Ethereum Gains Push Corporate Portfolios Into Profit in 2025

24.07.2025 15:00 2 min. read Kosta Gushterov

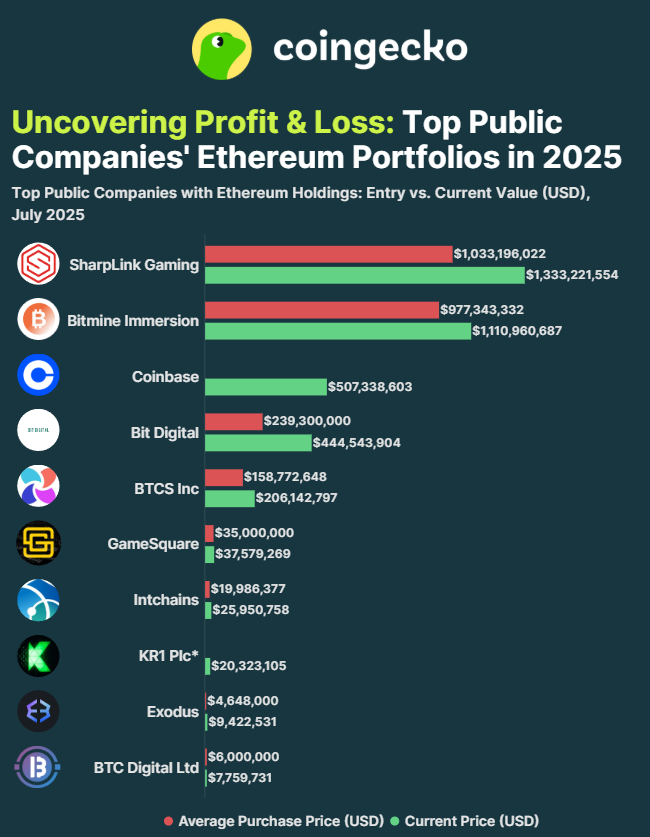

A new chart from CoinGecko reveals how top public companies are faring on their Ethereum investments in 2025—and most are now sitting on substantial gains.

With Ethereum’s market value climbing steadily, firms like SharpLink Gaming and Bitmine Immersion are leading the pack in realized and unrealized ETH profits.

SharpLink and Bitmine Top the Leaderboard

SharpLink Gaming holds the most profitable Ethereum position on the list. The company’s ETH holdings, originally purchased for $1.03 billion, are now worth $1.33 billion, reflecting over $300 million in unrealized gains.

Bitmine Immersion follows closely. With an entry price of $977 million, its Ethereum stash has appreciated to $1.11 billion, a gain of over $133 million.

Coinbase and Bit Digital See Strong Returns

Coinbase holds over $507 million in ETH, with current valuations unchanged in the image, suggesting recent entry or near-breakeven levels.

Bit Digital, however, shows a steep profit curve. The company entered with $239.3 million and is now sitting on $444.5 million, up over 85%.

Smaller Players, Big Upside

Even mid-tier and smaller players are turning green:

- BTCS Inc.: $158.7M invested, now worth $206.1M

- GameSquare: $35M entry, $37.5M current

- Intchains: $20M investment, $25.9M value

- Exodus and BTC Digital Ltd. also nearly doubled their ETH value

The only company currently close to breakeven is KR1 Plc, with current value just above its entry price.

Outlook

As Ethereum hovers near multi-year highs, institutional ETH portfolios are clearly outperforming. With ETF speculation, increased staking demand, and utility growth, these companies may see even larger gains ahead—especially if ETH revisits the $5,000 range projected by some analysts.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

3

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read

10 Crypto Unlocks to Watch in the Next 14 hours

A wave of token unlocks is set to hit the crypto market within the next 14 hours, potentially shaking up price dynamics for several low- and mid-cap projects.

What the Crypto Community is Thinking as Bitcoin Slips

Traders are growing cautious, and the crypto mood is beginning to shift. Bitcoin has stalled near $115,500, and momentum is no longer as confident as it was earlier this month.

Solana Plans 66% Block Upgrade to Boost Network Capacity

Solana developers have introduced a new proposal aimed at pushing the network’s performance even further.

Societe Generale Backs Bitcoin and Ethereum ETP Expansion

French banking giant Societe Generale has entered the crypto space more directly, forming a strategic partnership with 21Shares.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

3

Pepe Price Prediction: PEPE Could Rise Another 10% If It Breaks This Key Level

16.07.2025 17:26 3 min. read -

4

Top 10 Trending Altcoins Right Now, According to CoinGecko Data

13.07.2025 17:30 3 min. read -

5

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read