Ethereum Trading Volume Overtakes Bitcoin

23.07.2025 21:00 2 min. read Kosta Gushterov

A major shift is underway in crypto markets as Ethereum begins to outpace Bitcoin in both price performance and trading activity.

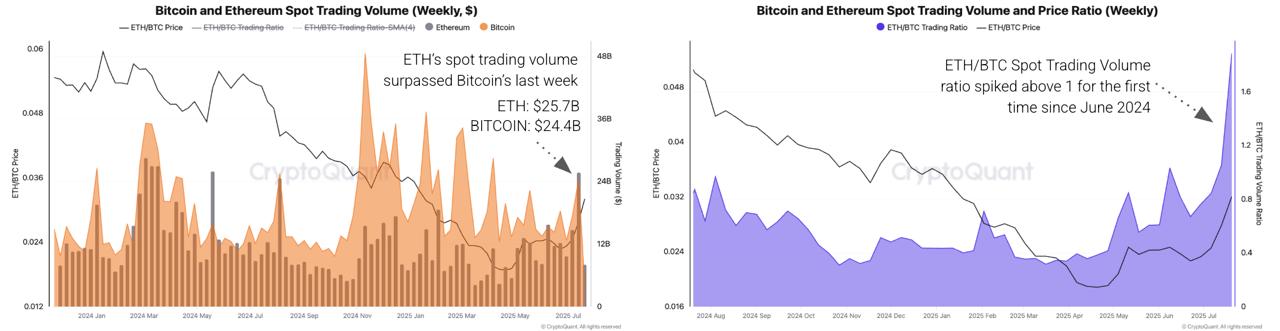

According to new data from CryptoQuant, ETH’s spot trading volume surpassed Bitcoin’s for the first time since June 2024, signaling renewed investor appetite for altcoins and accelerating signs of a potential new “altcoin season.”

ETH Outperforms BTC as Volume, Demand Spike

Ethereum’s weekly spot trading volume hit $25.7 billion, topping Bitcoin’s $24.4 billion. This marks the first time in over a year that ETH has consistently led in spot trading activity. The ETH/BTC trading volume ratio also rose above 1.0, a significant technical milestone last seen in mid-2024.

Since bottoming out in April, ETH has outperformed Bitcoin by 72%, with the ETH/BTC price ratio rising from 0.018 to 0.031—the highest since January. Analysts link this momentum to Ethereum’s undervaluation phase, now reversing as accumulation grows and sell pressure fades.

Altcoin and ETF Data Confirm Rotation Trend

Altcoin interest isn’t limited to Ethereum. Total spot trading volume for altcoins surged to $67 billion on July 17, the highest since March. Meanwhile, U.S.-based ETF data shows Ethereum allocations gaining ground against Bitcoin. The ETH/BTC ETF Holding Ratio climbed from 0.05 to 0.12, indicating institutional investors are buying ETH in larger quantities.

This momentum is further supported by exchange inflow data. Significantly less ETH is being deposited on exchanges compared to BTC, suggesting lower selling pressure and potential for continued outperformance.

Outlook: ETH/BTC Gains Could Extend

With rising institutional inflows, spiking spot volumes, and a favorable on-chain profile, Ethereum appears to be regaining market dominance. If this rotation trend holds, ETH/BTC could continue climbing—pushing more capital toward Ethereum and broader altcoin markets in the coming weeks.

-

1

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

09.07.2025 10:00 2 min. read -

2

PENGU Doubles in a Week as New Solana Presale is Tipped as the Best Meme Coin to Buy

17.07.2025 1:30 4 min. read -

3

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

4

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

5

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read

Solana Plans 66% Block Upgrade to Boost Network Capacity

Solana developers have introduced a new proposal aimed at pushing the network’s performance even further.

Societe Generale Backs Bitcoin and Ethereum ETP Expansion

French banking giant Societe Generale has entered the crypto space more directly, forming a strategic partnership with 21Shares.

Toncoin Treasury Launch: Ton Foundation and Kingsway Raise $400 Million

Toncoin is about to get a major institutional boost. The Ton Foundation and Kingsway Capital have teamed up on a bold initiative: raise $400 million to create a crypto treasury entity focused entirely on Toncoin.

Pepe Price Prediction: Legendary PEPE Bull Claims It Can Rise by 40X Next

The legendary trader who once turned a $7,600 investment into $25 million by betting on Pepe (PEPE) once it was on no one’s radar claims that this same meme coin could rise by 40X soon. This bullish Pepe price prediction was shared by James Wynn via his social media account on X – currently followed […]

-

1

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

09.07.2025 10:00 2 min. read -

2

PENGU Doubles in a Week as New Solana Presale is Tipped as the Best Meme Coin to Buy

17.07.2025 1:30 4 min. read -

3

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

4

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

5

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read