Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read Kosta Gushterov

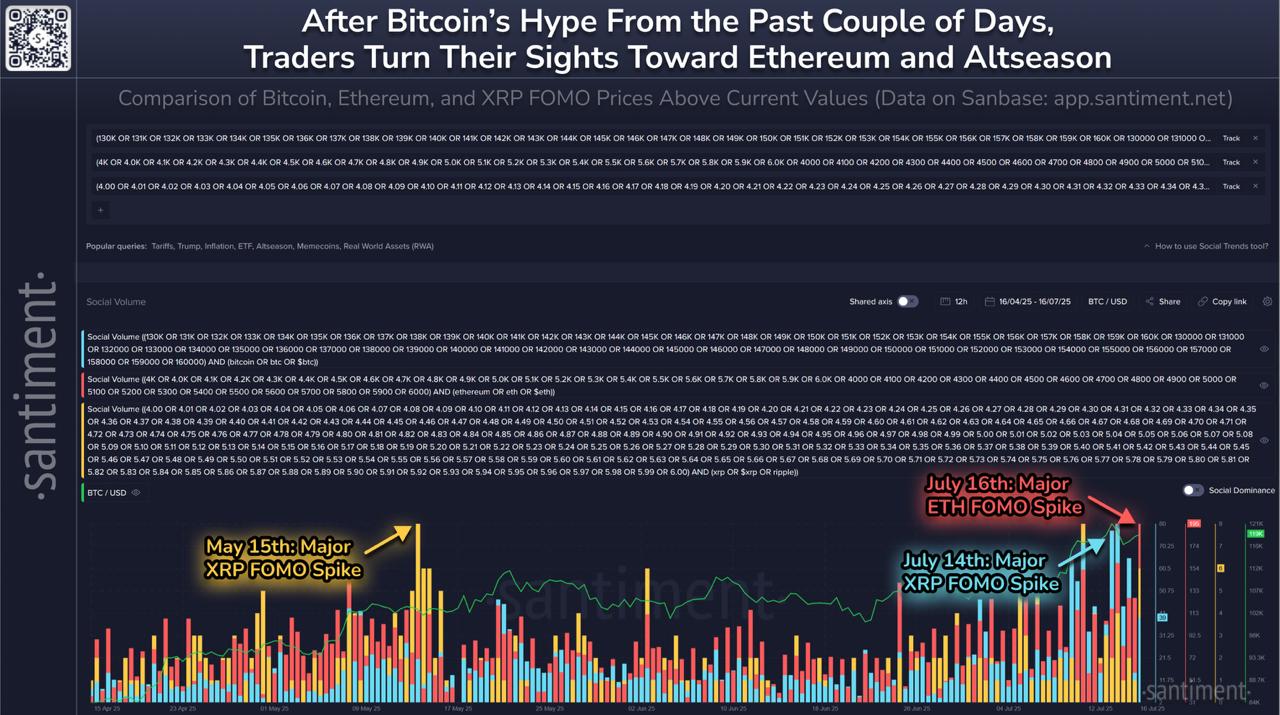

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

According to Santiment data, the attention has now moved toward Ethereum, which has seen a major spike in social media mentions and price projections above $4,000 across platforms like X, Reddit, and Telegram.

The chart highlights a notable shift in trader behavior. On July 16, Ethereum experienced a significant FOMO spike, following Bitcoin’s hype earlier in the week. This comes just two days after XRP also registered a major spike in online chatter on July 14—mirroring a previous wave on May 15.

These surges indicate that retail interest is rotating quickly between top-layer cryptocurrencies, often following price breakouts or headline-driven momentum.

Ethereum now leads the pack in terms of online buzz, potentially signaling the start of an altcoin season. As Bitcoin cools off after its rally, Ethereum is emerging as the next speculative target for traders anticipating continued upside. The combination of technical breakouts and aggressive social media sentiment is creating a feedback loop that could push ETH further up.

The current environment echoes previous market cycles where retail sentiment rapidly chases outperforming assets. With Ethereum back in the spotlight, the broader altcoin market may follow suit, especially if traders rotate capital from BTC profits into high-beta alternatives. Santiment’s data reveals how quickly crowd behavior shifts, and right now, Ethereum is at the center of that rotation.

-

1

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

2

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

BSTR to Launch With 30,021 BTC, Becomes 4th Largest Public Bitcoin Holder

BSTR Holdings Inc. is set to become the fourth-largest public holder of Bitcoin, announcing it will launch with 30,021 BTC on its balance sheet as part of its public debut.

Ethereum ETF Inflows Hit Record High as Price Jumps Past $3,400

Ethereum saw an explosive surge in institutional demand this week, with spot exchange-traded funds (ETFs) posting their highest single-day inflow on record. O

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

Fartcoin (FARTCOIN) is once again leaving a trail of strong gains as the crypto market rallies. In the past 24 hours alone, the token has produced an 18.2% return as trading volumes have exploded. Data from CoinMarketCap shows that Fartcoin’s volumes have more than doubled during this period. More than $500 million worth of this […]

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

The cryptocurrency market is experiencing a notable shift in capital flows as Bitcoin’s market dominance has dropped to 61.6%, marking a 2.36% decrease.

-

1

First-Ever Staked Crypto ETF Set to Launch in the U.S. This Week

01.07.2025 9:00 2 min. read -

2

Ethereum Core Developer Launches Foundation to Push ETH to $10,000

03.07.2025 20:00 2 min. read -

3

XRP Price Prediction: Price Compression and Higher ETF Approval Odds Could Propel XRP to $4

01.07.2025 20:03 3 min. read -

4

LINK Stuck Below $15 as Whales Accumulate and Retail Stalls, CryptoQuant Reports

03.07.2025 19:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read