FET Experiences Boom in Whale Transactions – Could it Boost Prices?

18.09.2024 14:00 1 min. read Alexander Stefanov

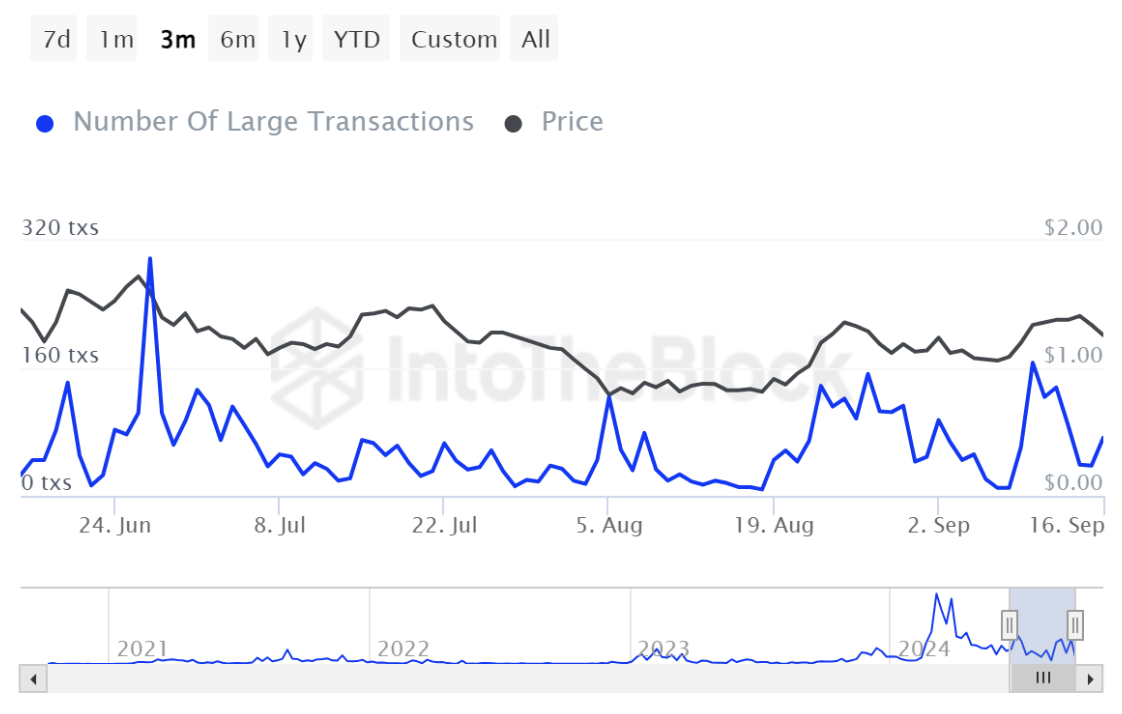

Whale activity around the Artificial Superintelligence Alliance (FET) has increased dramatically, with large transactions up 262%, as reported in IntoTheBlock data.

Large holders, often referred to as whales, are driving the upward momentum, suggesting that the token’s price could soon rise as local peaks signal potential growth.

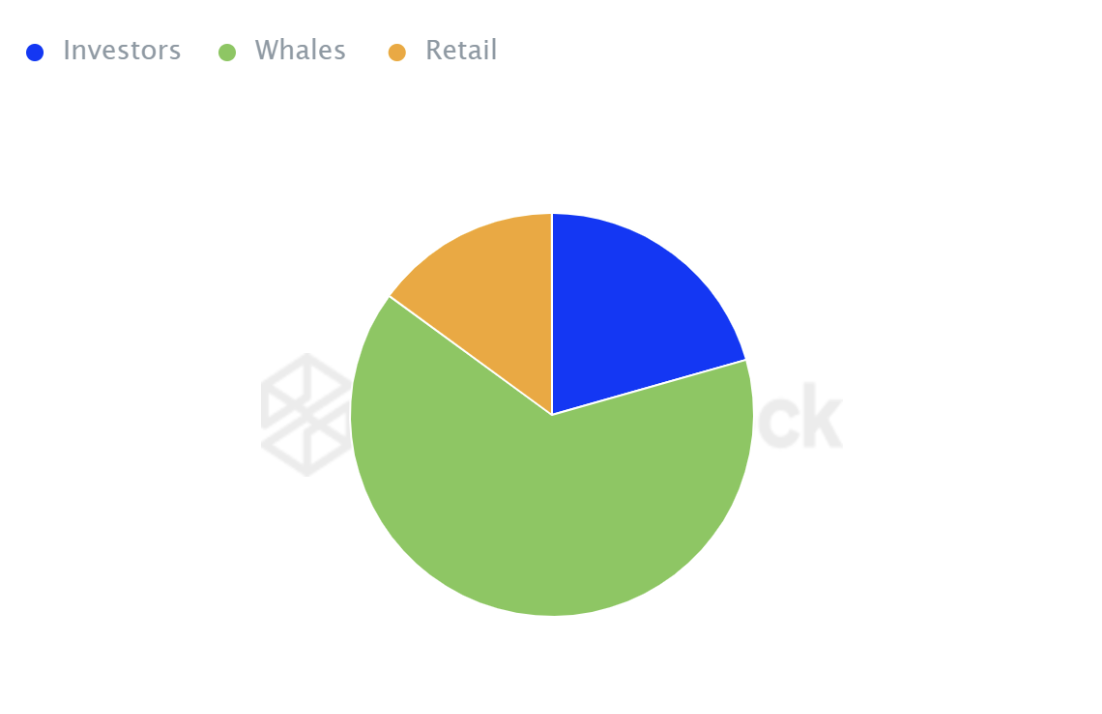

Large investors currently control 64% of the total FET allocation, a statistic that could suggest a significant price increase.

Although overall trading volume has declined, whales are stepping in to stabilize the situation.

Despite this intense whale participation, FET trading activity has dropped by 10, but this has not discouraged large holders who remain committed to increasing the token’s value.

Whale activity in the FET market is signaling a potential price breakout, with large holders controlling 64% of the asset. Recent spikes in significant transactions, up 262%, suggest that these major players are positioning for an upward move.

FET is currently trading within a symmetrical triangle pattern since March, indicating a period of consolidation and a likely breakout soon.

If whale trading continues at this pace, a bullish breakout could attract more buyers and push prices higher, making whale movements a key factor to watch for any upcoming price shifts.

-

1

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

4

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

5

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

4

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

5

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read