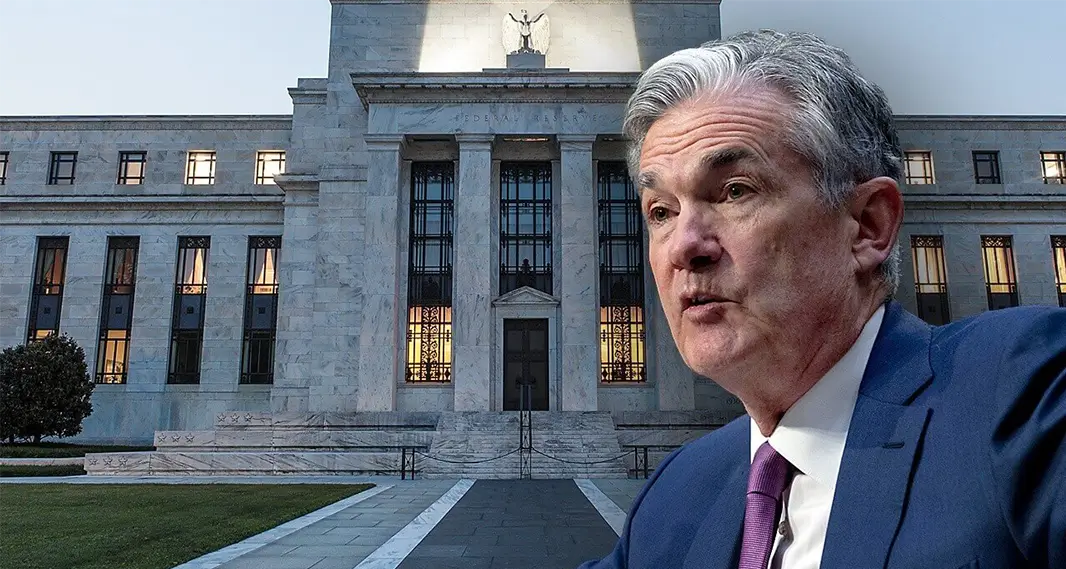

Fed Should Cut Rates by 0.75% Immediately, According to Expert

05.08.2024 15:53 1 min. read Alexander Stefanov

During an interview on CNBC, Wharton's Professor Jeremey Siegel, who is also the Chief Economist at WisdomTree calls for 0.75% emergency rate cut by the FED.

He also says that there should be another 0.75% rate cut after the next meeting – and thats a bare minimnum as the rate should be between 3.5% and 4%.

Siegel also mentioned that at the june meeting Fed said when inflation reached 2% and unemployment has come up to 4.2% the long-term federal funds rate should be 2.8%.

The economist stated that last Friday that unemployment target was surpassed and reached 4.3%. The inflation has also dropped 90% from its peak and is near the target. In other words the United States “overshot” the targets.

The Fed wanted these targets to be fulfilled and then they would cut the rates – but they didn’t, which according to Siegel makes absolutely no sense.

Not only the U.S. but other economies are suffering, because of Jerome Powell’s irrational decision making and an emergency rate cut is to be expected, since everything has gotten out of the Fed’s control.

-

1

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

2

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read -

3

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

4

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

5

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

13.07.2025 15:00 1 min. read -

2

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read -

3

U.S. Announces Sweeping New Tariffs on 30+ Countries

12.07.2025 16:30 2 min. read -

4

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

5

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read