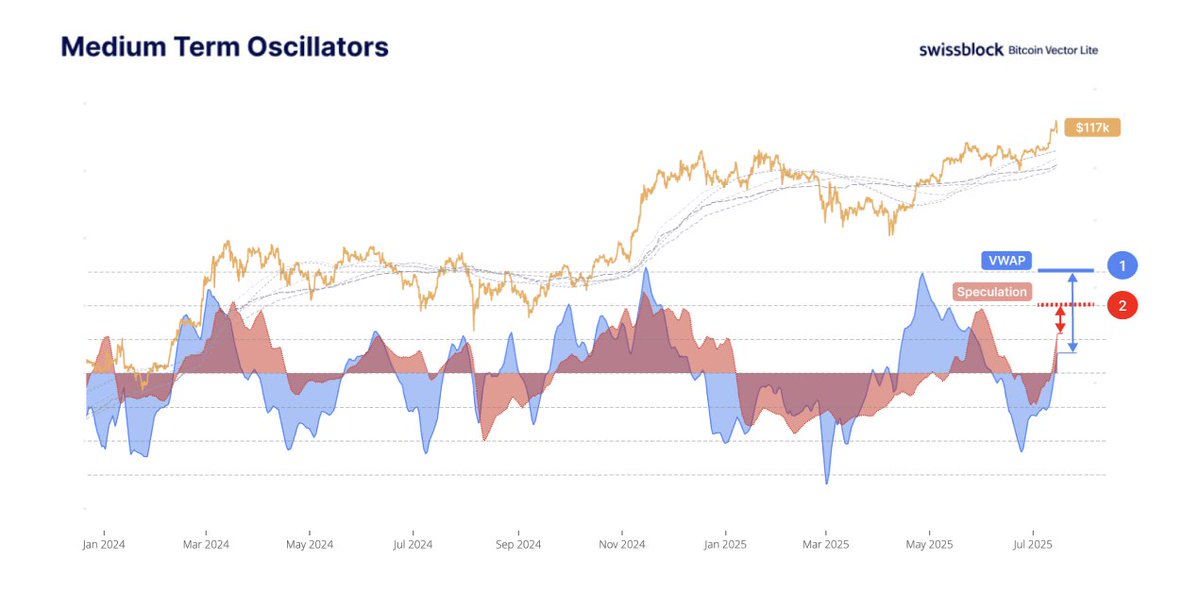

Speculation index and liquidity flows remain balanced

Woonomic’s Speculation Index and VWAP Liquidity, two key sentiment and liquidity oscillators, also remain within neutral zones. These tools, which measure risk appetite and liquidity stress, show no signs of excess—unlike prior cycle peaks where these indicators reached extreme levels.

This balance indicates that the rally is not being driven by reckless leverage or overconcentration of capital, but rather by steady demand and orderly accumulation. In fact, BTC’s price is climbing alongside healthy liquidity dispersion—a hallmark of sustainable growth rather than speculative blow-off.

READ MORE:

How Can You Tell When it’s Altcoin Season?

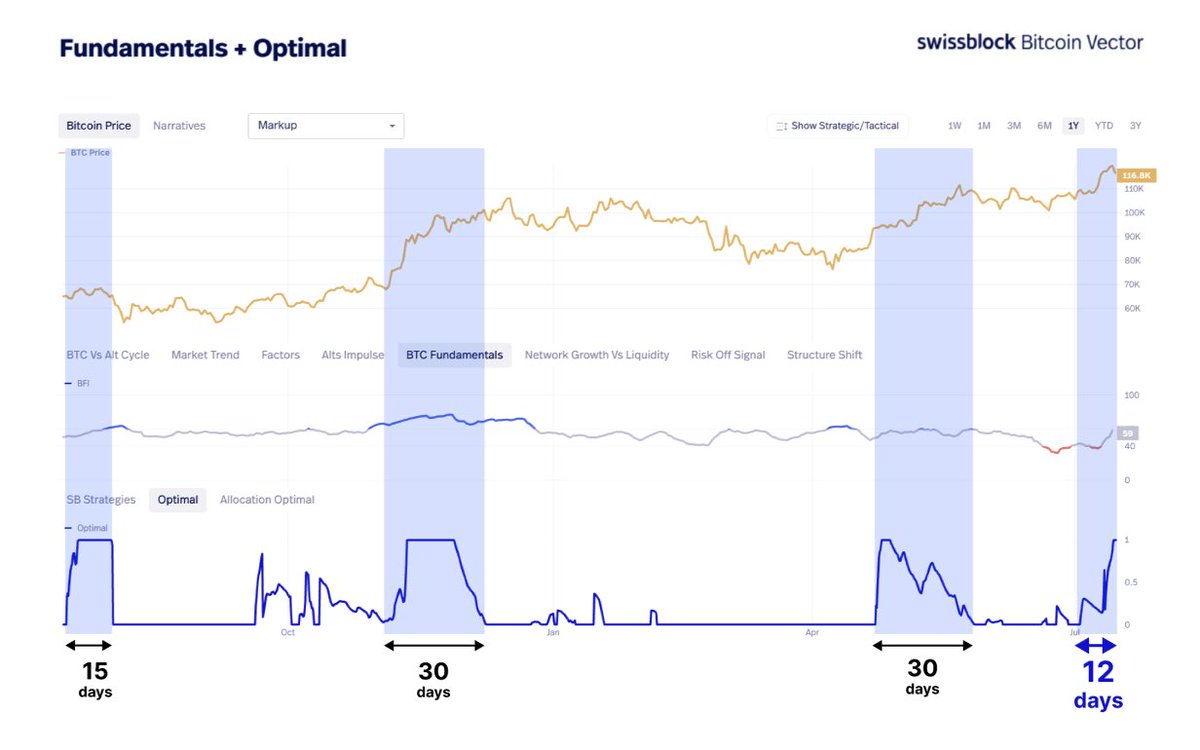

The cycle clock says there’s still time

Swissblock’s Optimal Signal, built by BitcoinVector, tracks the duration of Bitcoin’s past major rallies. Historically, strong upward moves last between 15 and 30 days. The current uptrend is only 12 days in, suggesting this cycle is far from over. Previous expansions in similar setups often experienced peak momentum in the second half of the rally window.

Adding further weight to this thesis is capital rotation into Ethereum, which typically follows Bitcoin’s lead mid-cycle as investors seek higher beta exposure.

Bottom line: No top—yet

While traders naturally wonder, “Has $BTC topped?”, Swissblock’s data suggests otherwise. Key profit, liquidity, and timing indicators show restraint and balance—not the reckless abandon that has marked previous cycle climaxes.

-

1

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

2

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read

Top Crypto Trends Dominating Discussions This Week

As Bitcoin smashes through all-time highs, crypto-related conversation is surging across social media.

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

In a striking contradiction to its long-held skepticism toward cryptocurrencies, Vanguard Group now owns more than 20 million shares of Strategy Inc.—the software company famously tied to Bitcoin through its massive holdings.

Deutsche Bank Explains why Bitcoin’s Dip May Not be What it Seems

Bitcoin’s fall from its recent $123,000 all-time high to $117,000 sparked waves of speculation—but according to Deutsche Bank, this isn’t a typical cooldown.

Bitcoin Short Squeeze Fuels Rally Toward $122,000 Resistance Zone

Bitcoin has surged toward the $122,000 mark following a wave of short liquidations, echoing market behavior last seen in November 2024.

-

1

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

2

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read