Ethereum Surges Past $3,900 as Altcoin Season Sparks ETF Boom

28.07.2025 8:23 2 min. read Kosta Gushterov

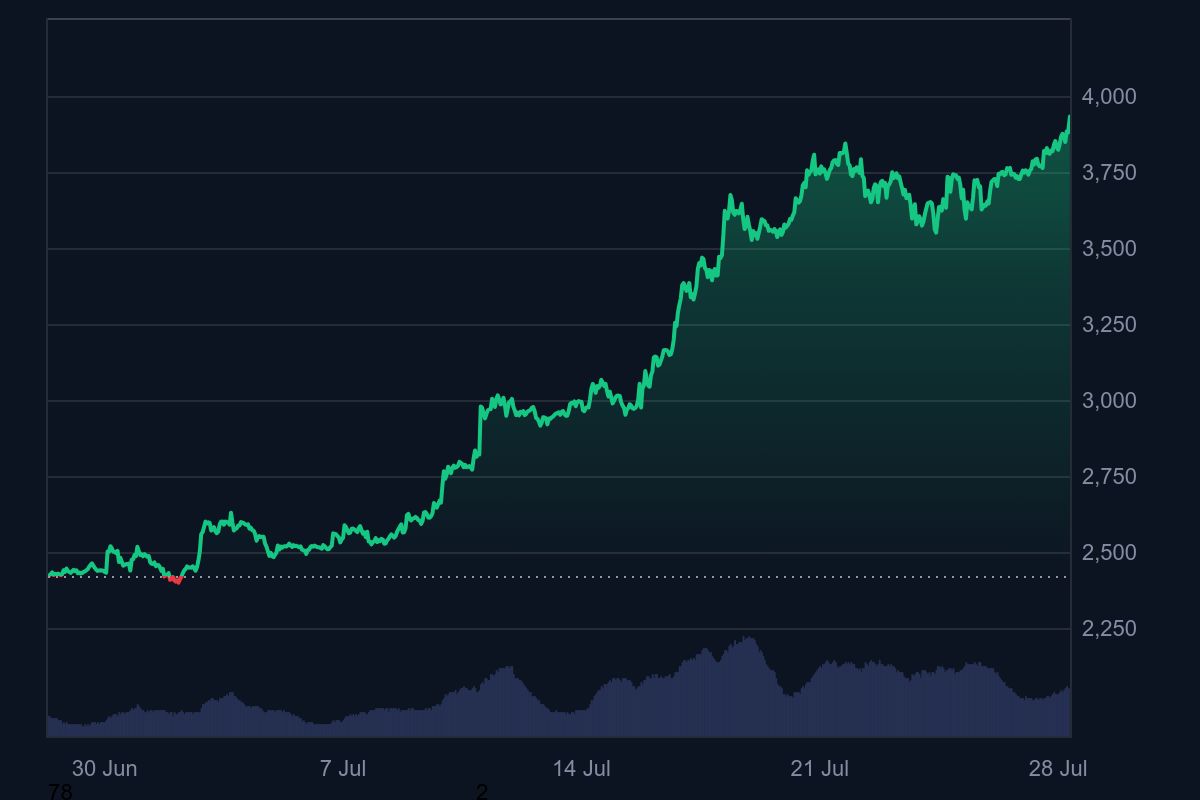

Ethereum just crossed the $3,900 mark, rising over 62% in the past month, according to CoinMarketCap data.

The move is backed by massive institutional accumulation, rising trading volume, and renewed excitement for altcoins. Traders like MMCrypto now say this breakout confirms the start of Altcoin Season.

Over the weekend, SharpLink Gaming added another 77,210 ETH worth $295 million, bringing their total to 438,017 ETH. The company also announced plans to stake much of its holdings—tightening supply and signaling long-term confidence. Other firms like Bitmine Immersion have followed suit, adding Ethereum to their balance sheets as a core treasury asset.

This momentum is drawing comparisons to Ethereum’s 2017 bull run, but this time with bigger players involved. Trader Merlijn highlighted how Ethereum has reclaimed its 50-week moving average and broken out of a long consolidation zone. In his words: “Same setup. More capital. Much bigger stakes.”

Institutional flows and ETF momentum fuel rally

On the ETF side, Ethereum inflows have massively outpaced Bitcoin. According to SoSoValue, ETH spot ETFs added $1.85 billion last week, compared to just $72 million for BTC. This is the second-highest weekly net inflow for ETH ETFs since launch. BlackRock’s ETHA alone now manages over $9.17 billion in assets, showcasing growing Wall Street interest.

Market sentiment reflects this shift. The global Fear & Greed Index now sits at 67—firmly in “Greed” territory—mirroring Ethereum’s 61% 30-day rally. Analysts expect this altcoin window to be short-lived but highly profitable for those who rotate smartly out of Bitcoin and into ETH and related tokens.

Even Michaël van de Poppe has turned bullish on altcoins like SUI, noting its growing ecosystem, TVL expansion, and BTC bridge development. He believes a consolidation period is next—followed by a new all-time high.

Short window for profits as ETH closes in on ATH

Ethereum is now approaching major psychological resistance near $4,000. If it breaks this level cleanly, traders anticipate a fast move toward price discovery. MMCrypto stressed that while Bitcoin remains king, Ethereum’s breakout provides one of the clearest signals in years for altcoin upside. “Once we confirm the breakout, it’s GO TIME,” he wrote.

As institutional money rotates into utility-focused coins, Ethereum remains the anchor of this new wave. Whether the window lasts days or weeks, ETH’s surge marks a clear regime shift—and the start of a high-stakes altcoin season.

-

1

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

2

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

3

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

4

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read -

5

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read

Binance Launches RWUSD Product with Up to 4.2% APR

Binance Earn has rolled out RWUSD, a new principal-protected product offering exposure to yields from Real-World Assets (RWA) like tokenized U.S. Treasury Bills.

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum 2025 Mirrors 2017 Breakout—But With Wall Street Fueling the Surge

Ethereum (ETH) appears to be entering a breakout phase eerily reminiscent of its historic 2017 rally—but this time, the move is backed by deep institutional support and ETF inflows.

SUI Price Breaks Key Resistance as BTCFi Vision Gains Traction

SUI, the native token of the Sui blockchain, is drawing attention following a major breakout on the charts—driven by surging total value locked (TVL) and growing anticipation around Bitcoin-native decentralized finance (BTCFi) infrastructure.

-

1

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read -

2

Will Ethereum and Solana Benefit from Wall Street’s Shift?

09.07.2025 19:00 2 min. read -

3

BNB Chain Upgrades and Token Delistings Reshape Binance Ecosystem

16.07.2025 22:00 2 min. read -

4

Dogecoin Price Prediction: DOGE Volumes Nearly Double – Can It Get to $1 In This Cycle?

18.07.2025 20:10 3 min. read -

5

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read