Grayscale’s Ethereum ETF Outflows Declined – How Did Bitcoin ETFs Fare?

13.08.2024 12:35 1 min. read Kosta Gushterov

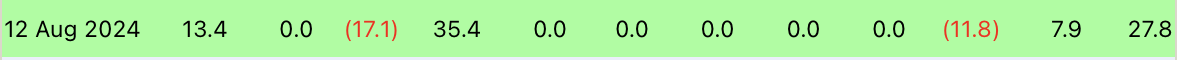

On August 12, spot Bitcoin exchange-traded funds (ETFs) in the U.S. recorded net inflows of just $27.8 million.

According to Farside, Grayscale’s GBTC-converted fund and Bitwise’s BITB were the only ETFs to experience outflows for the day, with $11.8 million and $17.1 million, respectively.

BlackRock’s Bitcoin fund (IBIT) was one of three funds to see inflows, adding $13.4 million. ARKB was the best performer of the day, bringing in $35.4 million, while Hashdex’s DEFI registered $7.9 million.

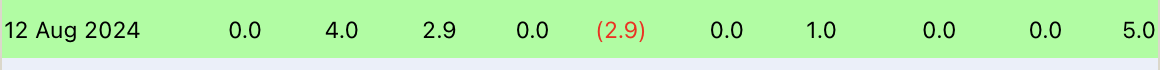

On the other hand, spot Ethereum ETFs also posted positive results on Monday, with total inflows amounting to $5 million.

The largest inflow was recorded by Fidelity’s FETH, with $4 million, followed by Bitwise’s ETHW with $2.9 million and Franklin Templeton’s EZET with $1 million.

Interestingly, Grayscale’s ETHE, which had previously seen large outflows, registered a neutral result this time.

-

1

Ethereum ETFs See First Outflows After Record Inflow Streak

14.06.2025 15:00 1 min. read -

2

Solana ETF Push Gains Momentum After Flurry of S-1 Updates

14.06.2025 21:00 1 min. read -

3

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read -

4

Pi Coin Eyes Potential Reversal After 70% Slide, Chart Pattern and Upcoming Event Hint at Rebound

24.06.2025 11:00 2 min. read -

5

Lion Group Bets Big on Altcoins With $500M Hyperliquid Strategy

20.06.2025 12:00 1 min. read

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

Bitcoin’s bullish undercurrent continues to strengthen as on-chain data and derivatives market behavior reveal aggressive accumulation from long-term holders and whales.

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

Zak Cole, a prominent Ethereum core developer, has unveiled a bold new initiative aimed at significantly expanding the Ethereum ecosystem and driving the price of ETH to $10,000.

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

According to a new report by CryptoQuant, Chainlink (LINK) is locked in a prolonged accumulation phase between $12 and $15, driven by aggressive whale behavior amid muted retail participation.

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

As institutional adoption of Bitcoin accelerates, U.S. asset management giant Franklin Templeton has issued a cautionary note on the growing trend of crypto-based treasury strategies.

-

1

Ethereum ETFs See First Outflows After Record Inflow Streak

14.06.2025 15:00 1 min. read -

2

Solana ETF Push Gains Momentum After Flurry of S-1 Updates

14.06.2025 21:00 1 min. read -

3

Altcoin Market Poised for Turbulence as Key Support Levels Flash Signals

16.06.2025 21:00 2 min. read -

4

Pi Coin Eyes Potential Reversal After 70% Slide, Chart Pattern and Upcoming Event Hint at Rebound

24.06.2025 11:00 2 min. read -

5

Lion Group Bets Big on Altcoins With $500M Hyperliquid Strategy

20.06.2025 12:00 1 min. read