Fantom Crashes to New Lows as Market Panic Sets In

05.08.2024 16:00 1 min. read Alexander Stefanov

Fantom's (FTM) value has plummeted by 20% in the last day, now trading at $0.29, a low not seen since October 2023.

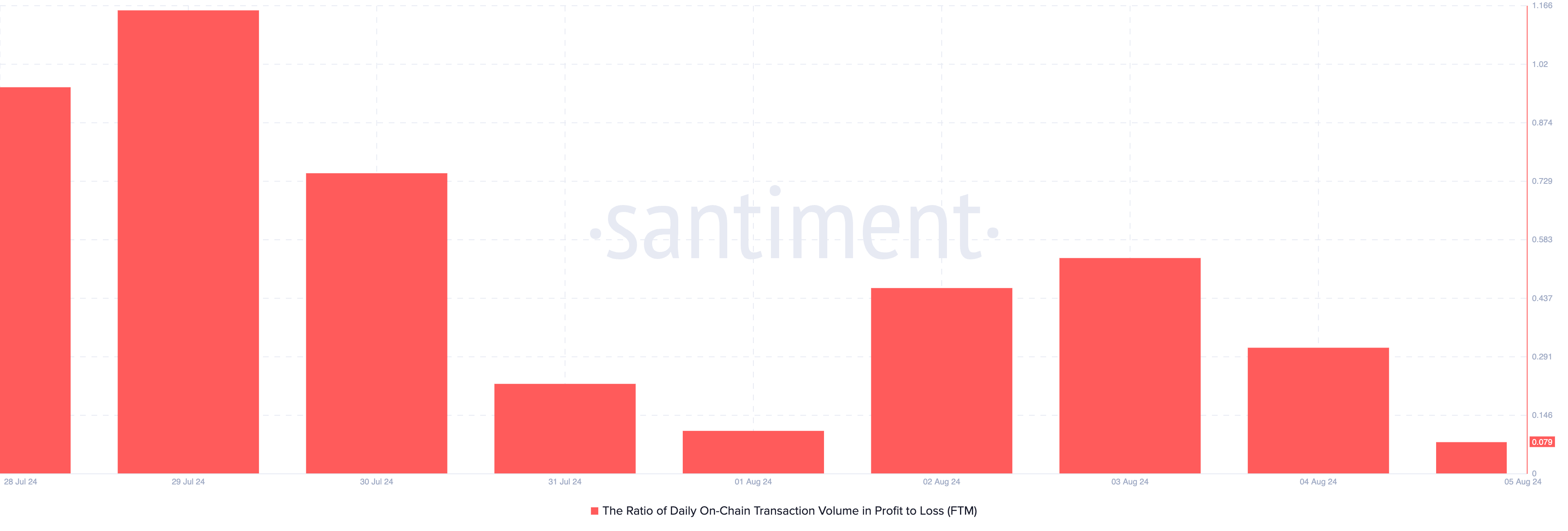

This decline has led to significant losses for many holders, with a noticeable increase in unprofitable transactions and long position liquidations in the derivatives market.

Analysis shows a high ratio of transactions at a loss compared to those at a profit, with 72% of wallet addresses currently underwater. Only 23% of holders are making a profit at this price level. The derivatives market has seen $2.16 million in long positions liquidated in the past 24 hours, the highest in two months.

Key indicators suggest further declines, with FTM’s Elder-Ray Index at -0.19 showing strong bearish sentiment and its price falling below the 20-day EMA, signaling increased selling pressure. If this trend continues, FTM could drop to $0.25.

The broader market downturn has also affected other cryptocurrencies, contributing to the bearish outlook. Investors are now closely watching market trends and indicators to gauge the next movements. The increased volatility in the market is leading to heightened caution among traders, who are seeking stability in an unpredictable environment.

-

1

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

4

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

5

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

BNB Coin Price Prediction: As BNB Chain Daily Transaction Volumes Explode Can It Hit $900?

Trading volumes for BNB Coin (BNB) have doubled in the past 24 hours to $3.8 billion as the price rises by 7%. This favors a bullish BNB Coin price prediction at a point when the token just made a new all-time high. BNB is the second crypto in the top 5 to make a new […]

PENGU Price Soars While Whale Transfers Raise Alarms

The Pudgy Penguins’ PENGU token is under intense scrutiny after large transfers from its team wallet raised potential red flags.

BNB Hits New All-Time High Amid Token Launch Frenzy

BNB surged to a new all-time high on July 28 around $860, breaking above the critical $846 level following a sharp 7% intraday move.

-

1

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

4

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

5

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read