Ethereum Price Prediction: ETH Buy Signal Confirmed Despite Today’s Retreat

30.05.2025 23:13 3 min. read Alejandro Ar

Ethereum (ETH) has gone down by 2.4% in the past 24 hours and currently sits at $2,580 in what has been mostly a red week for the crypto market.

Trading volumes have retreated by 5% during this same period, indicating that the selling spree is not that strong at the moment.

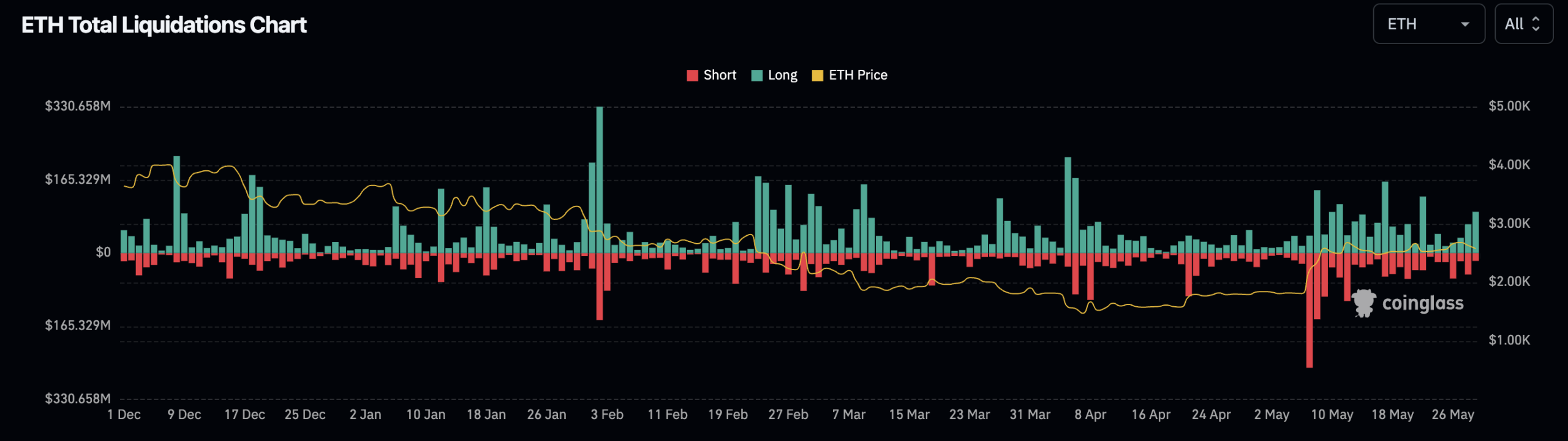

However, crypto liquidations have been quite strong in the past day as data from CoinGlass shows that $785 million worth of crypto trades have been wiped out. Nearly 90% of that total corresponds to long positions.

Despite the latest bearish price action, ETH liquidations are not even close to its recent records. In the past 24 hours, $93 million worth of long positions were closed as a result of the downtrend. Comparatively, $330 million worth of ETH longs were flushed out back on February 2.

Hence, the extent of the decline has not been severe enough to catalyze such strong movements.

Meanwhile, the Ethereum ecosystem is still the largest one in total value locked (TVL) and its stablecoin balance has been steadily growing, moving from $112 billion to $122 billion since the year started.

During bull markets, DeFi applications tend to experience higher transaction volumes and that favors the demand for ETH as the utility token of the Ethereum Virtual Machine (EVM). This favors a bullish Ethereum price prediction.

Ethereum Price Prediction: 19% Gain Expected After Bullish EMA Crossover

In this context, Ethereum’s price action signals continue to be bullish following the release and implementation of the Pectra upgrade.

Looking at the daily price chart, the 21-day exponential moving average (EMA) just made a ‘golden cross’ with the 200-day EMA. This technical buy signal is typically followed by a strong jump in the price of the asset.

The last time it happened, it produced a 19% gain based on ETH’s closing price at the time of the crossover and the closing price of the token at the peak of its uptrend.

However, in prior instances, it has delivered even higher gains. In some cases, it has even resulted in ETH doubling its price.

Hence, this latest drop is not necessarily indicative that the rally is over as technical signals are still supporting a bullish Ethereum price prediction.

It is worth noting that Bitcoin (BTC) made a new all-time high and Ethereum has not yet been able to move past the $3,000 mark.

If this altcoin plays catch up in the next few days, we could see ETH rising to $3,000 fast and possibly beyond.

Meanwhile, as BTC nears the $125,000 level, a new crypto presale called BTC Bull Token (BTCBULL) offers attractive rewards that are unlocked every time the top crypto hits a specific price milestone.

BTC Bull Token (BTCBULL) Offers Airdrops and Token Burns to Investors as BTC Reaches Higher Levels

BTC Bull Token (BTCBULL) offers milestone-based rewards to token holders as Bitcoin (BTC) reaches new targets.

Starting at a baseline price of $100,000, for every $25K that BTC adds, a new reward will be distributed.

The first milestone is now closer than ever. Once BTC reaches $125,000, a portion of BTCBULL’s circulating supply will be burned. Next up, once the price gets to $150K, token holders will receive a direct Bitcoin airdrop.

To start earning passive income during this latest BTC rally, you can buy $BTCBULL by visitting its official website.

You can either swap USDT or ETH for this token or use a bank card to invest.

-

1

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

2

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

Smart contract platforms Ethereum and Solana are shaping the crypto market’s future with big upgrades and shifting strategies.

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

Arthur Hayes has radically changed his stance on crypto markets. After months of caution, the BitMEX co-founder now believes a powerful altcoin rally is on the horizon.

Ethereum ETFs Signal Strong July Surge

Ethereum exchange-traded funds are gaining momentum, with recent inflows ranking among the top ten ever recorded.

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

Bitcoin’s breakout to a new all-time high above $118,000 has reignited momentum across the crypto market. While BTC itself saw nice gains several altcoins are riding the wave of renewed investor interest.

-

1

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

2

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read