Franklin Templeton Joins XRP ETF Race as SEC Weighs Proposals

12.03.2025 10:00 2 min. read Alexander Zdravkov

Financial giant Franklin Templeton, managing a staggering $1.53 trillion in assets, has officially entered the race to launch an XRP exchange-traded fund (ETF).

This move places it alongside firms like Bitwise, Canary Capital, 21Shares, Grayscale, and WisdomTree, which have already submitted similar applications.

Regulatory discussions around these proposals are gaining momentum, with the U.S. Securities and Exchange Commission (SEC) acknowledging the filings from these companies.

While this recognition is seen as an encouraging step, it remains uncertain whether the regulator will approve them.

The SEC’s stance on cryptocurrency appears to be shifting, especially following leadership changes, but the final outcome is yet to be determined. A decision on Grayscale’s application is expected by October 18.

In a separate development, Volatility Shares has put forward its own unique XRP-related ETF proposals, including a product designed for investors looking to speculate on a decline in the token’s price.

XRP ETF Race Heats Up, While Solaxy Offers Something New

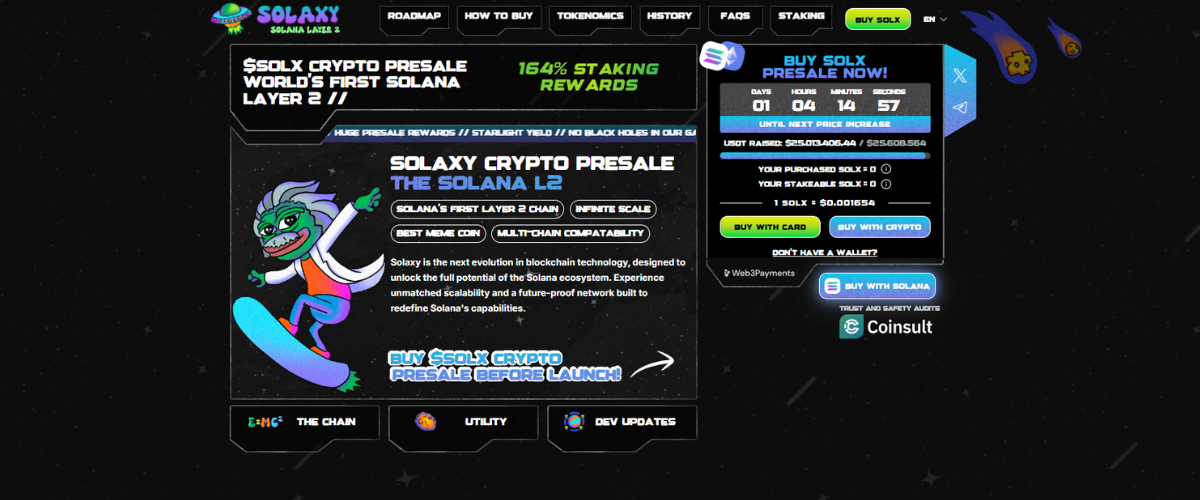

Solaxy ($SOLX) is revolutionizing blockchain technology by offering the first Layer-2 solution on Solana. This project significantly improves speed and reduces transaction fees, solving network congestion problems.

Solaxy’s advanced rollup architecture shows strong potential to optimize transaction speeds and reduce congestion-related inefficiencies on Solana. The project’s approach reduces congestion and ensures smooth execution, even during peak activity. For traders, this means faster and more reliable transactions, preventing failed swaps.

Beyond improving transaction efficiency, Solaxy is expanding interoperability between Solana and Ethereum. The $SOLX token functions as a multi-chain asset, allowing users to engage across both ecosystems. This provides access to Ethereum’s liquidity while benefiting from Solana’s speed and cost efficiency.

-

1

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

4

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

5

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

BNB Coin Price Prediction: As BNB Chain Daily Transaction Volumes Explode Can It Hit $900?

Trading volumes for BNB Coin (BNB) have doubled in the past 24 hours to $3.8 billion as the price rises by 7%. This favors a bullish BNB Coin price prediction at a point when the token just made a new all-time high. BNB is the second crypto in the top 5 to make a new […]

PENGU Price Soars While Whale Transfers Raise Alarms

The Pudgy Penguins’ PENGU token is under intense scrutiny after large transfers from its team wallet raised potential red flags.

BNB Hits New All-Time High Amid Token Launch Frenzy

BNB surged to a new all-time high on July 28 around $860, breaking above the critical $846 level following a sharp 7% intraday move.

-

1

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

4

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

5

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read