Ethereum’s Recent Performance Suggests Possible Market Rebound

18.02.2025 16:00 1 min. read Alexander Zdravkov

Over the past day, Ethereum (ETH) has managed to outperform the general cryptocurrency market, marking a rare occurrence that led to a 12-day high, signaling potential signs of recovery.

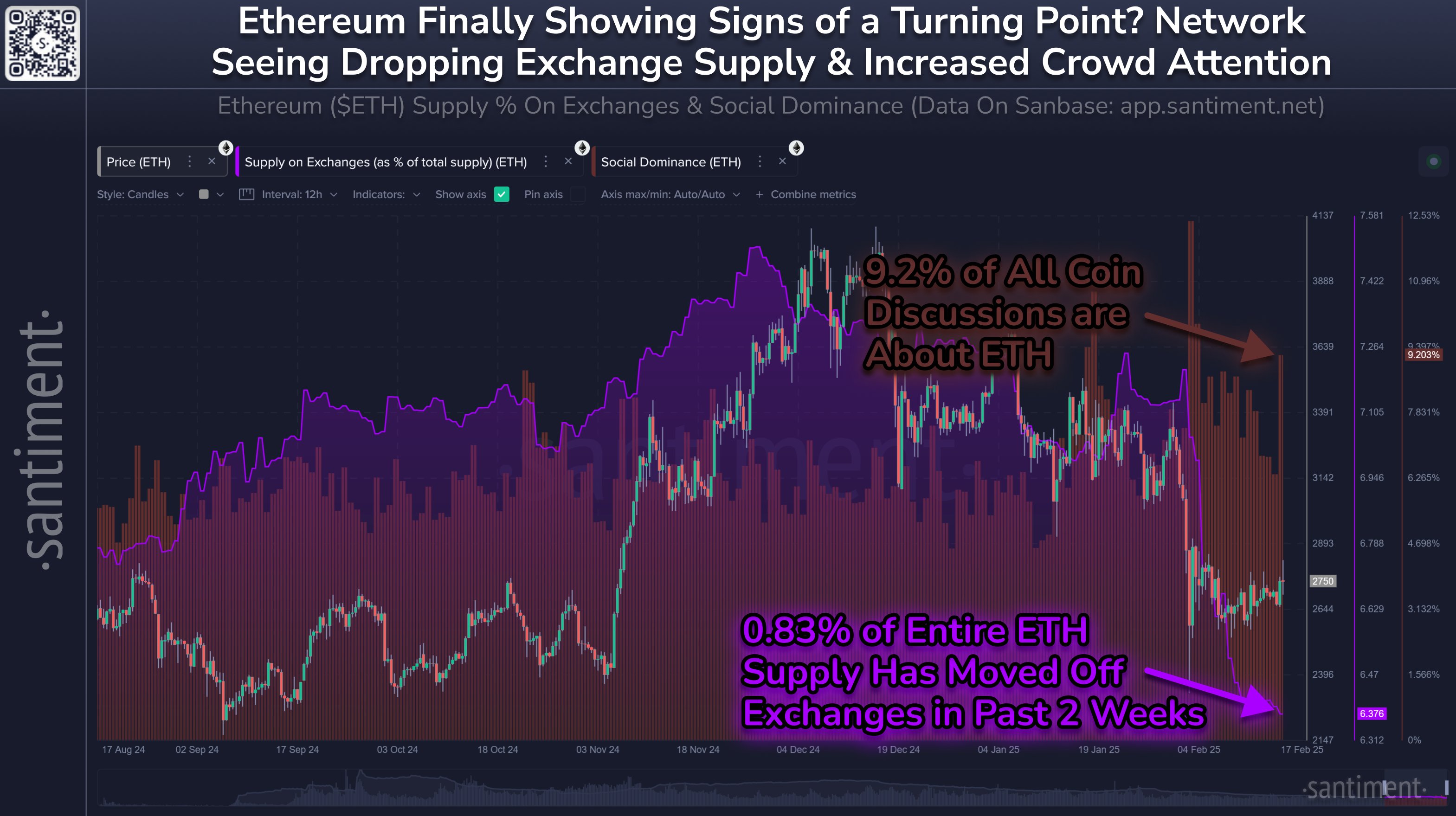

According to analytics firm Santiment, Ethereum displayed “mild signs” of a rebound, moving ahead of most altcoins as the week began.

Santiment highlighted that a significant portion of Ethereum’s supply continues to be moved off exchanges, with only 6.38% remaining on platforms. This behavior indicates long-term holding by investors, reducing the likelihood of a sudden sell-off.

The analysts observed that Ethereum has gained renewed attention from the crypto community in February, following a period of underperformance compared to other major cryptocurrencies.

While some, like crypto YouTuber Lark Davis, remain skeptical, the recent price movement has improved the ETH/BTC ratio slightly.

This metric, which compares Ethereum’s value to Bitcoin, has been at multi-year lows but saw a 7% increase on February 17, although it remains close to its weakest levels since December 2020.

-

1

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read

Altcoin Volume on Binance Hits Highest Level Since February

Altcoin trading volume on Binance Futures surged to $100.7 billion in a single day, reaching its highest level since February 3, 2025, according to data from CryptoQuant.

Bitcoin Exchange Inflows Spike — What Does it Means for Altcoins?

Bitcoin just recorded its largest net inflow to exchanges since July 2024, signaling a potential shift in market behavior.

Tron Signals Early Altseason Shift as Bitcoin Decouples

Tron (TRX) is showing signs of breaking away from Bitcoin’s price action, potentially positioning itself as a leading indicator of an emerging altseason.

3 Cryptocurrencies Showing Strong Momentum Right Now

While Bitcoin consolidates, capital is rotating into select high-growth tokens showing strong upside momentum.

-

1

Whale Activity Alert: Which Altcoins Saw Millions Flow Into Exchanges?

09.07.2025 9:00 2 min. read -

2

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read