Forbes Reveals the Most Trusted Crypto Exchanges of 2025

30.01.2025 17:30 1 min. read Alexander Zdravkov

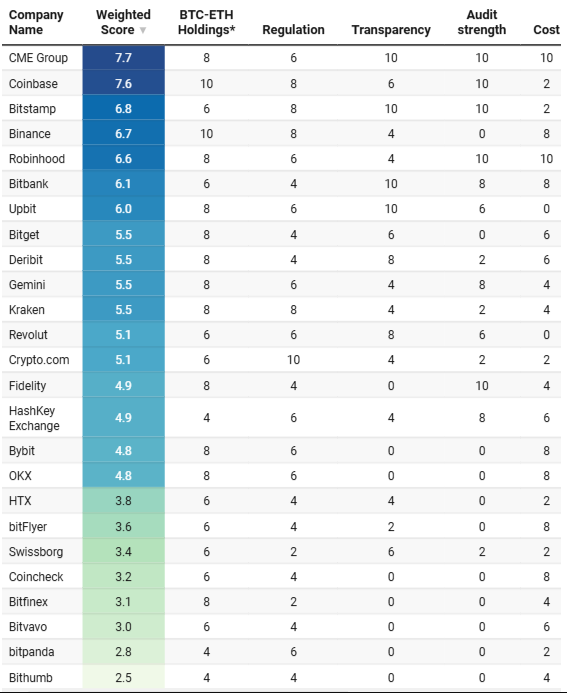

Forbes has released its annual ranking of the most reliable cryptocurrency exchanges, analyzing over 200 platforms based on security, compliance, and trading volume.

The report highlights that asset protection remains the top priority for retail traders.

At the top of the list is CME Group, a global leader in derivatives trading. Though not retail-focused, its regulated Bitcoin futures market gives it a strong reputation for security and institutional trust.

Coinbase secured the second position, standing out as the largest Bitcoin custodian with 2.4 million BTC held across 8 million active accounts, totaling $245 billion in assets. The exchange also oversees $300 billion in digital holdings, including Ethereum and Solana.

Bitstamp landed at third place, strengthened by its upcoming acquisition by Robinhood, pending board approval. Meanwhile, Binance, the largest exchange by trading volume, ranked fourth, maintaining its dominance in Europe and BRICS nations with 245 million users and a $14 billion daily spot trading volume.

Rising to fifth place, Robinhood saw a 780% increase in trading activity, driven by its election-themed prediction markets and zero-fee trading model. The platform has also become the leading marketplace for memecoins like Dogecoin.

The Forbes ranking also included Bitbank, Upbit, Bitget, Deribit, and Gemini, recognized for their strong security measures and regulatory compliance.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

How to Earn Yield Holding USDC: A 2025 Guide

15.07.2025 18:10 2 min. read

Kraken Launches U.S. Crypto Derivatives Platform, Eyes Broader Market Expansion

Kraken has officially launched its U.S.-regulated crypto derivatives platform, marking a major step toward merging traditional finance tools with digital asset markets.

How to Earn Yield Holding USDC: A 2025 Guide

If you’re holding USDC and want to maximize your yield, Deribit now offers rewards for eligible users who store USDC on its platform.

Kazakhstan May Invest Gold Reserves in Crypto Sector

Kazakhstan is considering allocating a portion of its gold and foreign currency reserves, along with National Fund assets, into crypto-related investments.

Grayscale Confidentially Files for New SEC-registered Offering Amid Growing Crypto Market demand

Grayscale Investments announced today that it has confidentially submitted a draft registration statement on Form S-1 to the U.S.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

How to Earn Yield Holding USDC: A 2025 Guide

15.07.2025 18:10 2 min. read