EU Grants MiCA Licenses to 53 Crypto Firms: Here Is the Full List

07.07.2025 19:00 2 min. read Kosta Gushterov

The European Union has granted a total of 53 licenses under its MiCA (Markets in Crypto-Assets) regulatory framework, marking a major step toward harmonized crypto oversight across the region.

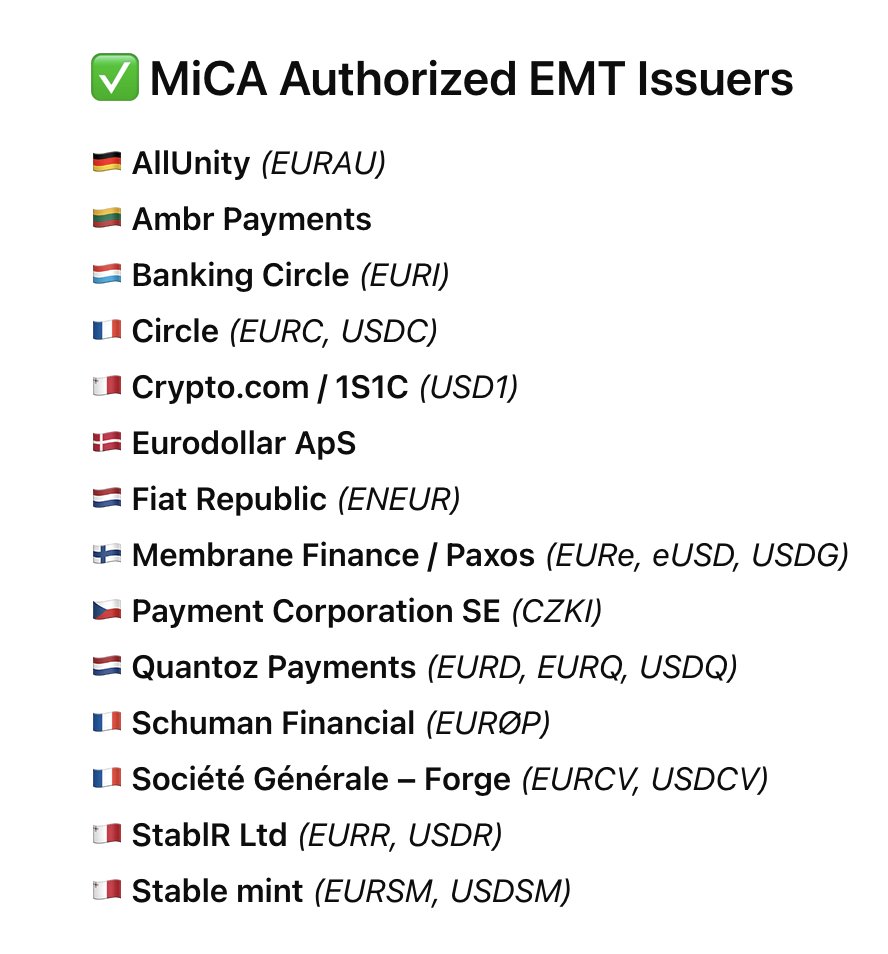

This includes 14 authorized e-money token (EMT) issuers and 39 MiCA-licensed crypto-asset service providers (CASPs).

The 14 EMT issuers originate from seven EU member states and are collectively issuing 20 fiat-backed stablecoins: 12 pegged to the euro, 7 to the U.S. dollar, and 1 to the Czech koruna. Leading names include Circle, Société Générale – Forge, Membrane Finance, and Crypto.com. These approvals aim to standardize stablecoin compliance under MiCA and expand consumer trust in digital euro and dollar equivalents.

Meanwhile, 39 CASPs have secured full MiCA licenses, allowing them to operate across the entire European Economic Area (EEA). Countries like Germany (12 firms), the Netherlands (11), and Malta (5) dominate the approvals. The list includes a blend of traditional financial institutions (e.g., BBVA, Clearstream), fintech platforms (eToro, N26), and major crypto exchanges (Coinbase, Kraken, Bitstamp, OKX).

MiCA Momentum Builds Amid Oversight Gaps and Compliance Push

Despite the progress, the MiCA rollout has revealed regulatory blind spots. No asset-referenced token (ART) issuers have been approved, indicating tepid market interest in non-fiat-backed assets. About 30 whitepapers have been filed under MiCA Title II for major assets like BTC and ETH, reflecting increasing institutional alignment with crypto regulation.

At the same time, over 35 firms are flagged as non-compliant—many by Italy’s CONSOB. Transition periods have ended in multiple jurisdictions, including Finland, Poland, and the Netherlands, where the Dutch AFM is leading license issuance. With MiCA enforcement underway, firms are racing to gain approval and passport their services across 30 EEA states.

-

1

Senate Confirms Crypto-Linked Nominee Jonathan Gould to Head OCC

11.07.2025 9:00 2 min. read -

2

South Korea Urges Asset Managers to Limit Exposure to Crypto Stock Like Coinbase,MicroStrategy

23.07.2025 10:00 1 min. read -

3

U.S. Regulators Define Crypto Custody Rules for Banks

15.07.2025 9:00 1 min. read -

4

Donald Trump to Unlock $9 trillion in Retirement Savings for Crypto and Gold Investments

18.07.2025 11:30 2 min. read -

5

Crypto Legislation Moves Forward Amid GOP Infighting Over CBDC Ban

17.07.2025 6:30 2 min. read

White House-backed Task Force Outlines Vision for Crypto Regulation

A coalition of U.S. federal agencies, formed under a January executive order by President Donald Trump, has released a fact sheet previewing its recommendations for a national digital asset framework.

Indonesia Triples Crypto Transaction Volume, Introduces New Tax Regime

Indonesia’s cryptocurrency sector saw explosive growth in 2024, with the total transaction value of crypto assets tripling year-on-year to over 650 trillion rupiah ($39.67 billion), according to data from the country’s financial regulator.

American Senator Introduces Bill to Count Crypto in Mortgage Eligibility

U.S. Senator Cynthia Lummis (R-Wyo.) has introduced the 21st Century Mortgage Act, a landmark bill that seeks to modernize federal home loan underwriting by including digital assets in mortgage eligibility assessments.

SEC Approves in-kind Creation and Redemption for Crypto ETPs, Marking Regulatory Shift

In a major development for the U.S. digital asset market, the Securities and Exchange Commission (SEC) has approved in-kind creation and redemption mechanisms for crypto asset exchange-traded products (ETPs), including those tied to Bitcoin and Ethereum.

-

1

Senate Confirms Crypto-Linked Nominee Jonathan Gould to Head OCC

11.07.2025 9:00 2 min. read -

2

South Korea Urges Asset Managers to Limit Exposure to Crypto Stock Like Coinbase,MicroStrategy

23.07.2025 10:00 1 min. read -

3

U.S. Regulators Define Crypto Custody Rules for Banks

15.07.2025 9:00 1 min. read -

4

Donald Trump to Unlock $9 trillion in Retirement Savings for Crypto and Gold Investments

18.07.2025 11:30 2 min. read -

5

Crypto Legislation Moves Forward Amid GOP Infighting Over CBDC Ban

17.07.2025 6:30 2 min. read