Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Google’s AI Gemini Predicts When XRP Will Hit $10 & Tips New Altcoin for 3100% Surge

27.07.2025 12:53 5 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

With Bitcoin holding above $117,000 and altcoins bouncing in and out of rallies, everyone’s looking for what could break out next. One tool that many traders have been turning to lately to find out is Google’s Gemini AI.

This model is capable of accurate price forecasts, especially when it comes to bigger names like XRP. In its latest outlook, Gemini called for XRP to reach $10 sooner than most people expect, breaking down exactly what needs to happen to achieve this goal.

But it didn’t stop at major altcoins. The AI also pointed to a much smaller token – Bitcoin Hyper – as one that could deliver better returns than XRP. Gemini even thinks HYPER could rise 3,100% from its current presale price.

Let’s explore these bullish forecasts in more detail.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

XRP Pulls Back, but the Bigger Picture Still Looks Bullish

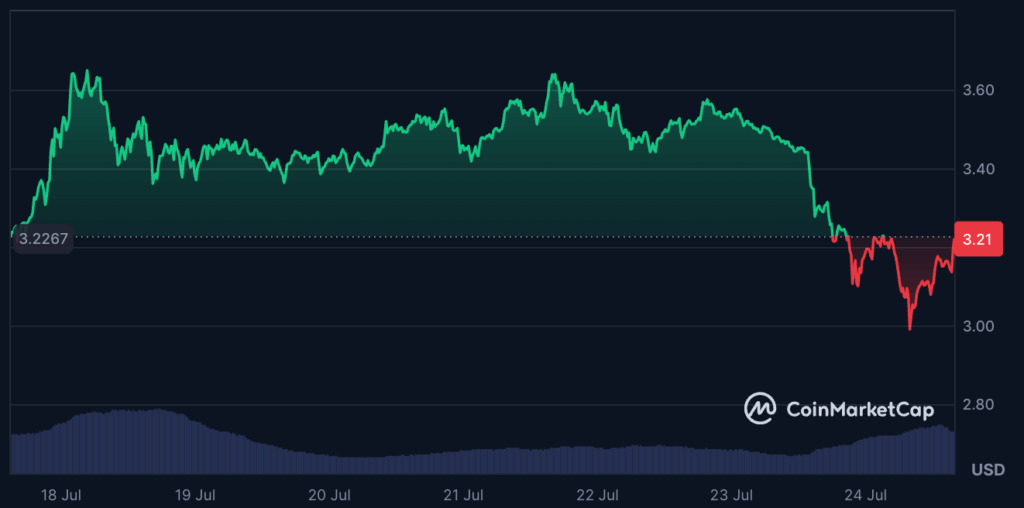

XRP is trading at $3.17, recovering slightly from a dip overnight but still down from its local high of $3.67. It’s dropped about 4% in the past 24 hours and is down 3% on the week – so the bears are in control for now.

But zoom out a bit, and XRP still looks strong. It’s up nearly 44% in the last month and almost 400% since this time last year. Much of that bullishness stems from regulatory clarity.

The Ripple-SEC battle concluded in March with a $50 million settlement, and the new crypto-friendly SEC chair has further boosted confidence. On top of that, Ripple launched its stablecoin (RLUSD), and the EVM-compatible XRPL sidechain has opened the door to DeFi on XRP.

XRP’s technicals also support the bull case. Its RSI is high, but it’s not showing signs of panic. The key moving averages are still pointing up, and the golden cross that flared in July is holding. In short: minor wobble, but long-term momentum.

Gemini Says XRP Could Reach $10 Soon – Here’s How

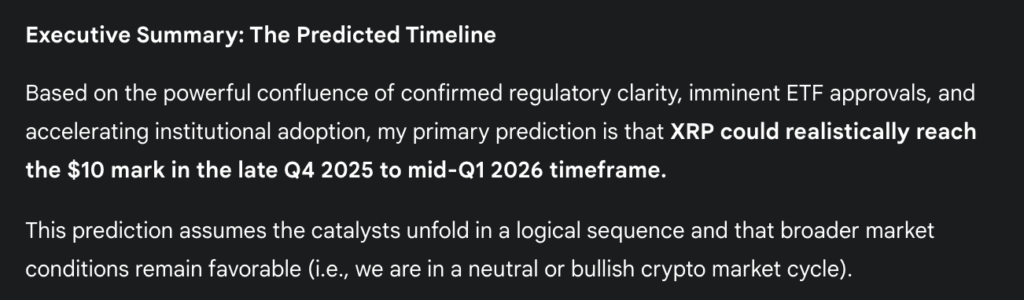

Gemini lays out a convincing roadmap for XRP to hit $10 between late 2025 and early 2026. Its thesis is simple: if XRP continues to gain utility, receives spot ETF approvals, and broader market conditions remain bullish, then all the pieces could fall into place for the bulls.

XRP’s climb would likely start with a climb toward $6 by the end of Q3. XRP recently broke out of a massive six-year triangle pattern, and Gemini sees that as the beginning of a much bigger run.

Then comes the ETF itself. Gemini predicts that XRP could spike 30–50% within days of an ETF approval announcement, potentially pushing past $9 quickly. And after a short cooldown, the inflow of institutional capital could help XRP shoot above $10.

Gemini compares this scenario to Ethereum’s bull run in 2021 – but this time, XRP has both regulatory clarity and ETF momentum behind it. That combination, Gemini argues, could be the catalyst for an explosive rally.

Why Gemini Thinks Bitcoin Hyper Could Outperform XRP & Post 32x Returns

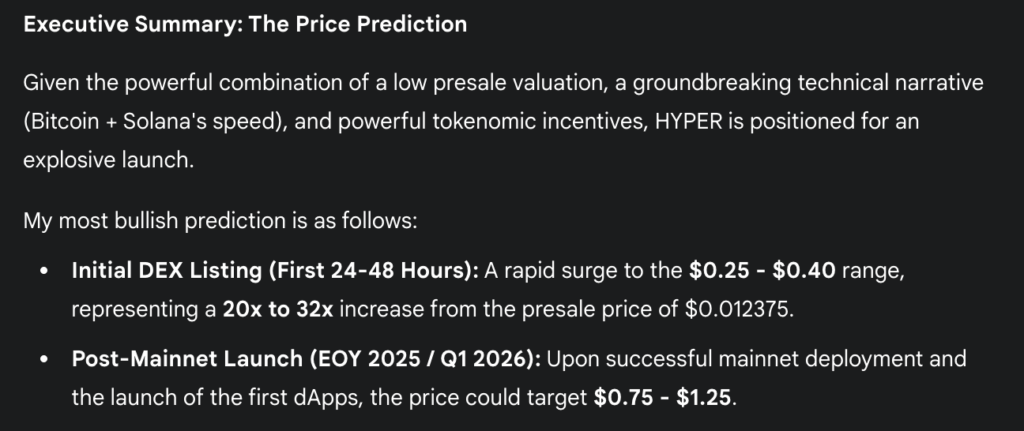

But Gemini believes Bitcoin Hyper could deliver even bigger gains than XRP – and potentially much sooner. Still in presale, the project has raised over $4.5 million, with HYPER tokens priced at just $0.012375.

According to Gemini, that’s a setup for a post-launch rally to between $0.25 and $0.40. If HYPER reaches the upper end of that range, it would be a 32x return for investors.

What makes Gemini so bullish on Bitcoin Hyper is its narrative: Bitcoin’s security with Solana’s speed. Its Layer-2 network will support smart contracts, DeFi, and NFTs – everything Bitcoin lacks natively.

The AI compares it to Stacks and Lightning Network, but says Bitcoin Hyper is a leap ahead of these projects. Offering up to 65,000 TPS, it’s built for real throughput, and that could be what finally unlocks Bitcoin’s dormant liquidity.

HYPER holders also receive a massive 212% APY by staking, which incentivizes HODLing rather than selling. Pair that with a low initial float and early whale interest, and the post-launch supply is likely to be extremely tight. That’s why 99Bitcoins’ analysts dubbed it the “best crypto to buy” this month.

Gemini’s long-term view is that if Bitcoin Hyper delivers on its roadmap – mainnet launch, working dApps, and CEX listings – it could climb as high as $1.25 by early 2026

That would still give it a fully diluted market cap of $21 billion – higher than HYPE and XLM, but well within reach in a peak bull cycle.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read -

2

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

12.07.2025 11:04 4 min. read -

3

Pump.fun’s $PUMP ICO Launches July 12 — But a Low-Cap Contender Is Gaining Steam

11.07.2025 17:47 4 min. read -

4

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

5

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read

Best Crypto to Buy Now as Dogecoin Signals A Bullish Price Move

The bull market has pumped the meme coin ecosystem, carving a clear path for old meme assets to grow. Thanks to this, Dogecoin, the world’s biggest meme coin by market capitalization, has now entered back in range. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, […]

Best Cryptos to Watch as Ethereum Bull Sharplink Makes New Strategic Web3 Moves

For years, MicroStrategy has served as the market’s benchmark example of institutional Bitcoin conviction. Now, a similar narrative is unfolding in Ethereum, and Sharplink is at the center of it. The gaming-focused firm has become the largest public company holder of ETH, overtaking DAOs and family offices with a balance sheet that includes over 360,000 […]

Best Crypto to Buy Now? Institutions Stack Up On The Next 10x Tokens Despite Market Volatility

One of the defining features of this year’s crypto rally has been the relentless accumulation by institutions. What began with a concentrated focus on Bitcoin has started to branch out, as capital allocators prepare for a future where other digital assets gain similar legitimacy. The growing conversation around altcoin ETFs, particularly for Ethereum, has added […]

Best Meme Coins To Buy The Dip As Bitcoin, Altcoins Crash

After a day of aggressive selling, the market is starting to show signs of life again, and investors are wasting no time getting back in. What began as a sharp correction has quickly turned into a shopping spree, especially among retail traders who view this dip as temporary. With Bitcoin stabilizing and Ethereum regaining strength, […]

-

1

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read -

2

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

12.07.2025 11:04 4 min. read -

3

Pump.fun’s $PUMP ICO Launches July 12 — But a Low-Cap Contender Is Gaining Steam

11.07.2025 17:47 4 min. read -

4

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

5

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read